Shareholder Letter Q2 2024

Clear Secure, Inc. | Q2 2024 | Page 2 Shareholder Letter Q2 2024 Second Quarter 2024 Financial Highlights (all figures are for Second Quarter 2024 and percentage change is expressed as year-over-year, unless otherwise specified)* Revenue of $186.7 million was up 24.6% while Total Bookings of $197.0 million were up 12.5% Operating income of $30.3 million; Adjusted EBITDA of $47.5 million Net Income of $38.6 million, Earnings per Common Share Basic and Diluted of $0.26 Net cash provided by operating activities of $114.6 million; Free Cash Flow of $110.1 million Q224 results include $0.6 million of COVID-19 relief benefits 3,566,853 shares repurchased at an average price of $18.25 Active in 58 CLEAR Plus airports with the launch of Daniel K. Inouye International Airport (Honolulu) TSA PreCheck® Enrollment Provided by CLEAR live in 46 airports nationwide * A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided at the end of this letter. “ In the second quarter we continued to execute on our three key priorities— improving the Member experience, scaling TSA PreCheck®, and scaling CLEAR Verified. We added a record 2.3 million Members, expanded margins and generated significant operating and Free Cash Flow—clear evidence of the traction we are seeing in the marketplace and our ability to scale profitably,” said Caryn Seidman Becker, CLEAR’s CEO

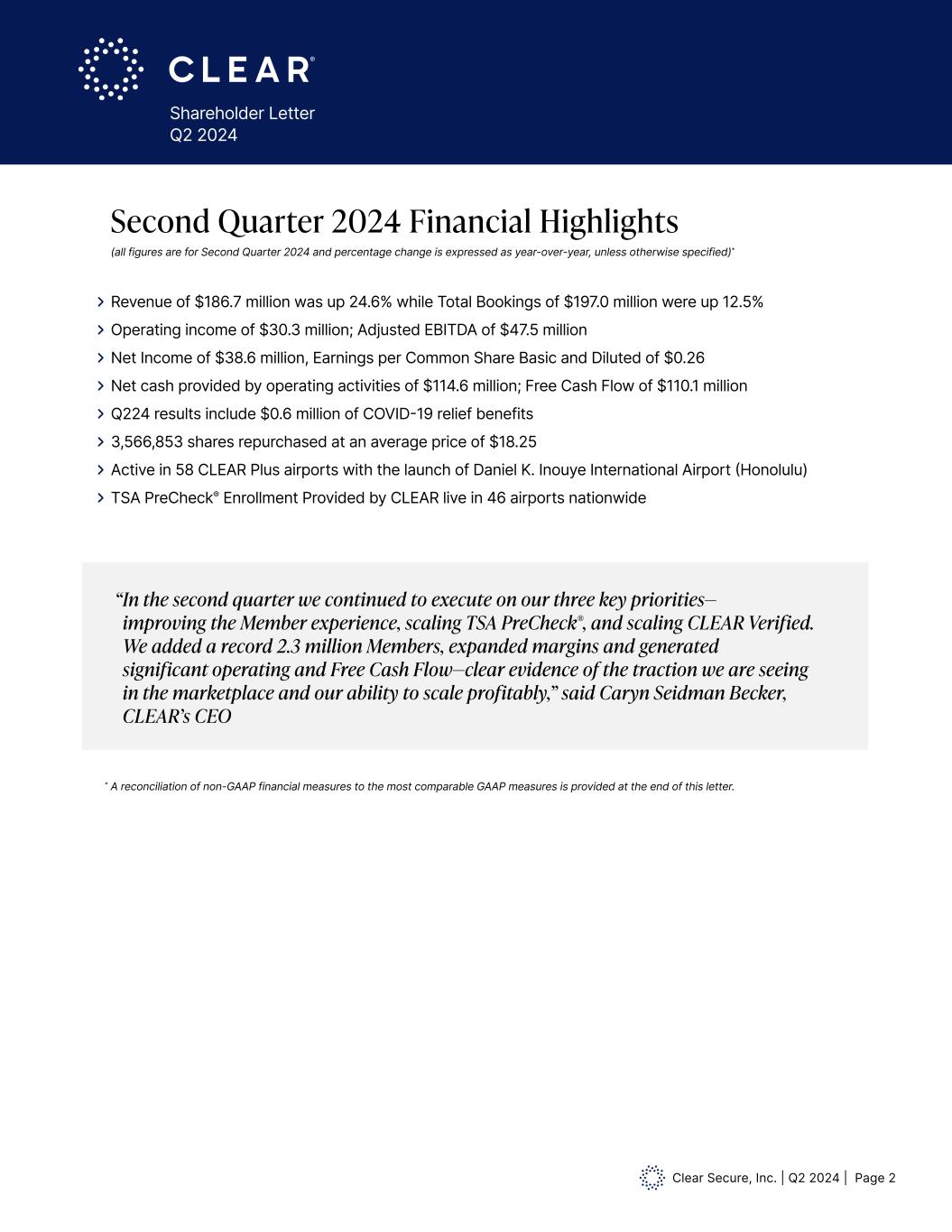

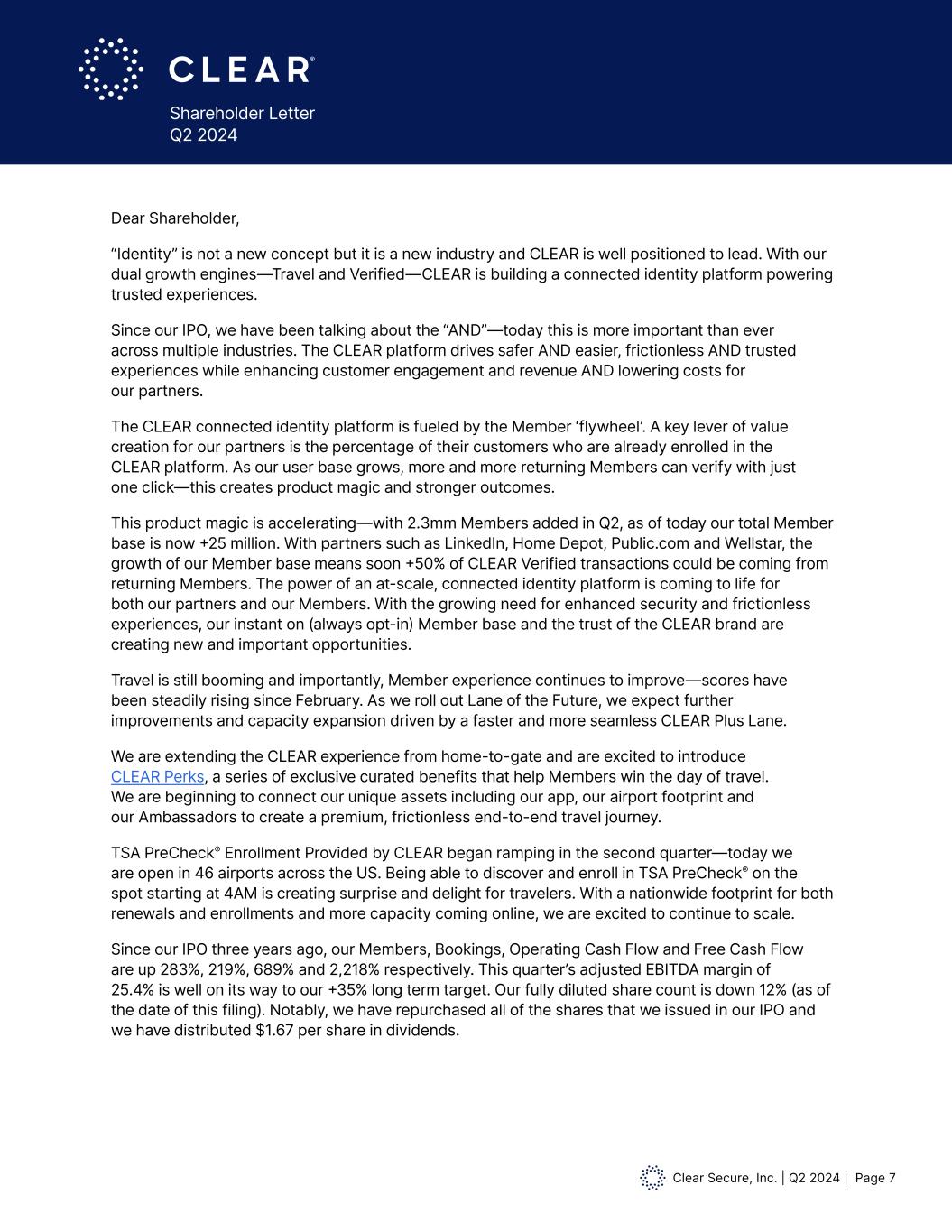

Clear Secure, Inc. | Q2 2024 | Page 3 Shareholder Letter Q2 2024 $149.9 $160.4 $171.0 $179.0 $186.7 $175.1 $191.7 $195.3 $180.6 $197.0 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total GAAP Revenue & Bookings Revenue Total Bookings 17,385 18,594 20,194 21,941 24,211 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Enrollments (Thousands) 154,317 167,417 180,807 192,610 206,673 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Platform Uses (Thousands) Annual CLEAR Plus Gross Dollar Retention $149.9 $160.4 $171.0 $179.0 $186.7 $175.1 $191.7 $195.3 $180.6 $197.0 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total GAAP Revenue & Bookings Revenue Total Bookings 17,385 18,594 20,194 21,941 24,211 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Enrollments (Thousands) 154,317 167,417 180,807 192,610 206,673 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Platform Uses (Thousands) Annual CLEAR Plus Gross Dollar Retention in millions in thousands Total GAAP Revenue & Bookings Total Cumulative Enrollments $149.9 $160.4 $171.0 $179.0 $186.7 $175.1 $191.7 $195.3 $180.6 $197.0 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total G AP Revenue & B okings Revenue Total B okings 17,385 18,594 20,194 21,941 24,2 1 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Enrollments (Thousands) 154,317 167,417 180,807 192,610 206,673 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Platform Uses (Thousands) A nual CLEAR Plus Gro s Dollar Retention

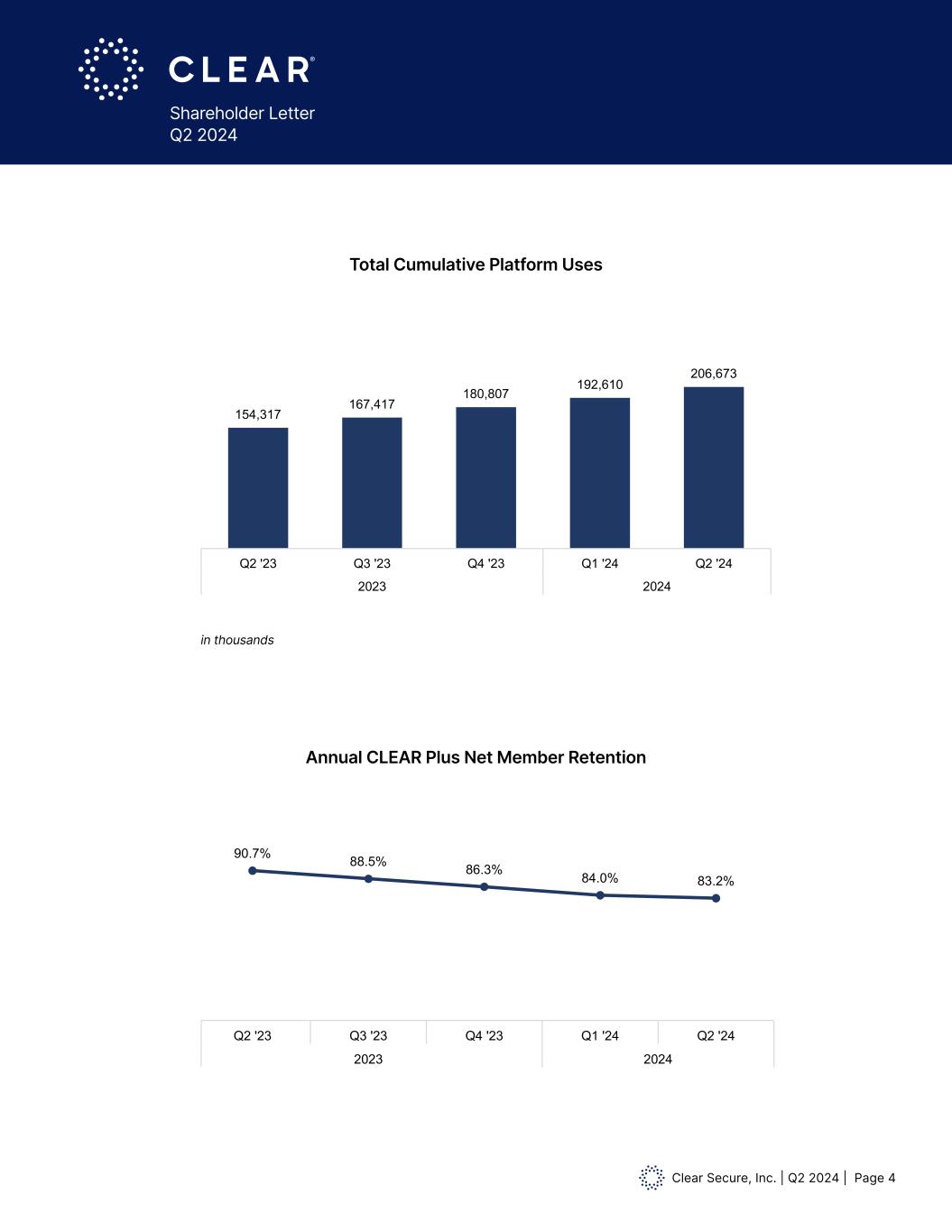

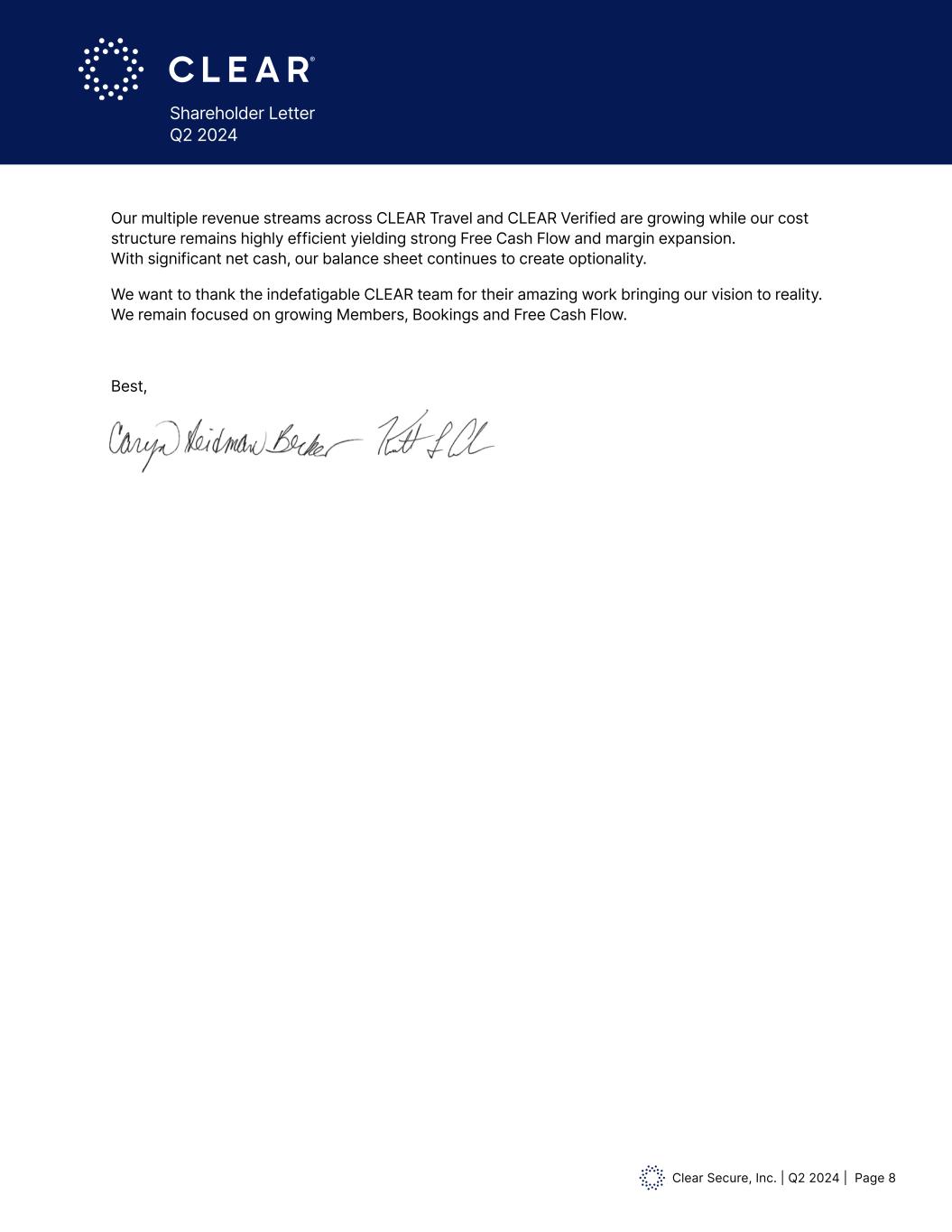

Clear Secure, Inc. | Q2 2024 | Page 4 Shareholder Letter Q2 2024 $149.9 $160.4 $171.0 $179.0 $186.7 $175.1 $191.7 $195.3 $180.6 $197.0 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total GAAP Revenue & Bookings Revenue Total Bookings 17,385 18,594 20,194 21,941 24,211 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Enrollments (Thousands) 154,317 167,417 180,807 192,610 206,673 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Platform Uses (Thousands) Annual CLEAR Plus Gross Dollar Retention 90.7% 88.5% 86.3% 84.0% 83.2% Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Annual CLEAR Plus Net Member Retention 6,183 6,374 6,720 6,798 7,095 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Acitve CLEAR Plus Members (Thousands) 8.7x 8.5x 8.1x 7.8x 7.4x Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Annualized CLEAR Plus Member Usage Annual CLEAR Plus Gross Dollar Retention $149.9 $160.4 $171.0 $179.0 $186.7 $175.1 $191.7 $195.3 $180.6 $197.0 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total GAAP Revenue & Bookings Revenue Total Bookings 17,385 18,594 20,194 21,941 24,211 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Enrollments (Thousands) 154,317 167,417 180,807 192,610 206,673 Q2 '23 Q3 '23 ' ' 2023 Total Cumulative Platform Uses (Thousands) Annual CLEAR Plus Gross Dollar Retention Total Cumulative Platform Uses Annual CLEAR Plus Net Member Retention in thousands

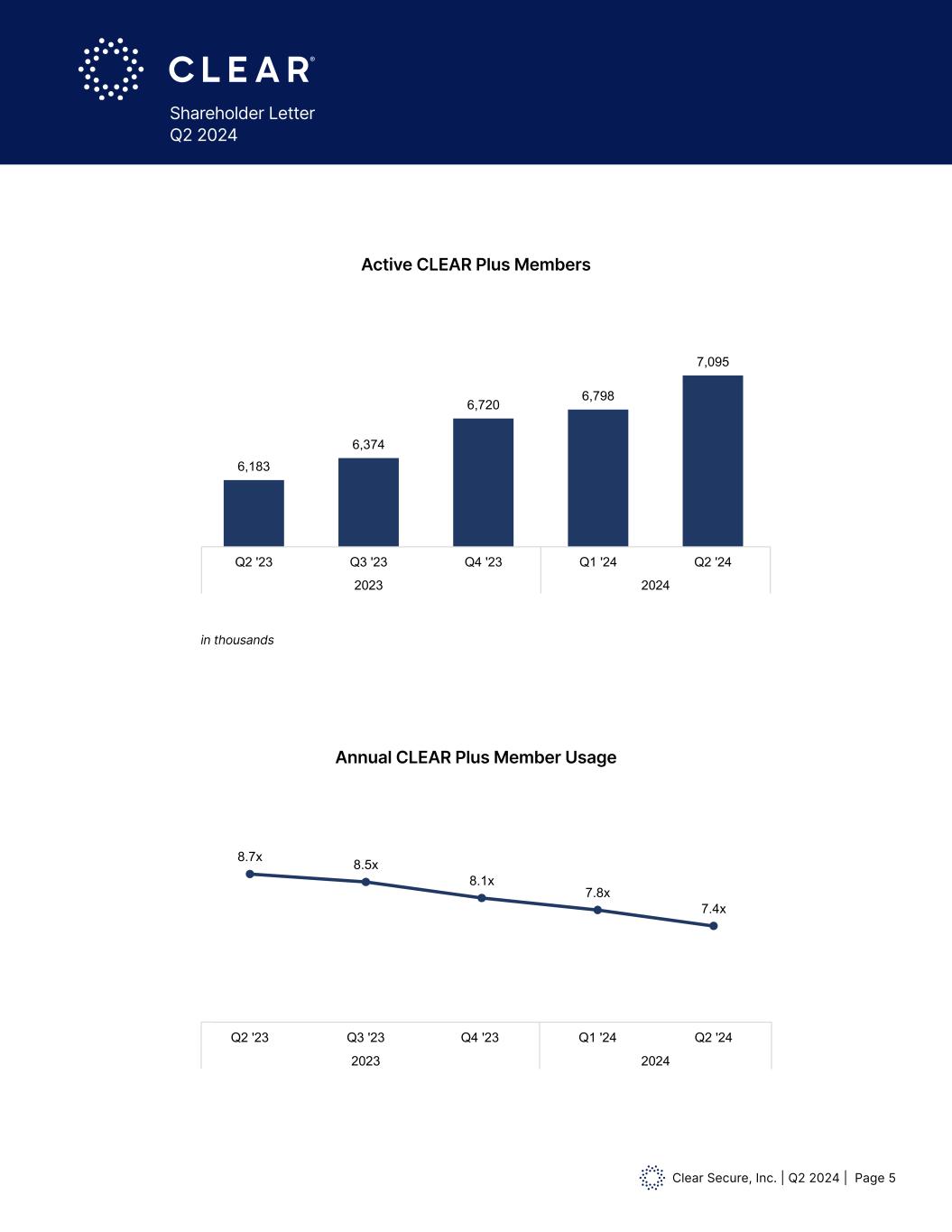

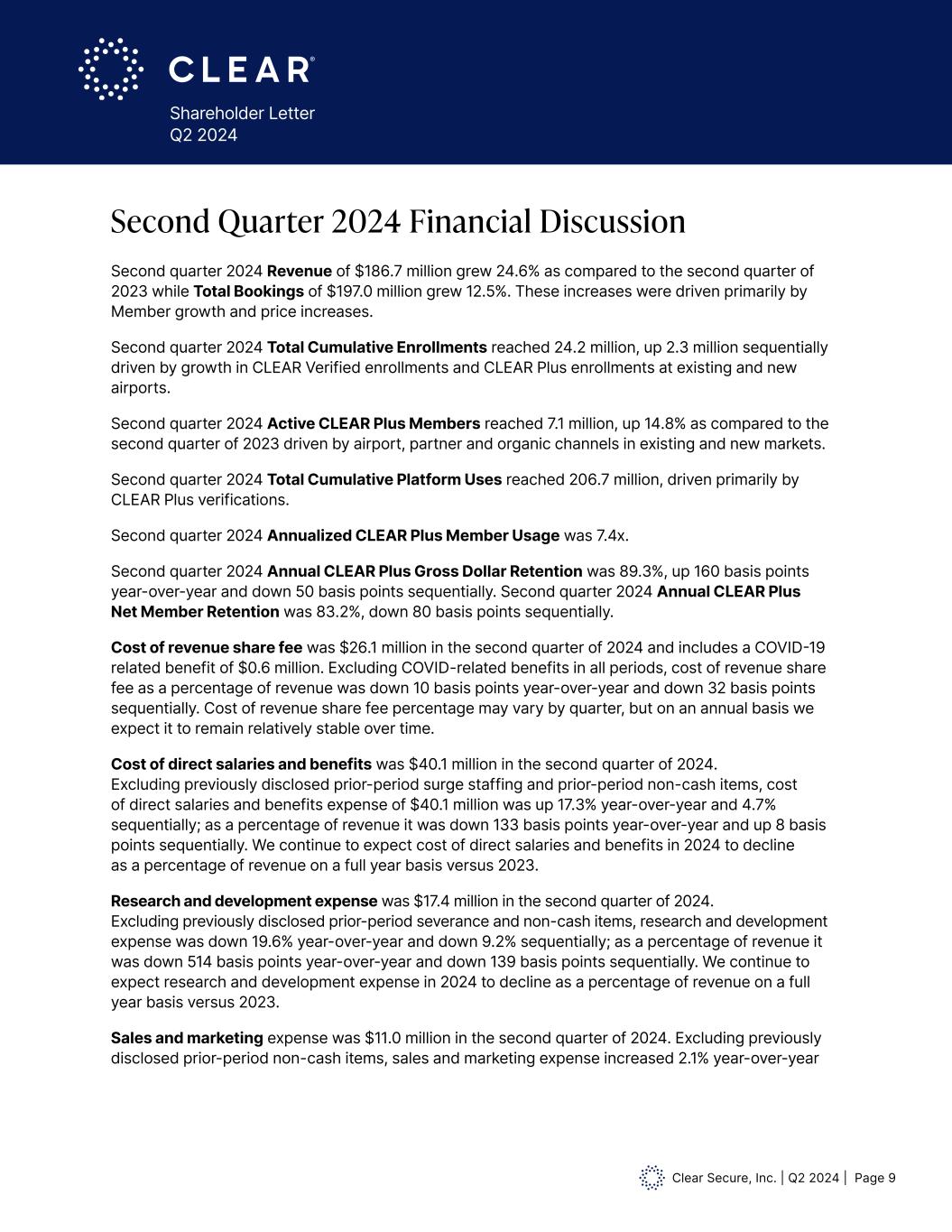

Clear Secure, Inc. | Q2 2024 | Page 5 Shareholder Letter Q2 2024 Active CLEAR Plus Members Annual CLEAR Plus Member Usage $149.9 $160.4 $171.0 $179.0 $186.7 $175.1 $191.7 $195.3 $180.6 $197.0 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total GAAP Revenue & Bookings Revenue Total Bookings 17,385 18,594 20,194 21,941 24,211 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Enrollments (Thousands) 154,317 167,417 180,807 192,610 206,673 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Platform Uses (Thousands) Annual CLEAR Plus Gross Dollar Retention $149.9 $160.4 $171.0 $179.0 $186.7 $175.1 $191.7 $195.3 $180.6 $197.0 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total GAAP Revenue & Bookings Revenue Total Bookings 17,385 18,594 20,194 21,941 24,211 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Enrollments (Thousands) 154,317 167,417 180,807 192,610 206,673 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Total Cumulative Platform Uses (Thousands) Annual CLEAR Plus Gross Dollar Retention 90.7% 88.5% 86.3% 84.0% 83.2% Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Annual CLEAR Plus Net Member Retention 6,183 6,374 6,720 6,798 7,095 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Acitve CLEAR Plus Members (Thousands) 8.7x 8.5x 8.1x 7.8x 7.4x Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Annualized CLEAR Plus Member Usage Annual CLEAR Plus Gross Dollar Retention in thousands 90.7% 88.5% 86.3% 84.0% 83.2% Q2 '23 Q3 '23 Q4 '23 1 '24 2 '24 2023 2024 Annual CLEAR Plus N t Member Retention 6,183 6,374 6,720 6,798 7,095 Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Acitve LEAR Plus Members (Thousands) 8.7x 8.5x 8.1x 7.8x 7.4x Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Annualized CLEAR Plus Member Usage Annual CLEAR Plus Gross Dollar Retention

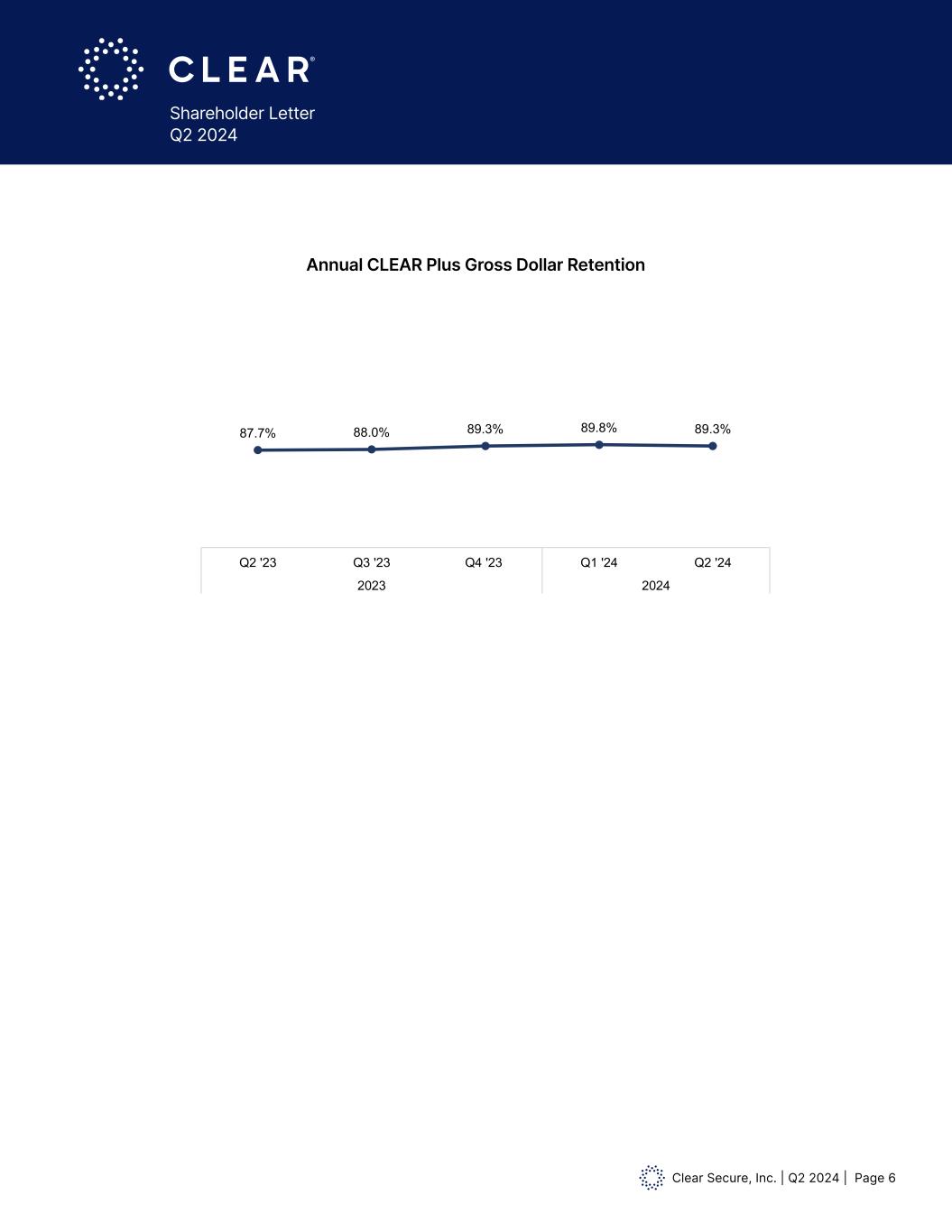

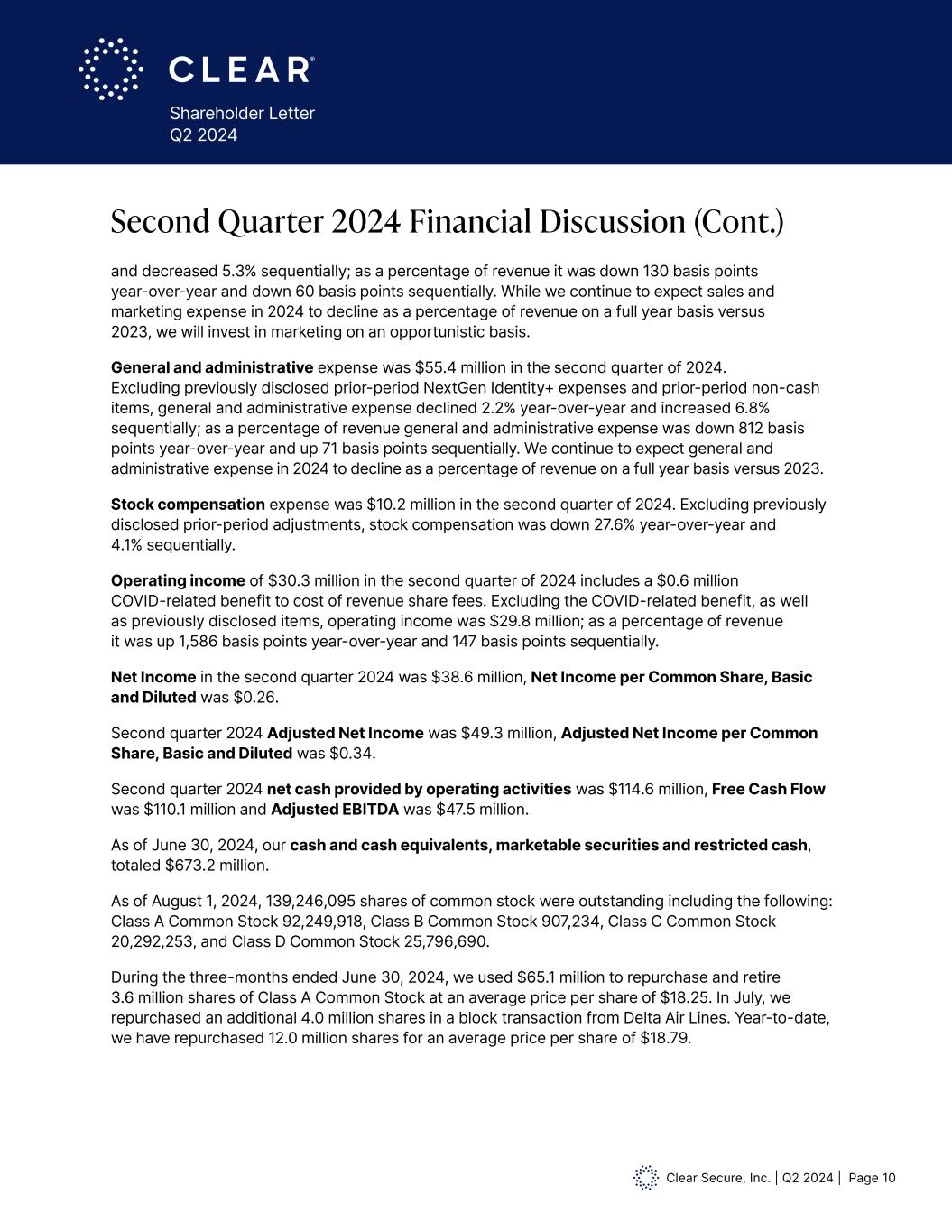

Clear Secure, Inc. | Q2 2024 | Page 6 Shareholder Letter Q2 2024 Revenue Total Bookings 87.7% 88.0% 89.3% 89.8% 89.3% Q2 '23 Q3 '23 Q4 '23 Q1 '24 Q2 '24 2023 2024 Annual CLEAR Plus Gross Dollar Retention Annual CLEAR Plus Gross Dollar Retention

Clear Secure, Inc. | Q2 2024 | Page 7 Shareholder Letter Q2 2024 Dear Shareholder, “Identity” is not a new concept but it is a new industry and CLEAR is well positioned to lead. With our dual growth engines—Travel and Verified—CLEAR is building a connected identity platform powering trusted experiences. Since our IPO, we have been talking about the “AND”—today this is more important than ever across multiple industries. The CLEAR platform drives safer AND easier, frictionless AND trusted experiences while enhancing customer engagement and revenue AND lowering costs for our partners. The CLEAR connected identity platform is fueled by the Member ‘flywheel’. A key lever of value creation for our partners is the percentage of their customers who are already enrolled in the CLEAR platform. As our user base grows, more and more returning Members can verify with just one click—this creates product magic and stronger outcomes. This product magic is accelerating—with 2.3mm Members added in Q2, as of today our total Member base is now +25 million. With partners such as LinkedIn, Home Depot, Public.com and Wellstar, the growth of our Member base means soon +50% of CLEAR Verified transactions could be coming from returning Members. The power of an at-scale, connected identity platform is coming to life for both our partners and our Members. With the growing need for enhanced security and frictionless experiences, our instant on (always opt-in) Member base and the trust of the CLEAR brand are creating new and important opportunities. Travel is still booming and importantly, Member experience continues to improve—scores have been steadily rising since February. As we roll out Lane of the Future, we expect further improvements and capacity expansion driven by a faster and more seamless CLEAR Plus Lane. We are extending the CLEAR experience from home-to-gate and are excited to introduce CLEAR Perks, a series of exclusive curated benefits that help Members win the day of travel. We are beginning to connect our unique assets including our app, our airport footprint and our Ambassadors to create a premium, frictionless end-to-end travel journey. TSA PreCheck® Enrollment Provided by CLEAR began ramping in the second quarter—today we are open in 46 airports across the US. Being able to discover and enroll in TSA PreCheck® on the spot starting at 4AM is creating surprise and delight for travelers. With a nationwide footprint for both renewals and enrollments and more capacity coming online, we are excited to continue to scale. Since our IPO three years ago, our Members, Bookings, Operating Cash Flow and Free Cash Flow are up 283%, 219%, 689% and 2,218% respectively. This quarter’s adjusted EBITDA margin of 25.4% is well on its way to our +35% long term target. Our fully diluted share count is down 12% (as of the date of this filing). Notably, we have repurchased all of the shares that we issued in our IPO and we have distributed $1.67 per share in dividends.

Clear Secure, Inc. | Q2 2024 | Page 8 Shareholder Letter Q2 2024 Our multiple revenue streams across CLEAR Travel and CLEAR Verified are growing while our cost structure remains highly efficient yielding strong Free Cash Flow and margin expansion. With significant net cash, our balance sheet continues to create optionality. We want to thank the indefatigable CLEAR team for their amazing work bringing our vision to reality. We remain focused on growing Members, Bookings and Free Cash Flow. Best,

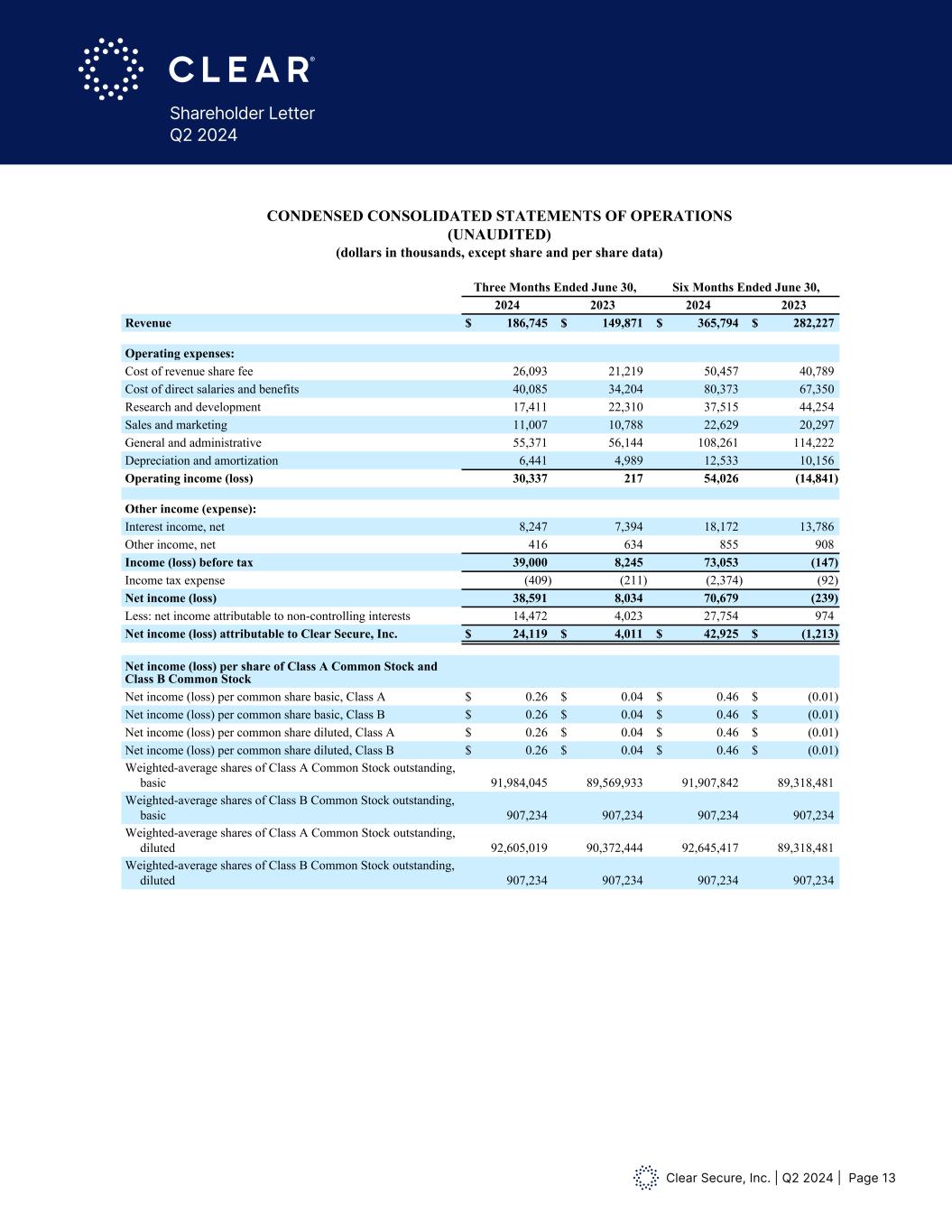

Clear Secure, Inc. | Q2 2024 | Page 9 Shareholder Letter Q2 2024 Second quarter 2024 Revenue of $186.7 million grew 24.6% as compared to the second quarter of 2023 while Total Bookings of $197.0 million grew 12.5%. These increases were driven primarily by Member growth and price increases. Second quarter 2024 Total Cumulative Enrollments reached 24.2 million, up 2.3 million sequentially driven by growth in CLEAR Verified enrollments and CLEAR Plus enrollments at existing and new airports. Second quarter 2024 Active CLEAR Plus Members reached 7.1 million, up 14.8% as compared to the second quarter of 2023 driven by airport, partner and organic channels in existing and new markets. Second quarter 2024 Total Cumulative Platform Uses reached 206.7 million, driven primarily by CLEAR Plus verifications. Second quarter 2024 Annualized CLEAR Plus Member Usage was 7.4x. Second quarter 2024 Annual CLEAR Plus Gross Dollar Retention was 89.3%, up 160 basis points year-over-year and down 50 basis points sequentially. Second quarter 2024 Annual CLEAR Plus Net Member Retention was 83.2%, down 80 basis points sequentially. Cost of revenue share fee was $26.1 million in the second quarter of 2024 and includes a COVID-19 related benefit of $0.6 million. Excluding COVID-related benefits in all periods, cost of revenue share fee as a percentage of revenue was down 10 basis points year-over-year and down 32 basis points sequentially. Cost of revenue share fee percentage may vary by quarter, but on an annual basis we expect it to remain relatively stable over time. Cost of direct salaries and benefits was $40.1 million in the second quarter of 2024. Excluding previously disclosed prior-period surge staffing and prior-period non-cash items, cost of direct salaries and benefits expense of $40.1 million was up 17.3% year-over-year and 4.7% sequentially; as a percentage of revenue it was down 133 basis points year-over-year and up 8 basis points sequentially. We continue to expect cost of direct salaries and benefits in 2024 to decline as a percentage of revenue on a full year basis versus 2023. Research and development expense was $17.4 million in the second quarter of 2024. Excluding previously disclosed prior-period severance and non-cash items, research and development expense was down 19.6% year-over-year and down 9.2% sequentially; as a percentage of revenue it was down 514 basis points year-over-year and down 139 basis points sequentially. We continue to expect research and development expense in 2024 to decline as a percentage of revenue on a full year basis versus 2023. Sales and marketing expense was $11.0 million in the second quarter of 2024. Excluding previously disclosed prior-period non-cash items, sales and marketing expense increased 2.1% year-over-year Second Quarter 2024 Financial Discussion

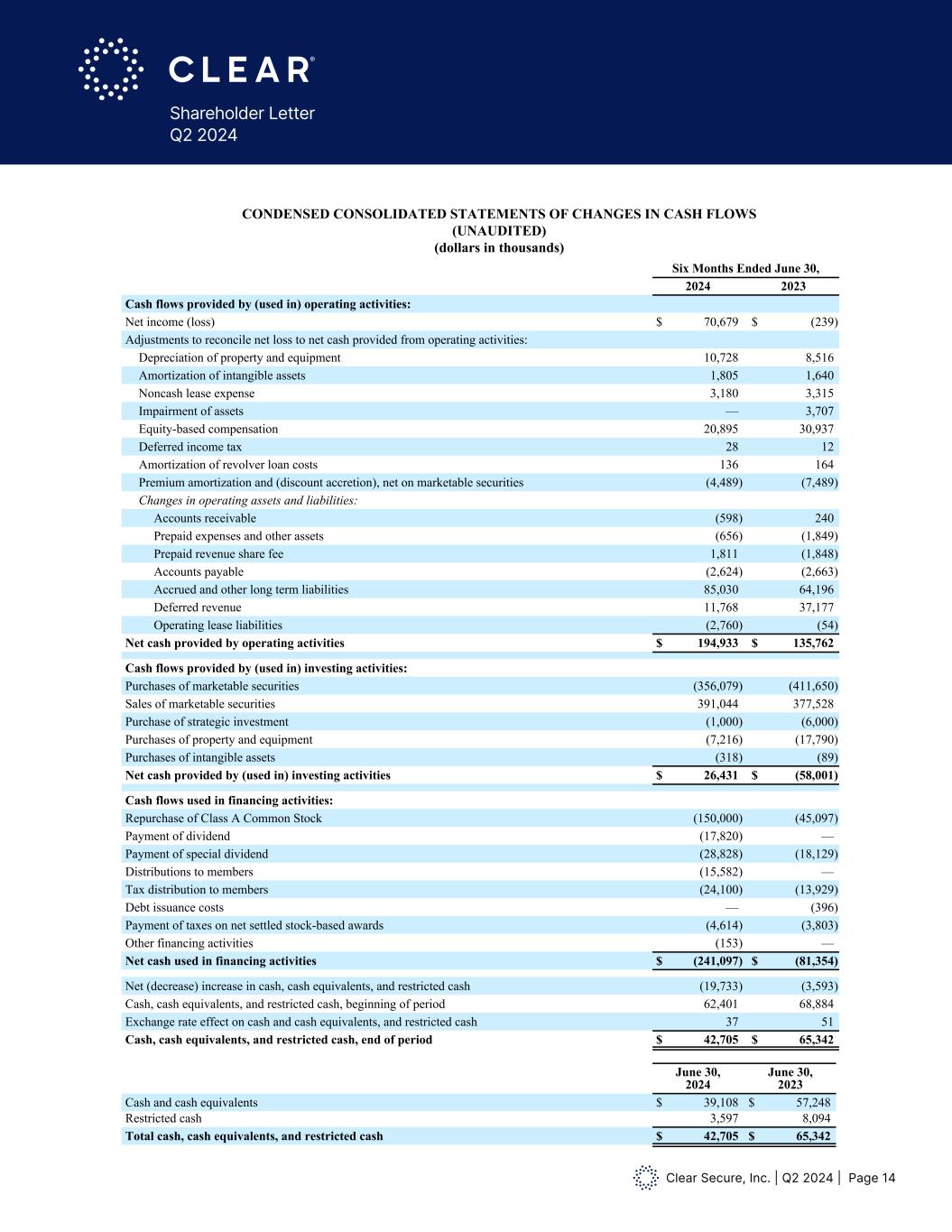

Clear Secure, Inc. | Q2 2024 | Page 10 Shareholder Letter Q2 2024 and decreased 5.3% sequentially; as a percentage of revenue it was down 130 basis points year-over-year and down 60 basis points sequentially. While we continue to expect sales and marketing expense in 2024 to decline as a percentage of revenue on a full year basis versus 2023, we will invest in marketing on an opportunistic basis. General and administrative expense was $55.4 million in the second quarter of 2024. Excluding previously disclosed prior-period NextGen Identity+ expenses and prior-period non-cash items, general and administrative expense declined 2.2% year-over-year and increased 6.8% sequentially; as a percentage of revenue general and administrative expense was down 812 basis points year-over-year and up 71 basis points sequentially. We continue to expect general and administrative expense in 2024 to decline as a percentage of revenue on a full year basis versus 2023. Stock compensation expense was $10.2 million in the second quarter of 2024. Excluding previously disclosed prior-period adjustments, stock compensation was down 27.6% year-over-year and 4.1% sequentially. Operating income of $30.3 million in the second quarter of 2024 includes a $0.6 million COVID-related benefit to cost of revenue share fees. Excluding the COVID-related benefit, as well as previously disclosed items, operating income was $29.8 million; as a percentage of revenue it was up 1,586 basis points year-over-year and 147 basis points sequentially. Net Income in the second quarter 2024 was $38.6 million, Net Income per Common Share, Basic and Diluted was $0.26. Second quarter 2024 Adjusted Net Income was $49.3 million, Adjusted Net Income per Common Share, Basic and Diluted was $0.34. Second quarter 2024 net cash provided by operating activities was $114.6 million, Free Cash Flow was $110.1 million and Adjusted EBITDA was $47.5 million. As of June 30, 2024, our cash and cash equivalents, marketable securities and restricted cash, totaled $673.2 million. As of August 1, 2024, 139,246,095 shares of common stock were outstanding including the following: Class A Common Stock 92,249,918, Class B Common Stock 907,234, Class C Common Stock 20,292,253, and Class D Common Stock 25,796,690. During the three-months ended June 30, 2024, we used $65.1 million to repurchase and retire 3.6 million shares of Class A Common Stock at an average price per share of $18.25. In July, we repurchased an additional 4.0 million shares in a block transaction from Delta Air Lines. Year-to-date, we have repurchased 12.0 million shares for an average price per share of $18.79. Second Quarter 2024 Financial Discussion (Cont.)

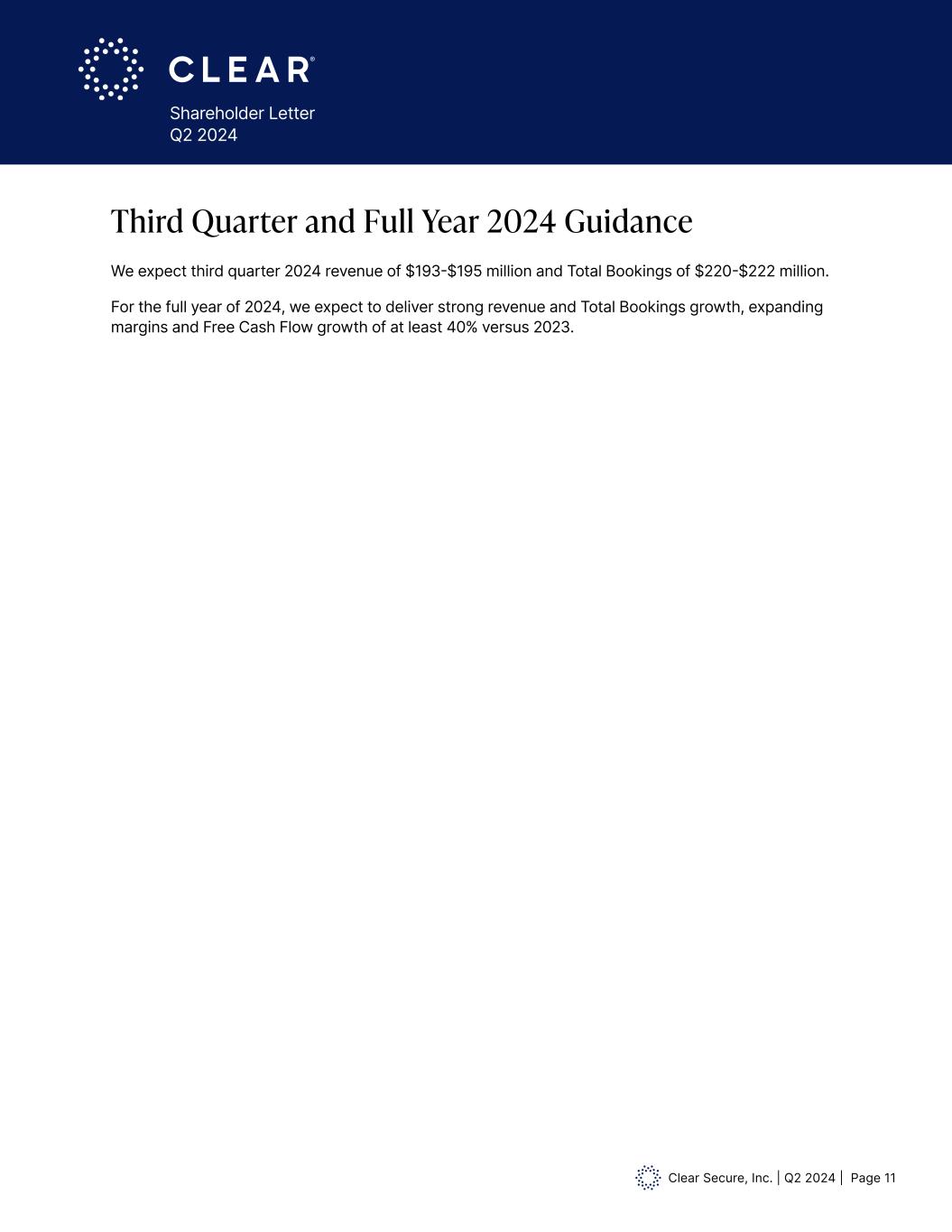

Clear Secure, Inc. | Q2 2024 | Page 11 Shareholder Letter Q2 2024 Third Quarter and Full Year 2024 Guidance We expect third quarter 2024 revenue of $193-$195 million and Total Bookings of $220-$222 million. For the full year of 2024, we expect to deliver strong revenue and Total Bookings growth, expanding margins and Free Cash Flow growth of at least 40% versus 2023.

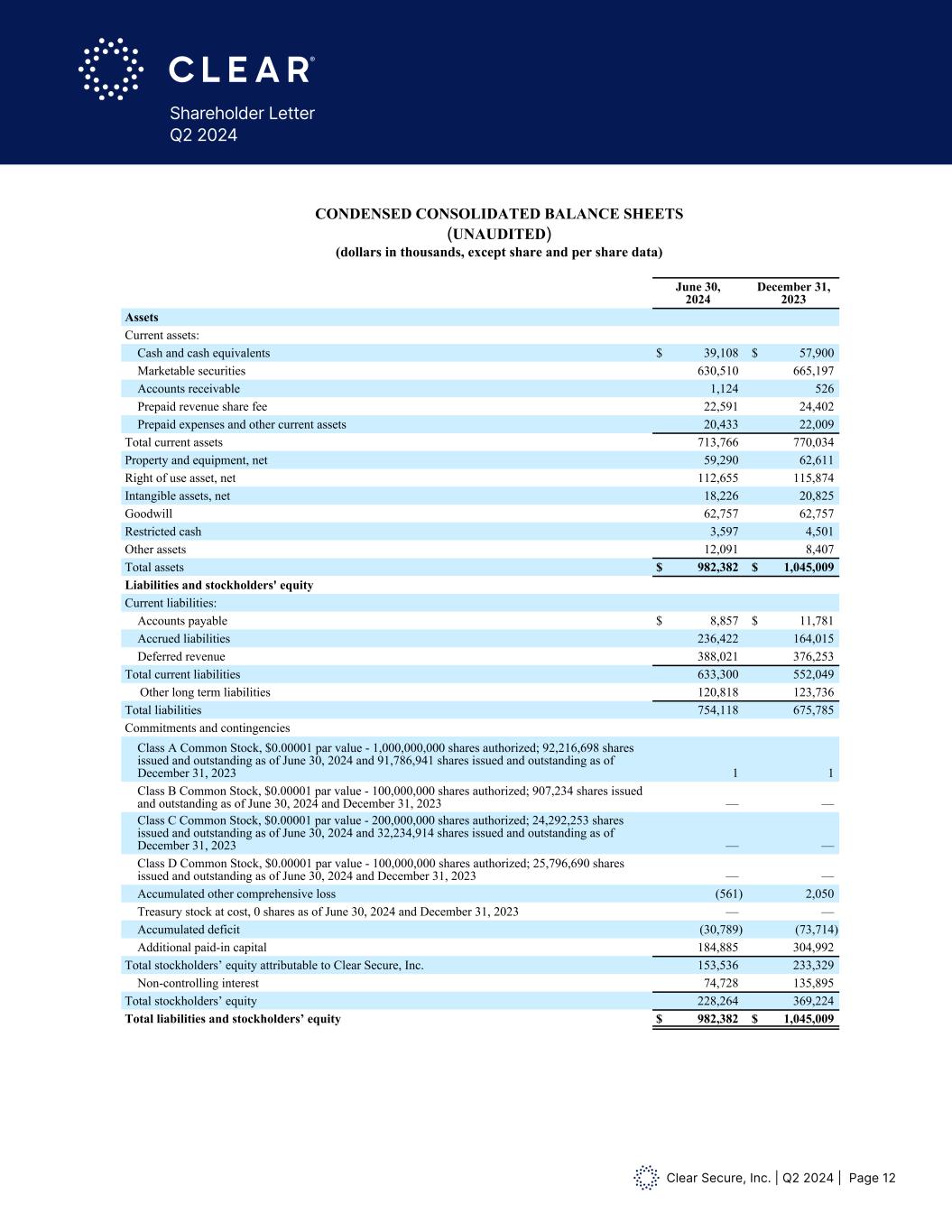

Clear Secure, Inc. | Q2 2024 | Page 12 Shareholder Letter Q2 2024 CLEAR SECURE, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (dollars in thousands, except share and per share data) June 30, 2024 December 31, 2023 Assets Current assets: Cash and cash equivalents $ 39,108 $ 57,900 Marketable securities 630,510 665,197 Accounts receivable 1,124 526 Prepaid revenue share fee 22,591 24,402 Prepaid expenses and other current assets 20,433 22,009 Total current assets 713,766 770,034 Property and equipment, net 59,290 62,611 Right of use asset, net 112,655 115,874 Intangible assets, net 18,226 20,825 Goodwill 62,757 62,757 Restricted cash 3,597 4,501 Other assets 12,091 8,407 Total assets $ 982,382 $ 1,045,009 Liabilities and stockholders' equity Current liabilities: Accounts payable $ 8,857 $ 11,781 Accrued liabilities 236,422 164,015 Deferred revenue 388,021 376,253 Total current liabilities 633,300 552,049 Other long term liabilities 120,818 123,736 Total liabilities 754,118 675,785 Commitments and contingencies (Note 17) Class A Common Stock, $0.00001 par value - 1,000,000,000 shares authorized; 92,216,698 shares issued and outstanding as of June 30, 2024 and 91,786,941 shares issued and outstanding as of December 31, 2023 1 1 Class B Common Stock, $0.00001 par value - 100,000,000 shares authorized; 907,234 shares issued and outstanding as of June 30, 2024 and December 31, 2023 — — Class C Common Stock, $0.00001 par value - 200,000,000 shares authorized; 24,292,253 shares issued and outstanding as of June 30, 2024 and 32,234,914 shares issued and outstanding as of December 31, 2023 — — Class D Common Stock, $0.00001 par value - 100,000,000 shares authorized; 25,796,690 shares issued and outstanding as of June 30, 2024 and December 31, 2023 — — Accumulated other comprehensive loss (561) 2,050 Treasury stock at cost, 0 shares as of June 30, 2024 and December 31, 2023 — — Accumulated deficit (30,789) (73,714) Additional paid-in capital 184,885 304,992 Total stockholders’ equity attributable to Clear Secure, Inc. 153,536 233,329 Non-controlling interest 74,728 135,895 Total stockholders’ equity 228,264 369,224 Total liabilities and stockholders’ equity $ 982,382 $ 1,045,009

Clear Secure, Inc. | Q2 2024 | Page 13 Shareholder Letter Q2 2024 CLEAR SECURE, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (dollars in thousands, except share and per share data) Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Revenue $ 186,745 $ 149,871 $ 365,794 $ 282,227 Operating expenses: Cost of revenue share fee 26,093 21,219 50,457 40,789 Cost of direct salaries and benefits 40,085 34,204 80,373 67,350 Research and development 17,411 22,310 37,515 44,254 Sales and marketing 11,007 10,788 22,629 20,297 General and administrative 55,371 56,144 108,261 114,222 Depreciation and amortization 6,441 4,989 12,533 10,156 Operating income (loss) 30,337 217 54,026 (14,841) Other income (expense): Interest income, net 8,247 7,394 18,172 13,786 Other income, net 416 634 855 908 Income (loss) before tax 39,000 8,245 73,053 (147) Income tax expense (409) (211) (2,374) (92) Net income (loss) 38,591 8,034 70,679 (239) Less: net income attributable to non-controlling interests 14,472 4,023 27,754 974 Net income (loss) attributable to Clear Secure, Inc. $ 24,119 $ 4,011 $ 42,925 $ (1,213) Net income (loss) per share of Class A Common Stock and Class B Common Stock (Note 15) Net income (loss) per common share basic, Class A $ 0.26 $ 0.04 $ 0.46 $ (0.01) Net income (loss) per common share basic, Class B $ 0.26 $ 0.04 $ 0.46 $ (0.01) Net income (loss) per common share diluted, Class A $ 0.26 $ 0.04 $ 0.46 $ (0.01) Net income (loss) per common share diluted, Class B $ 0.26 $ 0.04 $ 0.46 $ (0.01) Weighted-average shares of Class A Common Stock outstanding, basic 91,984,045 89,569,933 91,907,842 89,318,481 Weighted-average shares of Class B Common Stock outstanding, basic 907,234 907,234 907,234 907,234 Weighted-average shares of Class A Common Stock outstanding, diluted 92,605,019 90,372,444 92,645,417 89,318,481 Weighted-average shares of Class B Common Stock outstanding, diluted 907,234 907,234 907,234 907,234 CLEAR SECURE, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (dollars in thousands, except share and per share data) Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Revenue $ 186,745 $ 149,871 $ 365,794 $ 282,227 Operating expenses: Cost of revenue share fee 26,093 21,219 50,457 40,789 Cost of direct salaries and benefits 40,085 34,204 80,373 67,350 Research and development 17,411 22,310 37,515 44,254 Sales and marketing 11,007 10,788 22,629 20,297 General and administrative 55,371 56,144 108,261 114,222 Depreciation and amortization 6,441 4,989 12,533 10,156 Operating income (loss) 30,337 217 54,026 (14,841) Other income (expense): Interest income, net 8,247 7,394 18,172 13,786 Other income, net 416 634 855 908 Income (loss) before tax 39,000 8,245 73,053 (147) Income tax expense (409) (211) (2,374) (92) Net income (loss) 38,591 8,034 70,679 (239) Less: net income attributable to non-controlling interests 14,472 4,023 27,754 974 Net income (loss) attributable to Clear Secure, Inc. $ 24,119 $ 4,011 $ 42,925 $ (1,213) Net income (loss) per share of Class A Common Stock and Class B Common Stock (Note 15) Net income (loss) per common share basic, Class A $ 0.26 $ 0.04 $ 0.46 $ (0.01) Net income (loss) per common share basic, Class B $ 0.26 $ 0.04 $ 0.46 $ (0.01) Net income (loss) per common share diluted, Class A $ 0.26 $ 0.04 $ 0.46 $ (0.01) Net income (loss) per common share diluted, Class B $ 0.26 $ 0.04 $ 0.46 $ (0.01) Weighted-average shares of Class A Common Stock outstanding, basic 91,984,045 89,569,933 91,907,842 89,318,481 Weighted-average shares of Class B Common Stock outstanding, basic 907,234 907,234 907,234 907,234 Weighted-average shares of Class A Common Stock outstanding, diluted 92,605,019 90,372,444 92,645,417 89,318,481 Weighted-average shares of Class B Common Stock outstanding, diluted 907,234 907,234 907,234 907,234

Clear Secure, Inc. | Q2 2024 | Page 14 Shareholder Letter Q2 2024 CLEAR SECURE, INC. CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN CASH FLOWS (UNAUDITED) (dollars in thousands) Six Months Ended June 30, 2024 2023 Cash flows provided by (used in) operating activities: Net income (loss) $ 70,679 $ (239) Adjustments to reconcile net loss to net cash provided from operating activities: Depreciation of property and equipment 10,728 8,516 Amortization of intangible assets 1,805 1,640 Noncash lease expense 3,180 3,315 Impairment of assets — 3,707 Equity-based compensation 20,895 30,937 Deferred income tax 28 12 Amortization of revolver loan costs 136 164 Premium amortization and (discount accretion), net on marketable securities (4,489) (7,489) Changes in operating assets and liabilities: Accounts receivable (598) 240 Prepaid expenses and other assets (656) (1,849) Prepaid revenue share fee 1,811 (1,848) Accounts payable (2,624) (2,663) Accrued and other long term liabilities 85,030 64,196 Deferred revenue 11,768 37,177 Operating lease liabilities (2,760) (54) Net cash provided by operating activities $ 194,933 $ 135,762 Cash flows provided by (used in) investing activities: Purchases of marketable securities (356,079) (411,650) Sales of marketable securities 391,044 377,528 Purchase of strategic investment (1,000) (6,000) Purchases of property and equipment (7,216) (17,790) Purchases of intangible assets (318) (89) Net cash provided by (used in) investing activities $ 26,431 $ (58,001) Cash flows used in financing activities: Repurchase of Class A Common Stock (150,000) (45,097) Payment of dividend (17,820) — Payment of special dividend (28,828) (18,129) Distributions to members (15,582) — Tax distribution to members (24,100) (13,929) Debt issuance costs — (396) Payment of taxes on net settled stock-based awards (4,614) (3,803) Other financing activities (153) — Net cash used in financing activities $ (241,097) $ (81,354) Net (decrease) increase in cash, cash equivalents, and restricted cash (19,733) (3,593) Cash, cash equivalents, and restricted cash, beginning of period 62,401 68,884 Exchange rate effect on cash and cash equivalents, and restricted cash 37 51 Cash, cash equivalents, and restricted cash, end of period $ 42,705 $ 65,342 June 30, 2024 June 30, 2023 Cash and cash equivalents $ 39,108 $ 57,248 Restricted cash 3,597 8,094 Total cash, cash equivalents, and restricted cash $ 42,705 $ 65,342 CLEAR SECURE, INC. CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN CASH FLOWS (UNAUDITED) (dollars in thousands) Six Months Ended June 30, 2024 2023 Cash flows provided by (used in) operating activities: Net income (loss) $ 70,679 $ (239) Adjustments to reconcile net loss to net cash provided from operating activities: Depreciation of property and equipment 10,728 8,516 Amortization of intangible assets 1,805 1,640 Noncash lease expense 3,180 3,315 Impairment of assets — 3,707 Equity-based compensation 20,895 30,937 Deferred income tax 28 12 Amortization of revolver loan costs 136 164 Premium amortization and (discount accretion), net on marketable securities (4,489) (7,489) Changes in operating assets and liabilities: Accounts receivable (598) 240 Prepaid expenses and other assets (656) (1,849) Prepaid revenue share fee 1,811 (1,848) Accounts payable (2,624) (2,663) Accrued and other long term liabilities 85,030 64,196 Deferred revenue 11,768 37,177 Operating lease liabilities (2,760) (54) Net cash provided by operating activities $ 194,933 $ 135,762 Cash flows provided by (used in) investing activities: Purchases of marketable securities (356,079) (411,650) Sales of marketable securities 391,044 377,528 Purchase of strategic investment (1,000) (6,000) Purchases of property and equipment (7,216) (17,790) Purchases of intangible assets (318) (89) Net cash provided by (used in) investing activities $ 26,431 $ (58,001) Cash flows used in financing activities: Repurchase of Class A Common Stock (150,000) (45,097) Payment of dividend (17,820) — Payment of special dividend (28,828) (18,129) Distributions to members (15,582) — Tax distribution to members (24,100) (13,929) Debt issuance costs — (396) Payment of taxes on net settled stock-based awards (4,614) (3,803) Other financing activities (153) — Net cash used in financing activities $ (241,097) $ (81,354) Net (decrease) increase in cash, cash equivalents, and restricted cash (19,733) (3,593) Cash, cash equivalents, and restricted cash, beginning of period 62,401 68,884 Exchange rate effect on cash and cash equivalents, and restricted cash 37 51 Cash, cash equivalents, and restricted cash, end of period $ 42,705 $ 65,342 June 30, 2024 June 30, 2023 Cash and cash equivalents $ 39,108 $ 57,248 Restricted cash 3,597 8,094 Total cash, cash equivalents, and restricted cash $ 42,705 $ 65,342

Clear Secure, Inc. | Q2 2024 | Page 15 Shareholder Letter Q2 2024 To evaluate performance of the business, we utilize a variety of other non-GAAP financial reporting and performance measures. These key measures include Total Bookings, Total Cumulative Enrollments, Total Cumulative Platform Uses, Annual CLEAR Plus Net Member Retention, Annual CLEAR Plus Gross Dollar Retention, Active CLEAR Plus Members, and Annual CLEAR Plus Member Usage. Total Bookings Total Bookings represent our total revenue plus the change in deferred revenue during the period. Total Bookings in any particular period reflect sales to new and renewing CLEAR Plus subscribers plus any accrued billings to partners. Management believes that Total Bookings is an important measure of the current health and growth of the business and views it as a leading indicator. Total Cumulative Enrollments We define Total Cumulative Enrollments as the number of enrollments since inception as of the end of the period. An Enrollment is defined as any Member who has registered for the CLEAR platform since inception and has a profile (including limited time free trials regardless of conversion to paid membership) net of duplicate and/or purged accounts. This includes CLEAR Plus Members who have completed enrollment with CLEAR and have ever activated a payment method, plus associated family accounts. Management views this metric as an important tool to analyze the efficacy of our growth and marketing initiatives as new Members are potentially a current and leading indicator of revenues. Total Cumulative Platform Uses We define Total Cumulative Platform Uses as the number of individual engagements across CLEAR use cases, including CLEAR Plus, our flagship app and CLEAR Verified, since inception as of the end of the period. Management views this metric as an important tool to analyze the level of engagement of our Member base which can be a leading indicator of future growth, retention and revenue. Annual CLEAR Plus Net Member Retention We define Annual CLEAR Plus Net Member Retention as one minus the CLEAR Plus net Member churn on a rolling 12 month basis. We define “CLEAR Plus net Member churn” as total cancellations net of winbacks in the trailing 12 month period divided by the average Active CLEAR Plus Members as of the beginning of each month within the same 12 month period. Winbacks are defined as reactivated Members who have been cancelled for at least 60 days. Active CLEAR Plus Members are defined as Members who have completed enrollment with CLEAR and have activated a payment method for our in-airport CLEAR Plus service, including their registered family plan Members. Active CLEAR Plus Members also include those in a grace period of up to 51 days after a billing failure during which time we attempt to collect updated payment information. Management views this metric as an important tool to analyze the level of engagement of our Member base, which can be a leading indicator of future growth and revenue, as well as an indicator of customer satisfaction and long term business economics. Definitions of Key Performance Indicators

Clear Secure, Inc. | Q2 2024 | Page 16 Shareholder Letter Q2 2024 In addition to our results as determined in accordance with GAAP, we disclose Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Adjusted Net Income and Adjusted Net Income per Common Share, Basic and Diluted as non-GAAP financial measures that management believes provide useful information to investors. These measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for net income (loss), net cash provided by (used in) operating activities or any other operating performance measure calculated in accordance with GAAP, and may not be comparable to a similarly titled measure reported by other companies. Our Non-GAAP financial measures are expressed in thousands. Non-GAAP Financial Measures Annual CLEAR Plus Gross Dollar Retention We define Annual CLEAR Plus Gross Dollar Retention as the net bookings collected from a Fixed Cohort of Members during the Current Period as a percentage of the net bookings collected from the same Fixed Cohort during the Prior Period. The Current Period is the 12-month period ending on the reporting date, the Prior Period is the 12-month period ending on the reporting date one year earlier. The Fixed Cohort is defined as all Active CLEAR Plus Members as of the last day of the Prior Period who have activated a payment method for our in-airport CLEAR Plus service, including their registered family plan Members. Active CLEAR Plus Members also include those in a grace period of up to 51 days after a billing failure during which time we attempt to collect updated payment information. Bookings received from a third party as part of a partnership agreement are excluded from both periods; all Members, including those on a free or discounted plan, or who receive a full statement credit, only impact Annual CLEAR Plus Gross Dollar Retention to the extent that they are paying anything out-of-pocket on behalf of themselves or a registered family plan Member. Active CLEAR Plus Members We define Active CLEAR Plus Members as the number of members with an active CLEAR Plus subscription as of the end of the period. This includes CLEAR Plus Members who have an activated payment method, plus associated family accounts and is inclusive of Members who are in a limited time free trial; it excludes duplicate and/or purged accounts. Management views this as an important tool to measure the growth of its CLEAR Plus product. Annual CLEAR Plus Member Usage We define Annual CLEAR Plus Member Usage as the total number of unique CLEAR Plus airport verifications in the 365 days prior to the end of the period divided by active CLEAR Plus Members as of the end of the period who have been enrolled for at least 365 days. The numerator includes only verifications of the population in the denominator. Management views this as an important tool to analyze the level of engagement of our active CLEAR Plus Member base. Definitions of Key Performance Indicators (Cont.)

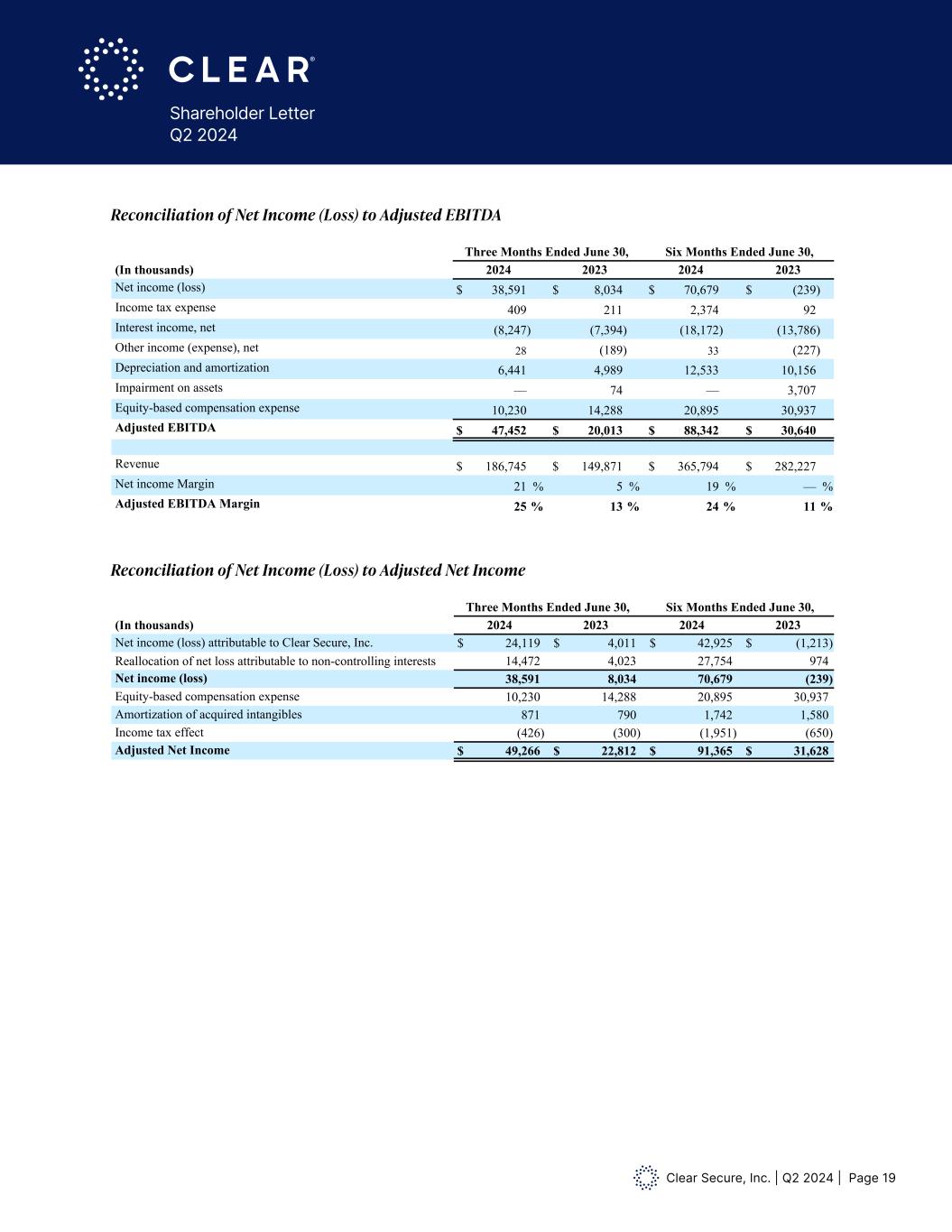

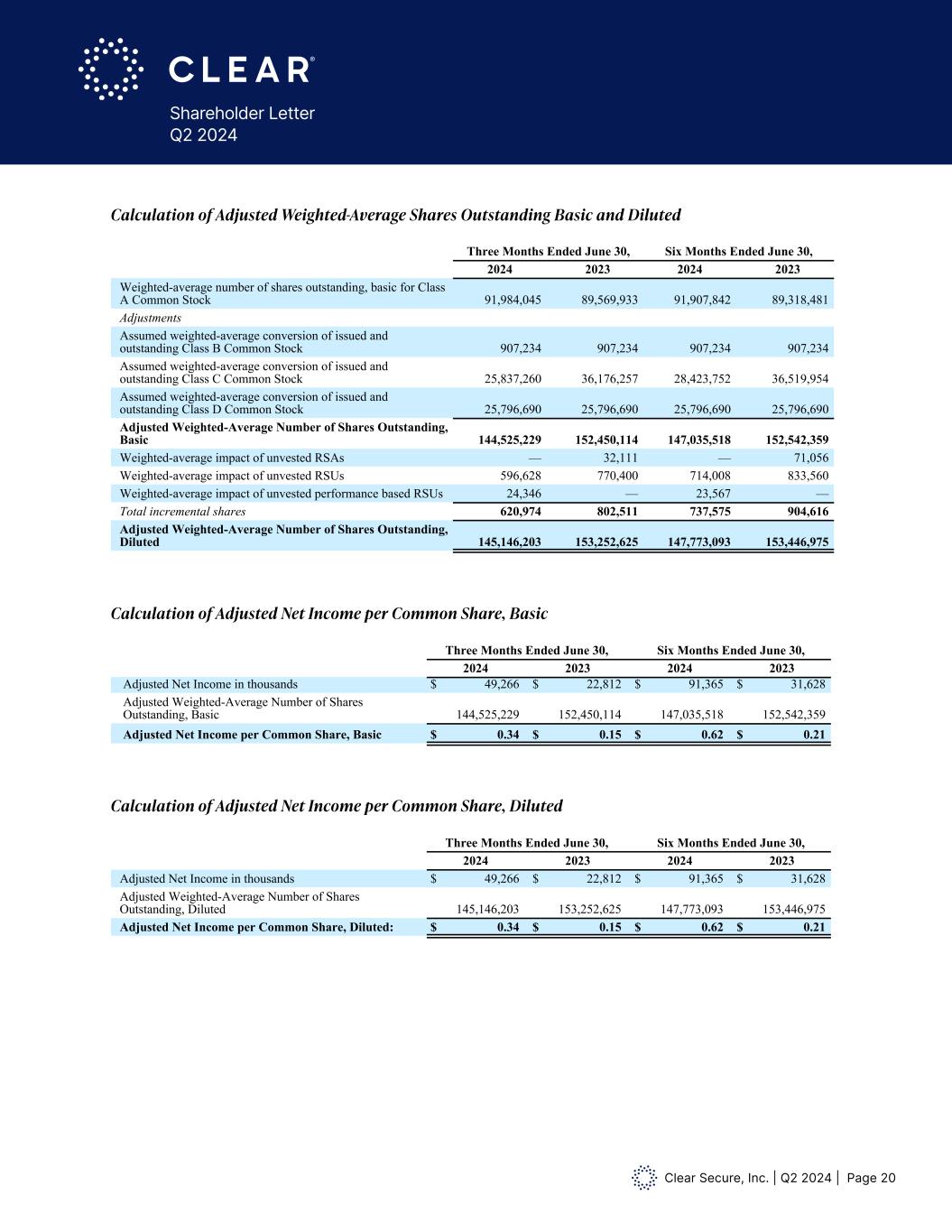

Clear Secure, Inc. | Q2 2024 | Page 17 Shareholder Letter Q2 2024 We periodically reassess the components of our Non-GAAP adjustments for changes in how we evaluate our performance and changes in how we make financial and operational decisions to ensure the adjustments remain relevant and meaningful. Adjusted EBITDA and Adjusted EBITDA Margin We define Adjusted EBITDA as net income (loss) adjusted for income taxes, interest (income) expense net, depreciation and amortization, impairment and losses on asset disposals, equity-based compensation expense, mark to market of warrant liabilities, net other income (expense) excluding sublease rental income, acquisition-related costs and changes in fair value of contingent consideration. Adjusted EBITDA is an important financial measure used by management and our board of directors (“Board”) to evaluate business performance. During the third quarter of fiscal year 2022, we revised our definition of Adjusted EBITDA (Loss) to exclude sublease rental income from our other income (expense) adjustment. During the fourth quarter of fiscal year 2022, we revised our definition of Adjusted EBITDA to include impairment on assets as a separate component. We did not revise prior years' Adjusted EBITDA because there was no impact of a similar nature in the prior period that affects comparability. Adjusted EBITDA margin is adjusted EBITDA, divided by total revenues. Adjusted Net Income We define Adjusted Net Income as net income (loss) attributable to Clear Secure, Inc. adjusted for the net income (loss) attributable to non-controlling interests, equity-based compensation expense, amortization of acquired intangible assets, acquisition-related costs, changes in fair value of contingent consideration and the income tax effect of these adjustments. Adjusted Net Income is used in the calculation of Adjusted Net Income per Common Share as defined below. Adjusted Net Income per Common Share We compute Adjusted Net Income per Common Share, Basic as Adjusted Net Income divided by Adjusted Weighted-Average Shares Outstanding for our Class A Common Stock, Class B Common Stock, Class C Common Stock and Class D Common Stock assuming the exchange of all vested and outstanding common units in Alclear at the end of each period presented. We do not present Adjusted Net Income per Common Share for shares of our Class B Common Stock although they are participating securities based on the assumed conversion of those shares to our Class A Common Stock. We do not present Adjusted Net Income per Common Share on a dilutive basis for periods where we have Adjusted Net Income since we do not assume the conversion of any potentially dilutive equity instruments as the result would be anti-dilutive. In periods where we have Adjusted Net Income, the Company also calculates Adjusted Net Income per Common Share, Diluted based on the effect of potentially dilutive equity instruments for the periods presented using the treasury stock/if-converted method, as applicable. Adjusted Net Income and Adjusted Net Income per Common Share exclude, to the extent applicable, the tax effected impact of non-cash expenses and other items that are not directly related to our core operations. These items are excluded because they are connected to the Company’s long term Non-GAAP Financial Measures (Cont.)

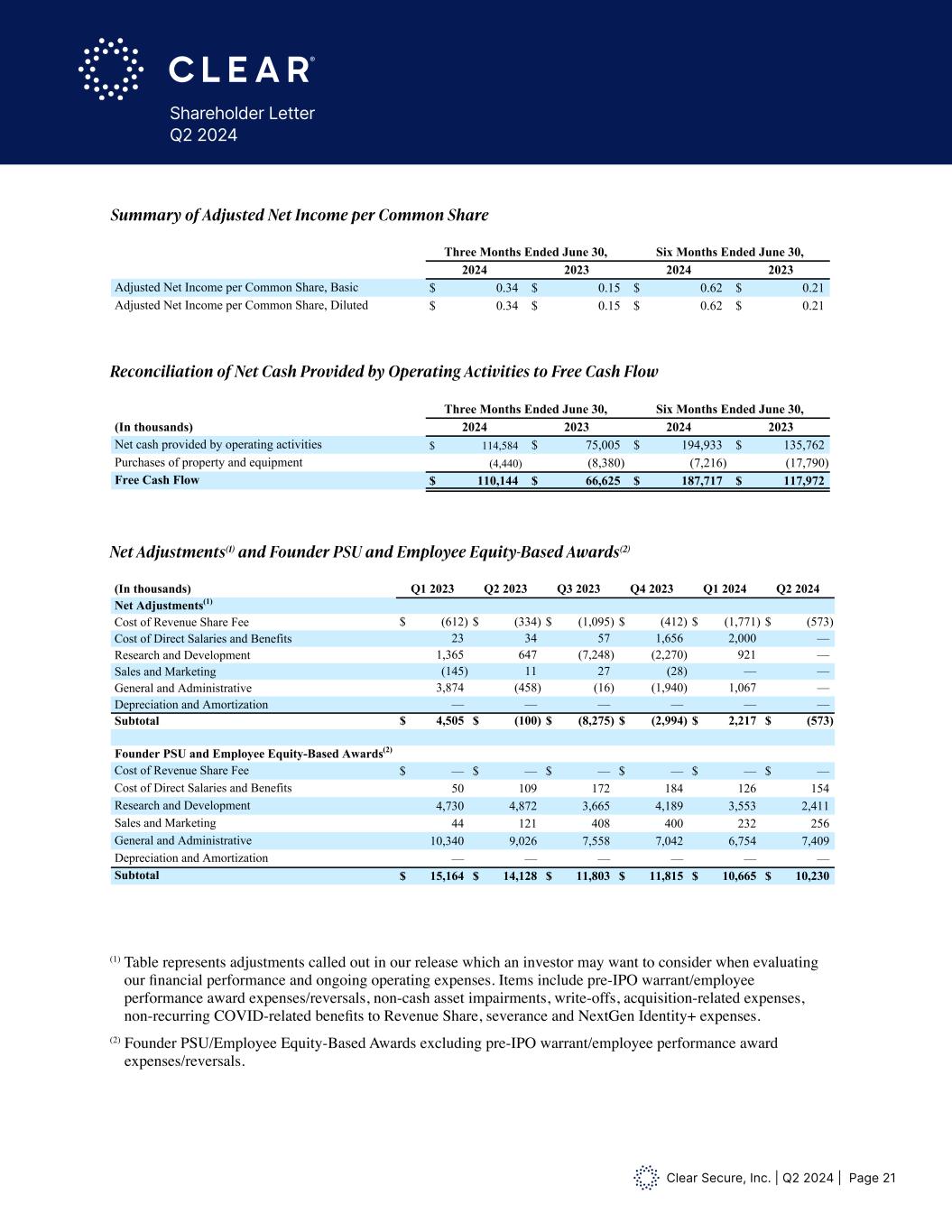

Clear Secure, Inc. | Q2 2024 | Page 18 Shareholder Letter Q2 2024 growth plan and not intended to increase short term revenue in a specific period. Further, to the extent that other companies use similar methods in calculating non-GAAP measures, the provision of supplemental non-GAAP information can allow for a comparison of the Company’s relative performance against other companies that also report non-GAAP operating results. Free Cash Flow We define Free Cash Flow as net cash provided by operating activities adjusted for purchases of property and equipment. With regards to our CLEAR Plus subscription service, we generally collect cash from our members upfront for annual subscriptions. As a result, when the business is growing Free Cash Flow can be a real time indicator of the current trajectory of the business. See below for reconciliations of these non-GAAP financial measures to their most comparable GAAP measures. Forward-Looking Statements This release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any and such forward looking statement are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments and events may differ materially from those in the forward-looking statements as a result of various factors, including those described in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. The Company disclaims any obligation to update any forward looking statements contained herein.

Clear Secure, Inc. | Q2 2024 | Page 19 Shareholder Letter Q2 2024 Free Cash Flow We define Free Cash Flow as net cash provided by operating activities adjusted for purchases of property and equipment. With regards to our CLEAR Plus subscription service, we generally collect cash from our members upfront for annual subscriptions. As a result, when the business is growing Free Cash Flow can be a real time indicator of the current trajectory of the business. See below for reconciliations of these non-GAAP financial measures to their most comparable GAAP measures. Forward Looking Statements This release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any and such forward looking statement are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments and events may differ materially from those in the forward-looking statements as a result of various factors, including those described in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. The Company disclaims any obligation to update any forward looking statements contained herein. Reconciliation of Net Income (Loss) to Adjusted EBITDA: Three Months Ended June 30, Six Months Ended June 30, (In thousands) 2024 2023 2024 2023 Net income (loss) $ 38,591 $ 8,034 $ 70,679 $ (239) Income tax expense 409 211 2,374 92 Interest income, net (8,247) (7,394) (18,172) (13,786) Other income (expense), net 28 (189) 33 (227) Depreciation and amortization 6,441 4,989 12,533 10,156 Impairment on assets — 74 — 3,707 Equity-based compensation expense 10,230 14,288 20,895 30,937 Adjusted EBITDA $ 47,452 $ 20,013 $ 88,342 $ 30,640 Revenue $ 186,745 $ 149,871 $ 365,794 $ 282,227 Net income Margin 21 % 5 % 19 % — % Adjusted EBITDA Margin 25 % 13 % 24 % 11 % Reconciliation of Net Income (Loss) to Adjusted Net Income Three Months Ended June 30, Six Months Ended June 30, (In thousands) 2024 2023 2024 2023 Net income (loss) attributable to Clear Secure, Inc. $ 24,119 $ 4,011 $ 42,925 $ (1,213) Reallocation of net loss attributable to non-controlling interests 14,472 4,023 27,754 974 Net income (loss) 38,591 8,034 70,679 (239) Equity-based compensation expense 10,230 14,288 20,895 30,937 Amortization of acquired intangibles 871 790 1,742 1,580 Income tax effect (426) (300) (1,951) (650) Adjusted Net Income $ 49,266 $ 22,812 $ 91,365 $ 31,628 Free Cash Flow We define Free Cash Flow as net cash provided by operating activities adjusted for purchases of property and equipment. With regards to ur CLEAR Plus sub cription service, we ge erally collect cash from our members upfront for annual subscriptions. As a result, when the business is growing Free Cash Flow can be a real time indicator of the current trajectory of the business. See below for reconciliations of these non-GAAP financial measures to their most comparable GAAP measures. Forward Looking Statements This release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any and such forward looking statement are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments and events may differ materially from those in the forward-looking statements as a result of various factors, including those described in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. The Company disclaims any obligation to update any forward looking statements contained herein. Reconciliation of Net Income (Loss) to Adjusted EBITDA: Three Months Ended June 30, Six Months Ended June 30, (In thousands) 2024 2023 2024 2023 Net income (loss) $ 38,591 $ 8,034 $ 70,679 $ (239) Income tax expense 409 211 2,374 92 Interest income, net (8,247) (7,394) (18,172) (13,786) Other income (expense), net 28 (189) 33 (227) Depreciation and amortization 6,441 4,989 12,533 10,156 Impairment on assets — 74 — 3,707 Equity-based compensation expense 10,230 14,288 20,895 30,937 Adjusted EBITDA $ 47,452 $ 20,013 $ 88,342 $ 30,640 Revenue $ 186,745 $ 149,871 $ 365,794 $ 282,227 Net income Margin 21 % 5 % 19 % — % Adjusted EBITDA Margin 25 % 13 % 24 % 11 % Reconciliation of Net Income (Loss) to Adjusted Net Income Three Months Ended June 30, Six Months Ended June 30, (In thousands) 2024 2023 2024 2023 Net income (loss) attributable to Clear Secure, Inc. $ 24,119 $ 4,011 $ 42,925 $ (1,213) Reallocation of net loss attributable to non-controlling interests 14,472 4,023 27,754 974 Net income (loss) 38,591 8,034 70,679 (239) Equity-based compensation expense 10,230 14,288 20,895 30,937 Amortization of acquired intangibles 871 790 1,742 1,580 Income tax effect (426) (300) (1,951) (650) Adjusted Net Income $ 49,266 $ 22,812 $ 91,365 $ 31,628 Reconciliation of Net Income (Loss) to Adjusted EBITDA Reconciliation of Net Income (Loss) to Adjusted Net Income

Clear Secure, Inc. | Q2 2024 | Page 20 Shareholder Letter Q2 2024 Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Calculation of Adjusted Net Income per Common Share, Basic Calculation of Adjusted Net Income per Common Share, Diluted Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Weighted-average number of shares outstanding, basic for Class A Common Stock 91,984,045 89,569,933 91,907,842 89,318,481 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 907,234 907,234 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 25,837,260 36,176,257 28,423,752 36,519,954 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 25,796,690 25,796,690 25,796,690 Adjusted Weighted-Average Number of Shares Outstanding, Basic 144,525,229 152,450,114 147,035,518 152,542,359 Weighted-average impact of unvested RSAs — 32,111 — 71,056 Weighted-average impact of unvested RSUs 596,628 770,400 714,008 833,560 Weighted-average impact of unvested performance based RSUs 24,346 — 23,567 — Total incremental shares 620,974 802,511 737,575 904,616 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 145,146,203 153,252,625 147,773,093 153,446,975 Calculation of Adjusted Net Income per Common Share, Basic Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 49,266 $ 22,812 $ 91,365 $ 31,628 Adjusted Weighted-Average Number of Shares Outstanding, Basic 144,525,229 152,450,114 147,035,518 152,542,359 Adjusted Net Income per Common Share, Basic $ 0.34 $ 0.15 $ 0.62 $ 0.21 Calculation of Adjusted Net Income per Common Share, Diluted Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 49,266 $ 22,812 $ 91,365 $ 31,628 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 145,146,203 153,252,625 147,773,093 153,446,975 Adjusted Net Income per Common Share, Diluted: $ 0.34 $ 0.15 $ 0.62 $ 0.21 Summary of Adjusted Net Income per Common Share: Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.34 $ 0.15 $ 0.62 $ 0.21 Adjusted Net Income per Common Share, Diluted $ 0.34 $ 0.15 $ 0.62 $ 0.21 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three Months Ended June 30, Six Months Ended June 30, (In thousands) 2024 2023 2024 2023 Net cash provided by operating activities $ 114,584 $ 75,005 $ 194,933 $ 135,762 Purchases of property and equipment (4,440) (8,380) (7,216) (17,790) Free Cash Flow $ 110,144 $ 66,625 $ 187,717 $ 117,972 Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Weighted-average number of shares utstanding, basic for Class A Common Stock 91, 84,045 89,569,9 3 91, ,842 89,318,481 dj stments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 907,234 907,234 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 25,837,260 36,176,257 28,423,752 36,519,954 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 25,796,690 25,796,690 25,796,690 Adjuste Weighted-Average Number of Shares Outstanding, Basic 144,525,229 152,450,114 147,035,518 152,542,359 Weighted-average impact of unvested RSAs — 32,111 — 71,056 Weighted-average impact of unvested RSUs 596,628 770,400 714,008 833,560 Weighted-average impact of unvested performance based RSUs 24,346 — 2 ,567 — Total incremental shares 620,974 802,511 737,575 904,616 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 145,146,203 153,252,625 147,773,093 153,446,975 Calculation of Adjusted Net Income per Common Share, Basic Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 49,266 $ 22,812 $ 91,365 $ 31,628 Adjusted Weighted-Average Number of Shares Outstanding, Basic 144,525,229 152,450,114 147,035,518 152,542,359 Adjusted Net Income per Common Share, Basic $ 0.34 $ 0.15 $ 0.62 $ 0.21 Calculation of Adjusted Net Income per Common Share, Diluted Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 j sted Net Income in thousands 49,266 22,8 2 91,3 5 31,6 8 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 145,146,203 153,252,625 147,773,093 153,446,975 Adjusted Net Income per Common Share, Diluted: $ 0.34 $ 0.15 $ 0.62 $ 0.21 Summary of Adjusted Net Income per Common Share: Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.34 $ 0.15 $ 0.62 $ 0.21 Adjusted Net Income per Common Share, Diluted $ 0.34 $ 0.15 $ 0.62 $ 0.21 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three Months Ended June 30, Six Months Ended June 30, (In thousands) 2024 2023 2024 2023 Net cash provided by operating activities $ 114,584 $ 75,005 $ 194,933 $ 135,762 Purchases of property and equipment (4,440) (8,380) (7,216) (17,790) Free Cash Flow $ 110,144 $ 66,625 $ 187,717 $ 117,972 Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Weighted-aver ge number f shares utstanding, basic for Class A Common Stock 91, 84,045 89,569,9 3 91, ,842 89,318,481 dj stme ts ss m weighted-average conversion of issued and out tanding Class B Common Stock 907, 34 907,23 907,234 907,234 Assume weighted-average co rsion of i sued and outstanding Class C Common Stock 25,837,260 36,176,257 28,423,752 36,519,954 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 25,796,690 25,796,690 25,796,690 Adjuste Weighted-Average Number of Shares Outstanding, Basic 144,525,229 152,450,114 147,035,518 152,542,359 Weighted-average impact of unvested RSAs — 32,111 — 71,056 Weighted-average impact of unvested RSUs 596,628 770,400 714,008 833,560 Weighted-average impact of unvested performance based RSUs 24,346 — 2 ,567 — Total incremental shares 620,974 802,511 737,575 9 4,616 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 145,146,203 153,252,625 147,773,093 153,446,975 Calculation of Adjusted Net Income per Common Share, Basic Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income in thousa ds $ 49,266 $ 22,812 $ 91,365 $ 31,628 Adjusted Weighted-Average Number of Shares Outstanding, Basic 144,525,229 152,450,114 147,035,518 152,542,359 Adjusted Net Income per Common Share, Basic $ 0.34 $ 0.15 $ 0.62 $ 0.21 Calculation of Adjusted Net Income per Common Share, Diluted Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 djusted Net Income in thousands $ 49,266 $ 22,812 $ 91,365 $ 31,628 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 145,146,203 153,252,625 147,773,093 153,446,975 Adjusted Net Income per Common Share, Diluted: $ 0.34 $ 0.15 $ 0.62 $ 0.21 Summary of Adjusted Net Income per Common Share: Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.34 $ 0.15 $ 0.62 $ 0.21 Adjusted Net Income per Common Share, Diluted $ 0.34 $ 0.15 $ 0.62 $ 0.21 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three Months Ended June 30, Six Months Ended June 30, (In thousands) 2024 2023 2024 2023 Net cash provided by operating activities $ 114,584 $ 75,005 $ 194,933 $ 135,762 Purchases of property and equipment (4,440) (8,380) (7,216) (17,790) Free Cash Flow $ 110,144 $ 66,625 $ 187,717 $ 117,97

Clear Secure, Inc. | Q2 2024 | Page 21 Shareholder Letter Q2 2024 Summary of Adjusted Net Income per Common Share Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow Net Adjustments(1) and Founder PSU and Employee Equity-Based Awards(2) (1) Table represents adjustments called out in our release which an investor may want to consider when evaluating our financial performance and ongoing operating expenses. Items include pre-IPO warrant/employee performance award expenses/reversals, non-cash asset impairments, write-offs, acquisition-related expenses, non-recurring COVID-related benefits to Revenue Share, severance and NextGen Identity+ expenses. (2) Founder PSU/Employee Equity-Based Awards excluding pre-IPO warrant/employee performance award expenses/reversals. Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Weighted-average number of shares outstanding, basic for Class A Common Stock 91,984,045 89,569,933 91,907,842 89,318,481 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 907,234 907,234 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 25,837,260 36,176,257 28,423,752 36,519,954 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 25,796,690 25,796,690 25,796,690 Adjusted Weighted-Average Number of Shares Outstanding, Basic 144,525,229 152,450,114 147,035,518 152,542,359 Weighted-average impact of unvested RSAs — 32,111 — 71,056 Weighted-average impact of unvested RSUs 596,628 770,400 714,008 833,560 Weighted-average impact of unvested performance based RSUs 24,346 — 23,567 — Total incremental shares 620,974 802,511 737,575 904,616 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 145,146,203 153,252,625 147,773,093 153,446,975 Calculation of Adjusted Net Income per Common Share, Basic Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 49,266 $ 22,812 $ 91,365 $ 31,628 Adjusted Weighted-Average Number of Shares Outstanding, Basic 144,525,229 152,450,114 147,035,518 152,542,359 Adjusted Net Income per Common Share, Basic $ 0.34 $ 0.15 $ 0.62 $ 0.21 Calculation of Adjusted Net Income per Common Share, Diluted Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 49,266 $ 22,812 $ 91,365 $ 31,628 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 145,146,203 153,252,625 147,773,093 153,446,975 Adjusted Net Income per Common Share, Diluted: $ 0.34 $ 0.15 $ 0.62 $ 0.21 Summary of Adjusted Net Income per Common Share: Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.34 $ 0.15 $ 0.62 $ 0.21 Adjusted Net Income per Common Share, Diluted $ 0.34 $ 0.15 $ 0.62 $ 0.21 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three Months Ended June 30, Six Months Ended June 30, (In thousands) 2024 2023 2024 2023 Net cash provided by operating activities $ 114,584 $ 75,005 $ 194,933 $ 135,762 Purchases of property and equipment (4,440) (8,380) (7,216) (17,790) Free Cash Flow $ 110,144 $ 66,625 $ 187,717 $ 117,972 Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Weighted-average number of shares outstanding, basic for Class A Common Stock 91,984,045 89,569,933 91,907,842 89,318,481 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 907,234 907,234 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 25,837,260 36,176,257 28,423,752 36,519,954 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 25,796,690 25,796,690 25,796,690 Adjusted Weighted-Average Number of Shares Outstanding, Basic 144,525,229 152,450,114 147,035,518 152,542,359 Weighted-average impact of unvested RSAs — 32,111 — 71,056 Weighted-average impact of unvested RSUs 596,628 770,400 714,008 833,560 Weighted-average impact of unvested performance based RSUs 24,346 — 23,567 — Total incremental shares 620,974 802,511 737,575 904,616 Adjusted Weighted-Average Number of Shares Outstanding, Dil ted 145,146,203 153,252,625 147,773,093 153,446,975 Calculation of Adjusted Net Income per Common Share, Basic Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 49,266 $ 22,812 $ 91,365 $ 31,628 Adjusted Weighted-Average Number of Shares Outstanding, Basic 144,525,229 152,450,114 147,035,518 152,542,359 Adjus ed Net Income per Common Sha e, Basic $ 0.34 $ 0.15 $ 0.62 $ 0.21 Calculation of Adjusted Net Income per Common Share, Diluted Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 49,266 $ 22,812 $ 91,365 $ 31,628 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 145,146,203 153,252,625 147,773,093 153,446,975 Adjusted Net Income per Common Share, Diluted: $ 0.34 $ 0.15 $ 0.62 $ 0.21 Summary of Adjusted Net Income per Common Share: Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.34 $ 0.15 $ 0.62 $ 0.21 Adjusted Net I come per Common Share, Diluted $ 0.34 $ 0.15 $ 0.62 $ 0.21 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three Months Ended June 30, Six Months Ended June 30, (In thousands) 2024 2023 2024 2023 Net cash provided by operating activities $ 114,584 $ 75,005 $ 194,933 $ 135,762 Purchases of property and equipment (4,440) (8,380) (7,216) (17,790) Free Cash Flow $ 110,144 $ 66,625 $ 187,717 $ 117,972 Net Adjustments(1) and Founder PSU and Employee Equity-Based Awards(2) (In thousands) Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Net Adjustments(1) Cost of Revenue Share Fee $ (612) $ (334) $ (1,095) $ (412) $ (1,771) $ (573) Cost of Direct Salaries and Benefits 23 34 57 1,656 2,000 — Research and Development 1,365 647 (7,248) (2,270) 921 — Sales and Marketing (145) 11 27 (28) — — General and Administrative 3,874 (458) (16) (1,940) 1,067 — Depreciation and Amortization — — — — — — Subtotal $ 4,505 $ (100) $ (8,275) $ (2,994) $ 2,217 $ (573) Founder PSU and Employee Equity-Based Awards(2) Cost of Revenue Share Fee $ — $ — $ — $ — $ — $ — Cost of Direct Salaries and Benefits 50 109 172 184 126 154 Research and Development 4,730 4,872 3,665 4,189 3,553 2,411 Sales and Marketing 44 121 408 400 232 256 General and Administrative 10,340 9,026 7,558 7,042 6,754 7,409 Depreciation and Amortization — — — — — — Subtotal $ 15,164 $ 14,128 $ 11,803 $ 11,815 $ 10,665 $ 10,230 (1) Table represents adjustments called out in our release which an investor may want to consider when evaluating our financial performance and ongoing operating expenses. Items include pre-IPO warrant/employee performance award expenses/reversals, non- cash asset impairments, writeoffs, acquisition-related expenses, non-recurring COVID-related benefits to Revenue Share, severance and NextGen Identity+ expenses. (2) Founder PSU/Employee Equity-Based Awards excluding pr -IPO warrant/employ e performance award xpenses/reversals.