Shareholder Letter Q1 2024

Clear Secure, Inc. | Q1 2024 | Page 2 Shareholder Letter Q1 2024 First Quarter 2024 Financial Highlights (all figures are for First Quarter 2024 and percentage change is expressed as year-over-year, unless otherwise specified)* Revenue of $179.0 million was up 35.3% while Total Bookings of $180.6 million were up 20.6% Operating income of $23.7 million; Adjusted EBITDA of $40.9 million Net Income of $32.1 million, Earnings per Common Share Basic and Diluted of $0.20 Net cash provided by operating activities of $80.3 million; Free Cash Flow of $77.6 million Q124 results include: (1) $3.1 million of NextGen Identity+ related expenses, (2) $0.9 million of cash severance expenses and (3) $1.8 million of COVID-19 relief benefits Share repurchase activity: 4,416,759 shares at an average price of $19.22 in Q124 Active in 57 CLEAR Plus airports with the launch of Kahului Airport (Maui) in April Renewed American Express partnership for an additional year TSA PreCheck® Enrollment Provided by CLEAR: online renewal available nationwide and live in 6 airports * A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided at the end of this letter. “ In the first quarter we executed on our three key priorities—improving the Member experience, scaling TSA PreCheck®, and scaling CLEAR Verified. Our financial results demonstrate our continued focus on profitable growth—with significant incremental margins and strong Free Cash Flow enabling aggressive capital return,” said Caryn Seidman Becker, CLEAR’s CEO

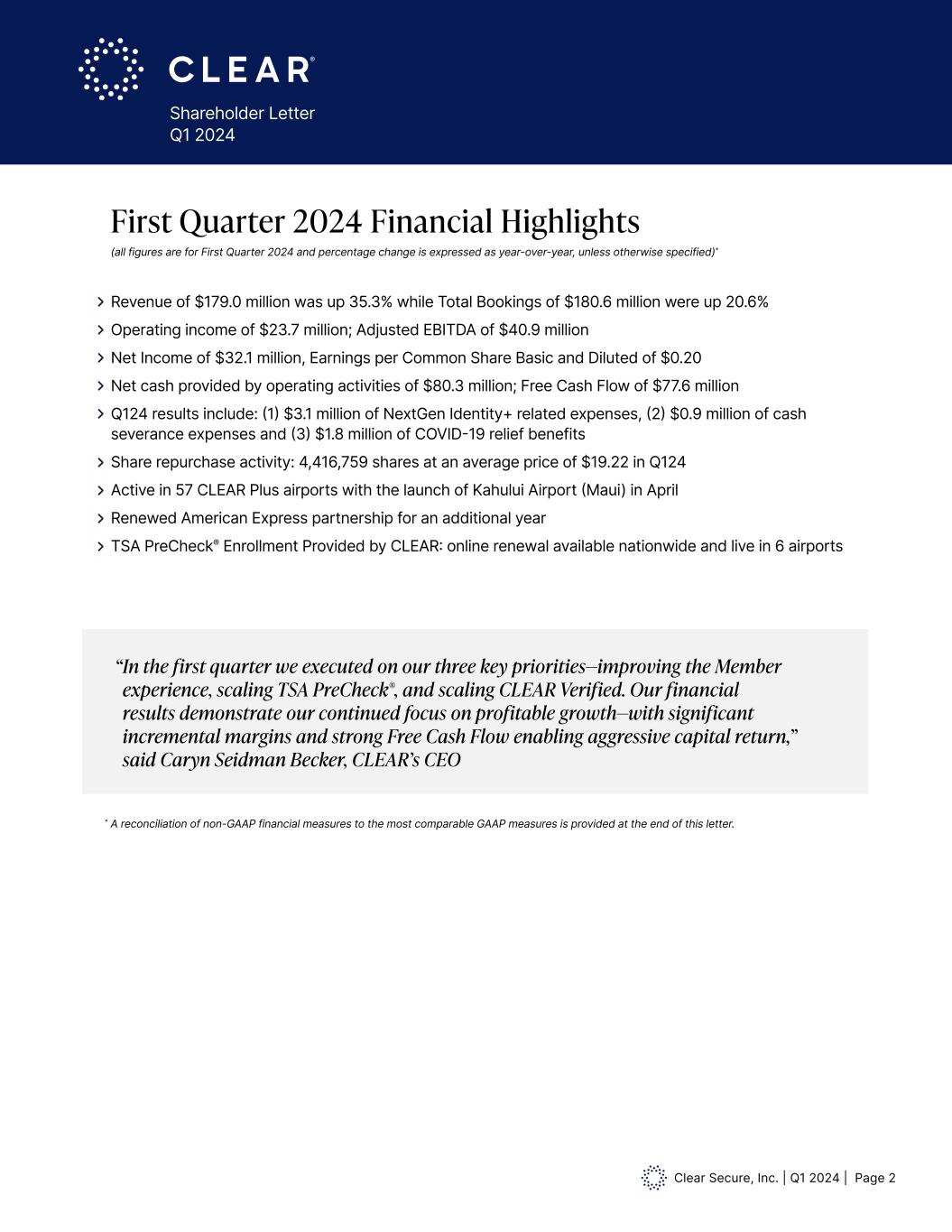

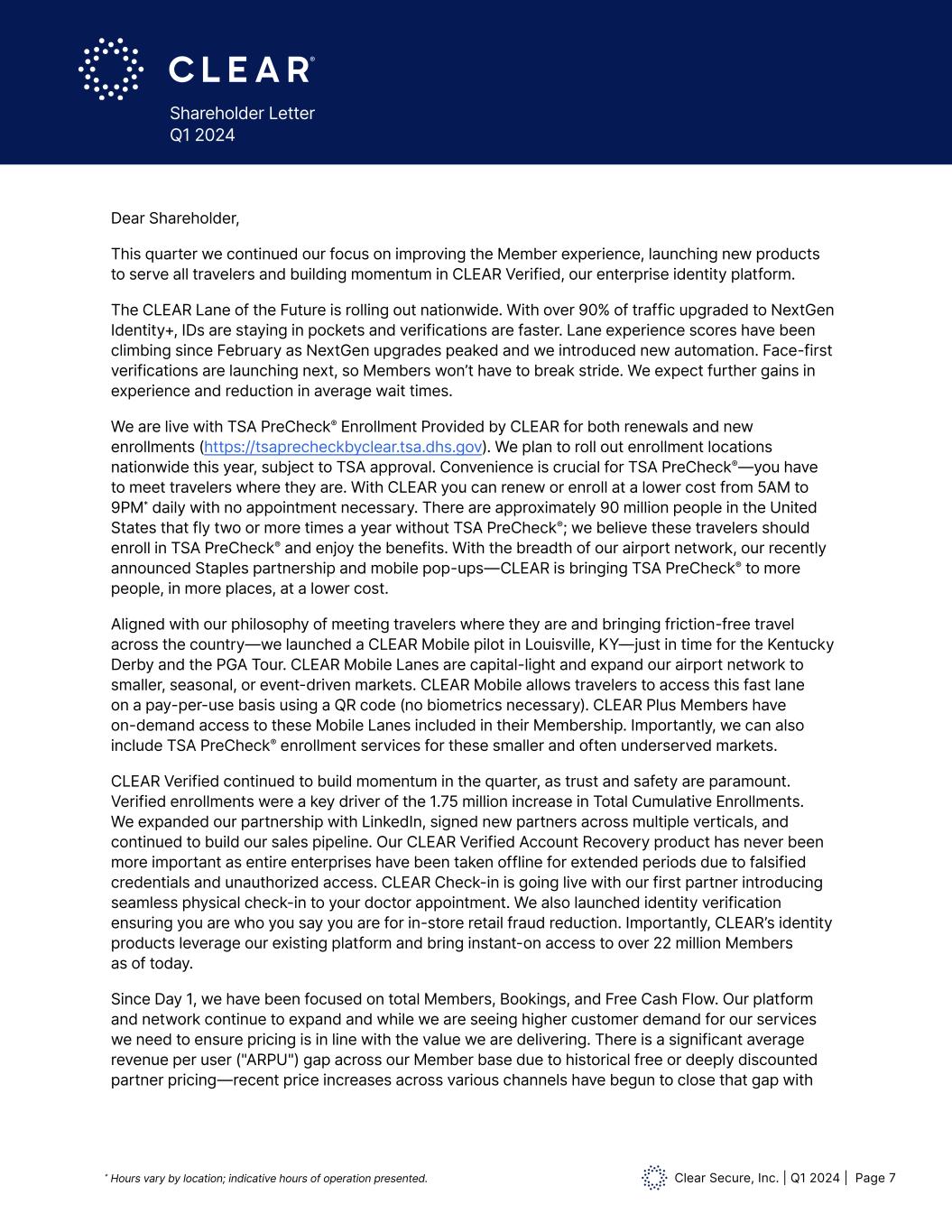

Clear Secure, Inc. | Q1 2024 | Page 3 Shareholder Letter Q1 2024 $132.4 $149.9 $160.4 $171.0 $179.0 $149.7 $175.1 $191.7 $195.3 $180.6 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Total GAAP Revenue & Bookings Revenue Total Bookings 16,202 17,385 18,594 20,194 21,941 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Total Cumulative Enrollments (Thousands) 141,106 154,317 167,417 180,807 192,610 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Total Cumulative Platform Uses (Thousands) $132.4 $149.9 $160.4 $171.0 $179.0 $149.7 $175.1 $191.7 $195.3 $180.6 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Total GAAP Revenue & Bookings Revenue Total Bookings 16,202 17,385 18,594 20,194 21,941 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Total Cumulative Enrollments (Thousands) 141,106 154,317 167,417 180,807 192,610 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Total Cumulative Platform Uses (Thousands) in millions in thousands Total GAAP Revenue & Bookings Total Cumulative Enrollments

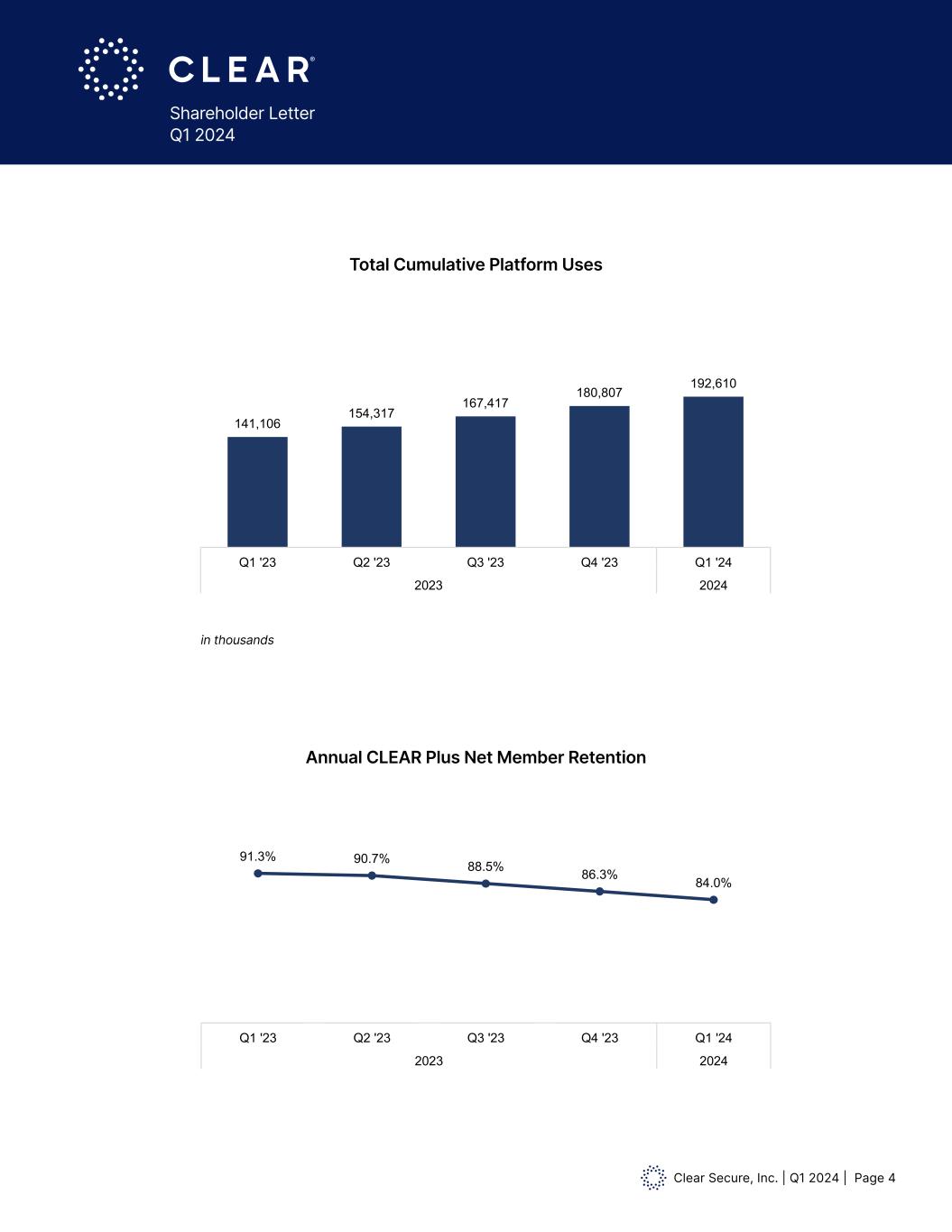

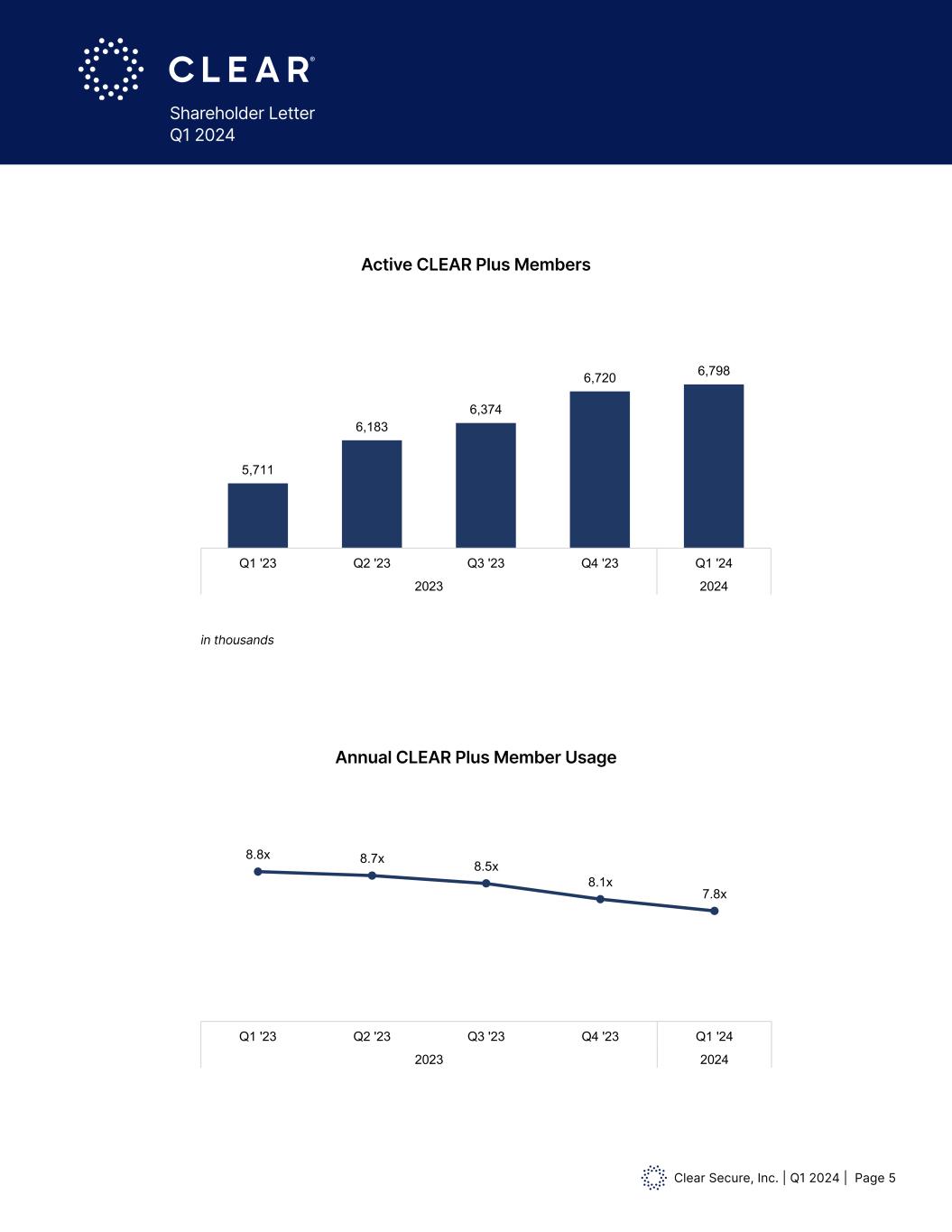

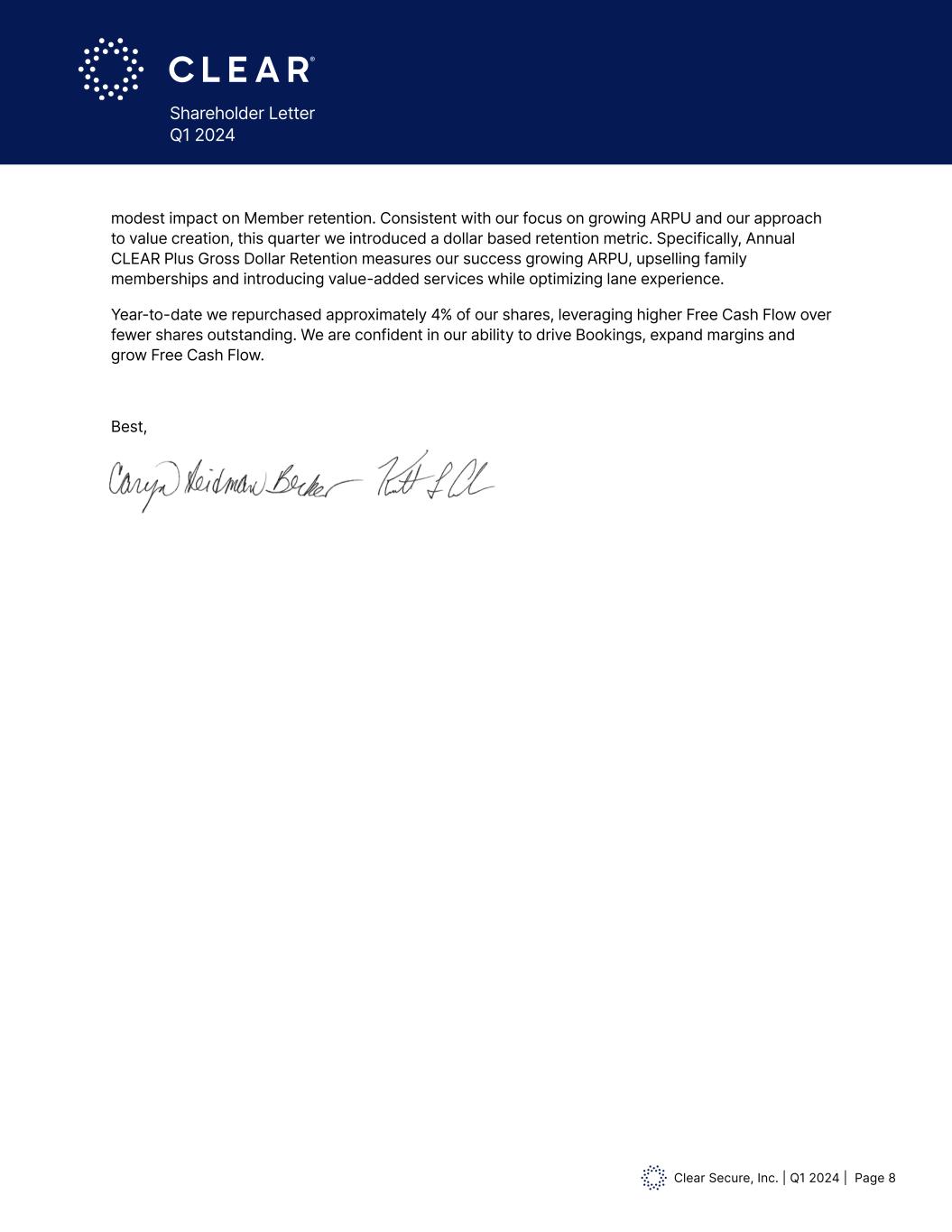

Clear Secure, Inc. | Q1 2024 | Page 4 Shareholder Letter Q1 2024 $180.6 Q1 '24 2024 21,941 Q1 '24 2024 192,610 Q1 '24 2024 91.3% 90.7% 88.5% 86.3% 84.0% Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Annual CLEAR Plus Net Member Retention 5,711 6,183 6,374 6,720 6,798 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Acitve CLEAR Plus Members (Thousands) 8.8x 8.7x 8.5x 8.1x 7.8x Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Annualized CLEAR Plus Member Usage $132.4 $149.9 $160.4 $171.0 $179.0 $149.7 $175.1 $191.7 $195.3 $180.6 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Total GAAP Revenue & Bookings Revenue Total Bookings 16,202 17,385 18,594 20,194 21,941 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Total Cumulative Enrollments (Thousands) 14 ,106 154,317 167,417 180,807 192,610 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Total Cumulative Platform Uses (Thousands) Total Cumulative Platform Uses Annual CLEAR Plus Net Member Retention in thousands

Clear Secure, Inc. | Q1 2024 | Page 5 Shareholder Letter Q1 2024 Active CLEAR Plus Members Annual CLEAR Plus Member Usage $180.6 Q1 '24 2024 21,941 Q1 '24 2024 192,610 Q1 '24 2024 91.3% 90.7% 88.5% 86.3% 84.0% Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Annual CLEAR Plus Net Member Retention 5,711 6,183 6,374 6,720 6,798 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Acitve CLEAR Plus Members (Thousands) 8.8x 8.7x 8.5x 8.1x 7.8x Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Annualized CLEAR Plus Member Usage in thousands $180.6 Q1 '24 2024 21,941 Q1 '24 2024 192,610 Q1 '24 2024 91.3% 90.7% 88.5% 86.3% 84.0% Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Annual CLEAR Plus Net Member Retention 5,711 6,183 6,374 6,720 6,798 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Acitve CLEAR Plus Members (Thousands) 8.8x 8.7x 8.5x 8.1x 7.8x Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2023 2024 Annualized CLEAR Plus Member Usage

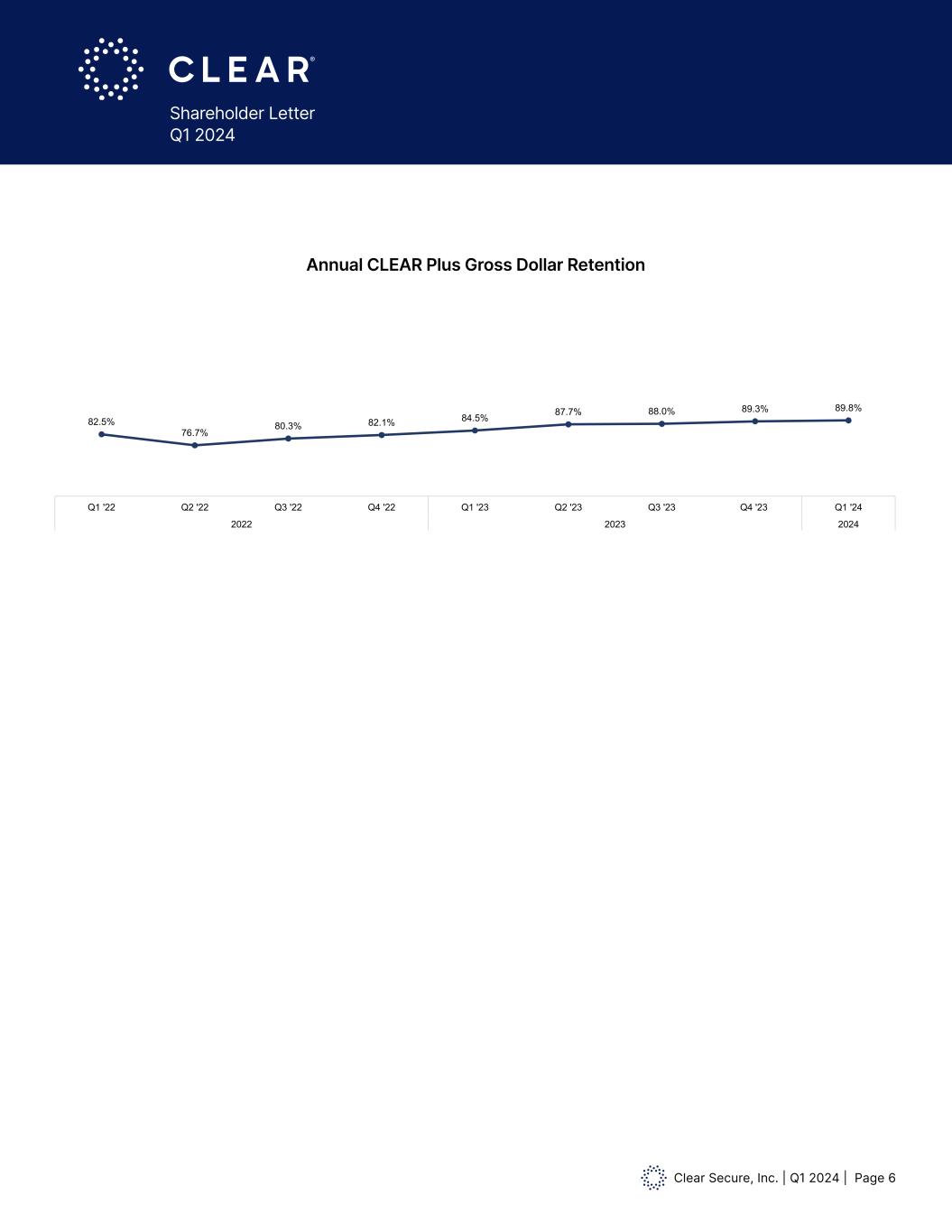

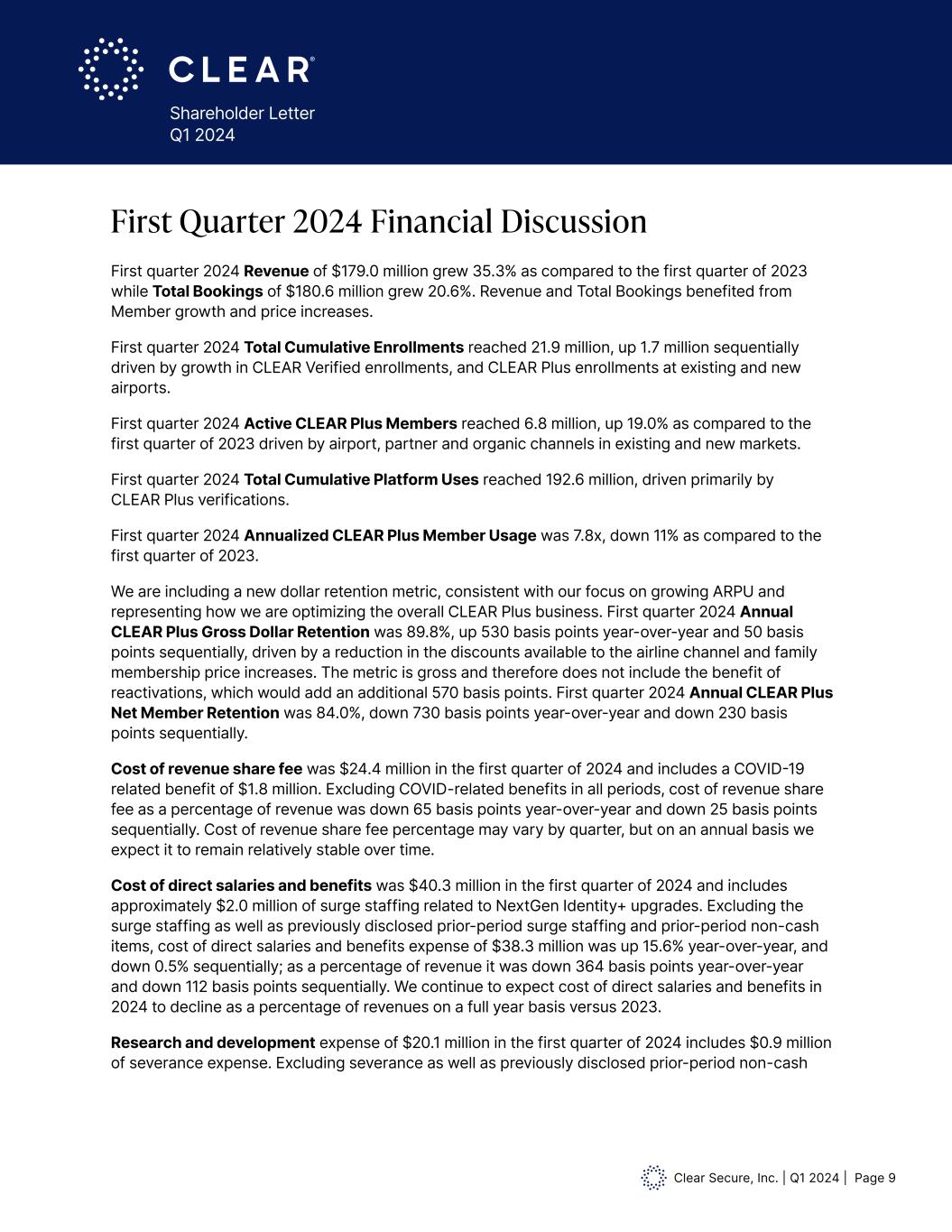

Clear Secure, Inc. | Q1 2024 | Page 6 Shareholder Letter Q1 2024 Revenue Total Bookings 82.5% 76.7% 80.3% 82.1% 84.5% 87.7% 88.0% 89.3% 89.8% Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Q1 '24 2022 2023 2024 Annual CLEAR Plus Gross Dollar Retention Annual CLEAR Plus Gross Dollar Retention

Clear Secure, Inc. | Q1 2024 | Page 7 Shareholder Letter Q1 2024 Dear Shareholder, This quarter we continued our focus on improving the Member experience, launching new products to serve all travelers and building momentum in CLEAR Verified, our enterprise identity platform. The CLEAR Lane of the Future is rolling out nationwide. With over 90% of traffic upgraded to NextGen Identity+, IDs are staying in pockets and verifications are faster. Lane experience scores have been climbing since February as NextGen upgrades peaked and we introduced new automation. Face-first verifications are launching next, so Members won’t have to break stride. We expect further gains in experience and reduction in average wait times. We are live with TSA PreCheck® Enrollment Provided by CLEAR for both renewals and new enrollments (https://tsaprecheckbyclear.tsa.dhs.gov). We plan to roll out enrollment locations nationwide this year, subject to TSA approval. Convenience is crucial for TSA PreCheck®—you have to meet travelers where they are. With CLEAR you can renew or enroll at a lower cost from 5AM to 9PM* daily with no appointment necessary. There are approximately 90 million people in the United States that fly two or more times a year without TSA PreCheck®; we believe these travelers should enroll in TSA PreCheck® and enjoy the benefits. With the breadth of our airport network, our recently announced Staples partnership and mobile pop-ups—CLEAR is bringing TSA PreCheck® to more people, in more places, at a lower cost. Aligned with our philosophy of meeting travelers where they are and bringing friction-free travel across the country—we launched a CLEAR Mobile pilot in Louisville, KY—just in time for the Kentucky Derby and the PGA Tour. CLEAR Mobile Lanes are capital-light and expand our airport network to smaller, seasonal, or event-driven markets. CLEAR Mobile allows travelers to access this fast lane on a pay-per-use basis using a QR code (no biometrics necessary). CLEAR Plus Members have on-demand access to these Mobile Lanes included in their Membership. Importantly, we can also include TSA PreCheck® enrollment services for these smaller and often underserved markets. CLEAR Verified continued to build momentum in the quarter, as trust and safety are paramount. Verified enrollments were a key driver of the 1.75 million increase in Total Cumulative Enrollments. We expanded our partnership with LinkedIn, signed new partners across multiple verticals, and continued to build our sales pipeline. Our CLEAR Verified Account Recovery product has never been more important as entire enterprises have been taken offline for extended periods due to falsified credentials and unauthorized access. CLEAR Check-in is going live with our first partner introducing seamless physical check-in to your doctor appointment. We also launched identity verification ensuring you are who you say you are for in-store retail fraud reduction. Importantly, CLEAR’s identity products leverage our existing platform and bring instant-on access to over 22 million Members as of today. Since Day 1, we have been focused on total Members, Bookings, and Free Cash Flow. Our platform and network continue to expand and while we are seeing higher customer demand for our services we need to ensure pricing is in line with the value we are delivering. There is a significant average revenue per user ("ARPU") gap across our Member base due to historical free or deeply discounted partner pricing—recent price increases across various channels have begun to close that gap with * Hours vary by location; indicative hours of operation presented.

Clear Secure, Inc. | Q1 2024 | Page 8 Shareholder Letter Q1 2024 modest impact on Member retention. Consistent with our focus on growing ARPU and our approach to value creation, this quarter we introduced a dollar based retention metric. Specifically, Annual CLEAR Plus Gross Dollar Retention measures our success growing ARPU, upselling family memberships and introducing value-added services while optimizing lane experience. Year-to-date we repurchased approximately 4% of our shares, leveraging higher Free Cash Flow over fewer shares outstanding. We are confident in our ability to drive Bookings, expand margins and grow Free Cash Flow. Best,

Clear Secure, Inc. | Q1 2024 | Page 9 Shareholder Letter Q1 2024 First quarter 2024 Revenue of $179.0 million grew 35.3% as compared to the first quarter of 2023 while Total Bookings of $180.6 million grew 20.6%. Revenue and Total Bookings benefited from Member growth and price increases. First quarter 2024 Total Cumulative Enrollments reached 21.9 million, up 1.7 million sequentially driven by growth in CLEAR Verified enrollments, and CLEAR Plus enrollments at existing and new airports. First quarter 2024 Active CLEAR Plus Members reached 6.8 million, up 19.0% as compared to the first quarter of 2023 driven by airport, partner and organic channels in existing and new markets. First quarter 2024 Total Cumulative Platform Uses reached 192.6 million, driven primarily by CLEAR Plus verifications. First quarter 2024 Annualized CLEAR Plus Member Usage was 7.8x, down 11% as compared to the first quarter of 2023. We are including a new dollar retention metric, consistent with our focus on growing ARPU and representing how we are optimizing the overall CLEAR Plus business. First quarter 2024 Annual CLEAR Plus Gross Dollar Retention was 89.8%, up 530 basis points year-over-year and 50 basis points sequentially, driven by a reduction in the discounts available to the airline channel and family membership price increases. The metric is gross and therefore does not include the benefit of reactivations, which would add an additional 570 basis points. First quarter 2024 Annual CLEAR Plus Net Member Retention was 84.0%, down 730 basis points year-over-year and down 230 basis points sequentially. Cost of revenue share fee was $24.4 million in the first quarter of 2024 and includes a COVID-19 related benefit of $1.8 million. Excluding COVID-related benefits in all periods, cost of revenue share fee as a percentage of revenue was down 65 basis points year-over-year and down 25 basis points sequentially. Cost of revenue share fee percentage may vary by quarter, but on an annual basis we expect it to remain relatively stable over time. Cost of direct salaries and benefits was $40.3 million in the first quarter of 2024 and includes approximately $2.0 million of surge staffing related to NextGen Identity+ upgrades. Excluding the surge staffing as well as previously disclosed prior-period surge staffing and prior-period non-cash items, cost of direct salaries and benefits expense of $38.3 million was up 15.6% year-over-year, and down 0.5% sequentially; as a percentage of revenue it was down 364 basis points year-over-year and down 112 basis points sequentially. We continue to expect cost of direct salaries and benefits in 2024 to decline as a percentage of revenues on a full year basis versus 2023. Research and development expense of $20.1 million in the first quarter of 2024 includes $0.9 million of severance expense. Excluding severance as well as previously disclosed prior-period non-cash First Quarter 2024 Financial Discussion

Clear Secure, Inc. | Q1 2024 | Page 10 Shareholder Letter Q1 2024 items, research and development expense of $19.2 million was down 6.8% year-over-year and down 7.2% sequentially; as a percentage of revenue it was down 483 basis points year-over-year and down 138 basis points sequentially. We continue to expect research and development expense in 2024 to decline as a percentage of revenues on a full year basis versus 2023. Sales and marketing expense was $11.6 million in the first quarter of 2024. Excluding previously disclosed prior-period non-cash items, sales and marketing expense increased 20.4% year-over-year and decreased 14.1% sequentially; as a percentage of revenue it was down 80 basis points year-over- year and down 142 basis points sequentially. While we continue to expect sales and marketing expense in 2024 to decline as a percentage of revenues on a full year basis versus 2023, we will invest in marketing on an opportunistic basis. General and administrative expense of $52.9 million in the first quarter of 2024 includes $1.1 million of NextGen Identity+ expenses. Excluding NextGen Identity+ expenses as well as previously disclosed prior-period NextGen Identity+ expenses and prior-period non-cash items, general and administrative expense of $51.8 million declined 4.4% year-over-year and 4.0% sequentially; as a percentage of revenue general and administrative expense was down 1,201 basis points year-over- year and 263 basis points sequentially. We continue to expect general and administrative expense in 2024 to decline as a percentage of revenues on a full year basis versus 2023. Stock compensation expense was $10.7 million in the first quarter of 2024. Excluding previously disclosed prior-period non-cash items, stock compensation expense of $10.7 million was down 29.7% year-over-year and 9.7% sequentially. Operating Income of $23.7 million in the first quarter of 2024 includes a $1.8 million COVID-related benefit to cost of revenue share fees, $0.9 million of severance expense and $3.1 million of NextGen Identity+ expenses. Excluding the COVID-related benefit and severance and NextGen Identity+ expenses, as well as previously disclosed prior-period NextGen Identity+ and prior-period non-cash items, Operating Income was $25.9 million; as a percentage of revenue it was up 2,244 basis points year-over-year and 704 basis points sequentially. Net Income in the first quarter 2024 was $32.1 million, Earnings per Common Share, Basic and Diluted was $0.20. First quarter 2024 net cash provided by operating activities was $80.3 million, Free Cash Flow was $77.6 million and Adjusted EBITDA was $40.9 million. As of March 31, 2024, our cash and cash equivalents, marketable securities and restricted cash, totaled $702 million. As of May 3, 2024, the following shares of common stock were outstanding: Class A Common Stock 93,022,861, Class B Common Stock 907,234, Class C Common Stock 25,103,193, and Class D Common Stock 25,796,690 totaling 144,829,978 shares of common stock. First Quarter 2024 Financial Discussion (Cont.)

Clear Secure, Inc. | Q1 2024 | Page 11 Shareholder Letter Q1 2024 During the three-months ended March 31, 2024, we used $84.9 million to repurchase and retire 4.4 million shares of Class A Common Stock at an average price of $19.22. Subsequent to quarter-end, we repurchased an additional 1.75 million shares at an average price of $19.38. First Quarter 2024 Financial Discussion (Cont.) Second Quarter and Full Year 2024 Guidance We expect second quarter 2024 revenue of $182.5-$184.5 million and Total Bookings of $192-$198 million. For the full year of 2024, we expect to deliver strong revenue and Total Bookings growth, expanding margins and Free Cash Flow growth of at least 30% versus 2023.

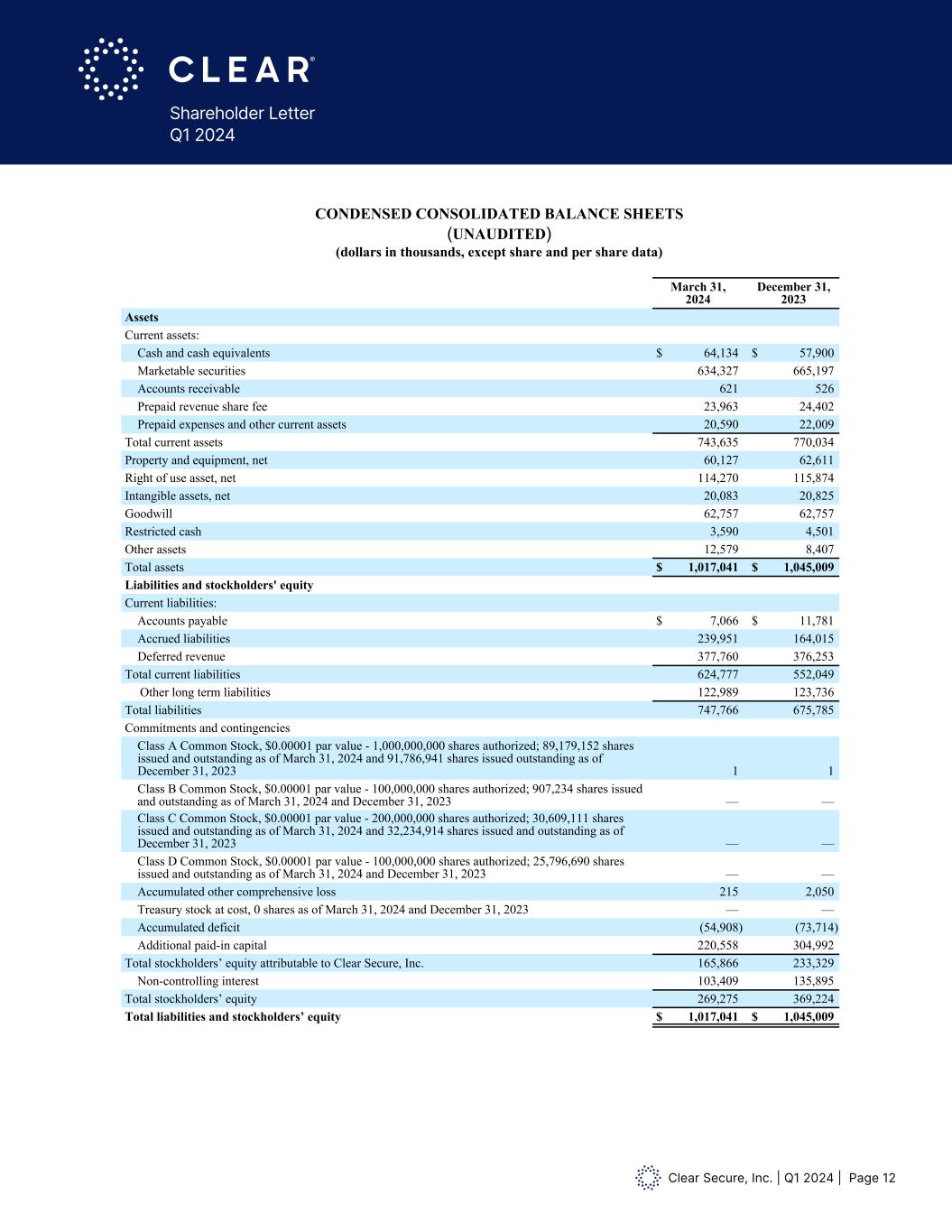

Clear Secure, Inc. | Q1 2024 | Page 12 Shareholder Letter Q1 2024 CLEAR SECURE, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (dollars in thousands, except share and per share data) March 31, 2024 December 31, 2023 Assets Current assets: Cash and cash equivalents $ 64,134 $ 57,900 Marketable securities 634,327 665,197 Accounts receivable 621 526 Prepaid revenue share fee 23,963 24,402 Prepaid expenses and other current assets 20,590 22,009 Total current assets 743,635 770,034 Property and equipment, net 60,127 62,611 Right of use asset, net 114,270 115,874 Intangible assets, net 20,083 20,825 Goodwill 62,757 62,757 Restricted cash 3,590 4,501 Other assets 12,579 8,407 Total assets $ 1,017,041 $ 1,045,009 Liabilities and stockholders' equity Current liabilities: Accounts payable $ 7,066 $ 11,781 Accrued liabilities 239,951 164,015 Deferred revenue 377,760 376,253 Total current liabilities 624,777 552,049 Other long term liabilities 122,989 123,736 Total liabilities 747,766 675,785 Commitments and contingencies Class A Common Stock, $0.00001 par value - 1,000,000,000 shares authorized; 89,179,152 shares issued and outstanding as of March 31, 2024 and 91,786,941 shares issued outstanding as of December 31, 2023 1 1 Class B Common Stock, $0.00001 par value - 100,000,000 shares authorized; 907,234 shares issued and outstanding as of March 31, 2024 and December 31, 2023 — — Class C Common Stock, $0.00001 par value - 200,000,000 shares authorized; 30,609,111 shares issued and outstanding as of March 31, 2024 and 32,234,914 shares issued and outstanding as of December 31, 2023 — — Class D Common Stock, $0.00001 par value - 100,000,000 shares authorized; 25,796,690 shares issued and outstanding as of March 31, 2024 and December 31, 2023 — — Accumulated other comprehensive loss 215 2,050 Treasury stock at cost, 0 shares as of March 31, 2024 and December 31, 2023 — — Accumulated deficit (54,908) (73,714) Additional paid-in capital 220,558 304,992 Total stockholders’ equity attributable to Clear Secure, Inc. 165,866 233,329 Non-controlling interest 103,409 135,895 Total stockholders’ equity 269,275 369,224 Total liabilities and stockholders’ equity $ 1,017,041 $ 1,045,009

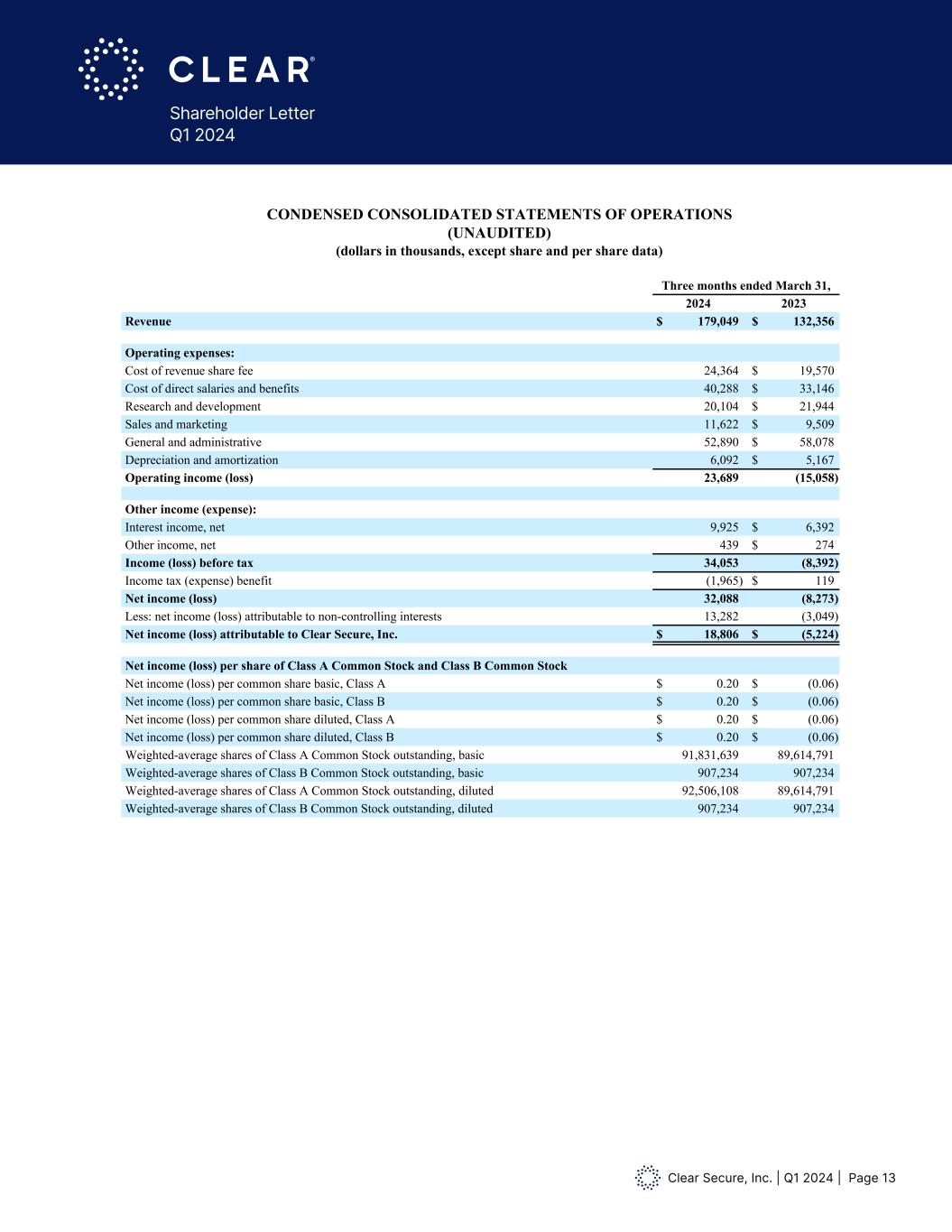

Clear Secure, Inc. | Q1 2024 | Page 13 Shareholder Letter Q1 2024 CLEAR SECURE, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (dollars in thousands, except share and per share data) Three months ended March 31, 2024 2023 Revenue $ 179,049 $ 132,356 Operating expenses: Cost of revenue share fee 24,364 $ 19,570 Cost of direct salaries and benefits 40,288 $ 33,146 Research and development 20,104 $ 21,944 Sales and marketing 11,622 $ 9,509 General and administrative 52,890 $ 58,078 Depreciation and amortization 6,092 $ 5,167 Operating income (loss) 23,689 (15,058) Other income (expense): Interest income, net 9,925 $ 6,392 Other income, net 439 $ 274 Income (loss) before tax 34,053 (8,392) Income tax (expense) benefit (1,965) $ 119 Net income (loss) 32,088 (8,273) Less: net income (loss) attributable to non-controlling interests 13,282 (3,049) Net income (loss) attributable to Clear Secure, Inc. $ 18,806 $ (5,224) Net income (loss) per share of Class A Common Stock and Class B Common Stock Net income (loss) per common share basic, Class A $ 0.20 $ (0.06) Net income (loss) per common share basic, Class B $ 0.20 $ (0.06) Net income (loss) per common share diluted, Class A $ 0.20 $ (0.06) Net income (loss) per common share diluted, Class B $ 0.20 $ (0.06) Weighted-average shares of Class A Common Stock outstanding, basic 91,831,639 89,614,791 Weighted-average shares of Class B Common Stock outstanding, basic 907,234 907,234 Weighted-average shares of Class A Common Stock outstanding, diluted 92,506,108 89,614,791 Weighted-average shares of Class B Common Stock outstanding, diluted 907,234 907,234

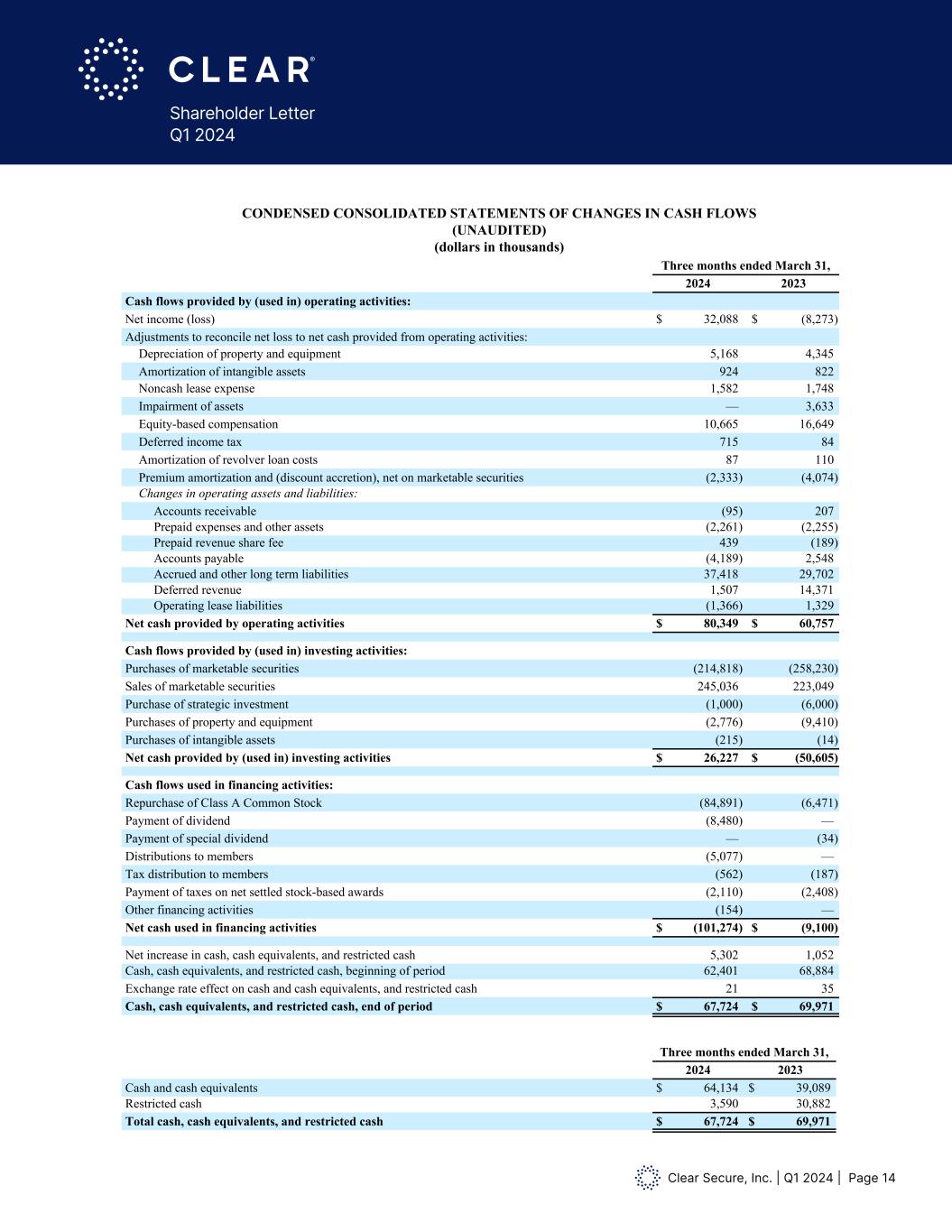

Clear Secure, Inc. | Q1 2024 | Page 14 Shareholder Letter Q1 2024 CLEAR SECURE, INC. CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN CASH FLOWS (UNAUDITED) (dollars in thousands) Three months ended March 31, 2024 2023 Cash flows provided by (used in) operating activities: Net income (loss) $ 32,088 $ (8,273) Adjustments to reconcile net loss to net cash provided from operating activities: Depreciation of property and equipment 5,168 4,345 Amortization of intangible assets 924 822 Noncash lease expense 1,582 1,748 Impairment of assets — 3,633 Equity-based compensation 10,665 16,649 Deferred income tax 715 84 Amortization of revolver loan costs 87 110 Premium amortization and (discount accretion), net on marketable securities (2,333) (4,074) Changes in operating assets and liabilities: Accounts receivable (95) 207 Prepaid expenses and other assets (2,261) (2,255) Prepaid revenue share fee 439 (189) Accounts payable (4,189) 2,548 Accrued and other long term liabilities 37,418 29,702 Deferred revenue 1,507 14,371 Operating lease liabilities (1,366) 1,329 Net cash provided by operating activities $ 80,349 $ 60,757 Cash flows provided by (used in) investing activities: Purchases of marketable securities (214,818) (258,230) Sales of marketable securities 245,036 223,049 Purchase of strategic investment (1,000) (6,000) Purchases of property and equipment (2,776) (9,410) Purchases of intangible assets (215) (14) Net cash provided by (used in) investing activities $ 26,227 $ (50,605) Cash flows used in financing activities: Repurchase of Class A Common Stock (84,891) (6,471) Payment of dividend (8,480) — Payment of special dividend — (34) Distributions to members (5,077) — Tax distribution to members (562) (187) Payment of taxes on net settled stock-based awards (2,110) (2,408) Other financing activities (154) — Net cash used in financing activities $ (101,274) $ (9,100) Net increase in cash, cash equivalents, and restricted cash 5,302 1,052 Cash, cash equivalents, and restricted cash, beginning of period 62,401 68,884 Exchange rate effect on cash and cash equivalents, and restricted cash 21 35 Cash, cash equivalents, and restricted cash, end of period $ 67,724 $ 69,971 Three months ended March 31, 2024 2023 Cash and cash equivalents $ 64,134 $ 39,089 Restricted cash 3,590 30,882 Total cash, cash equivalents, and restricted cash $ 67,724 $ 69,971

Clear Secure, Inc. | Q1 2024 | Page 15 Shareholder Letter Q1 2024 To evaluate performance of the business, we utilize a variety of other non-GAAP financial reporting and performance measures. These key measures include Total Bookings, Total Cumulative Enrollments, Total Cumulative Platform Uses, Annual CLEAR Plus Net Member Retention, Annual CLEAR Plus Gross Dollar Retention, Active CLEAR Plus Members, and Annual CLEAR Plus Member Usage. Total Bookings Total Bookings represent our total revenue plus the change in deferred revenue during the period. Total Bookings in any particular period reflect sales to new and renewing CLEAR Plus subscribers plus any accrued billings to partners. Management believes that Total Bookings is an important measure of the current health and growth of the business and views it as a leading indicator. Total Cumulative Enrollments We define Total Cumulative Enrollments as the number of enrollments since inception as of the end of the period. An Enrollment is defined as any Member who has registered for the CLEAR platform since inception and has a profile (including limited time free trials regardless of conversion to paid membership) net of duplicate and/or purged accounts. This includes CLEAR Plus Members who have completed enrollment with CLEAR and have ever activated a payment method, plus associated family accounts. Management views this metric as an important tool to analyze the efficacy of our growth and marketing initiatives as new Members are potentially a current and leading indicator of revenues. Total Cumulative Platform Uses We define Total Cumulative Platform Uses as the number of individual engagements across CLEAR use cases, including CLEAR Plus, our flagship app and CLEAR Verified, since inception as of the end of the period. Management views this metric as an important tool to analyze the level of engagement of our Member base which can be a leading indicator of future growth, retention and revenue. Annual CLEAR Plus Net Member Retention We define Annual CLEAR Plus Net Member Retention as one minus the CLEAR Plus net Member churn on a rolling 12 month basis. We define “CLEAR Plus net Member churn” as total cancellations net of winbacks in the trailing 12 month period divided by the average Active CLEAR Plus Members as of the beginning of each month within the same 12 month period. Winbacks are defined as reactivated Members who have been cancelled for at least 60 days. Active CLEAR Plus Members are defined as Members who have completed enrollment with CLEAR and have activated a payment method for our in-airport CLEAR Plus service, including their registered family plan Members. Active CLEAR Plus Members also include those in a grace period of up to 45 days after a billing failure during which time we attempt to collect updated payment information. Management views this metric as an important tool to analyze the level of engagement of our Member base, which can be a leading indicator of future growth and revenue, as well as an indicator of customer satisfaction and long term business economics. Definitions of Key Performance Indicators

Clear Secure, Inc. | Q1 2024 | Page 16 Shareholder Letter Q1 2024 In addition to our results as determined in accordance with GAAP, we disclose Adjusted EBITDA, Free Cash Flow, Adjusted Net Income and Adjusted Net Income per Common Share, Basic and Diluted as non-GAAP financial measures that management believes provide useful information to investors. These measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for net income (loss), net cash provided by (used in) operating activities or any other operating performance measure calculated in accordance with GAAP, and may not be comparable to a similarly titled measure reported by other companies. Our Non-GAAP financial measures are expressed in thousands. Non-GAAP Financial Measures Annual CLEAR Plus Gross Dollar Retention We define Annual CLEAR Plus Gross Dollar Retention as the net bookings collected from a Fixed Cohort of Members during the Current Period as a percentage of the net bookings collected from the same Fixed Cohort during the Prior Period. The Current Period is the 12-month period ending on the reporting date, the Prior Period is the 12-month period ending on the reporting date one year earlier. The Fixed Cohort is defined as all Active CLEAR Plus Members as of the last day of the Prior Period who have activated a payment method for our in-airport CLEAR Plus service, including their registered family plan Members. Active CLEAR Plus Members also include those in a grace period of up to 51 days after a billing failure during which time we attempt to collect updated payment information. Bookings received from a third party as part of a partnership agreement are excluded from both periods; all Members, including those on a free or discounted plan, or who receive a full statement credit, only impact Annual CLEAR Plus Gross Dollar Retention to the extent that they are paying anything out-of-pocket on behalf of themselves or a registered family plan Member. Active CLEAR Plus Members We define Active CLEAR Plus Members as the number of Members with an active CLEAR Plus subscription as of the end of the period. This includes CLEAR Plus Members who have an activated payment method, plus associated family accounts and is inclusive of Members who are in a limited time free trial; it excludes duplicate and/or purged accounts. Management views this as an important tool to measure the growth of its CLEAR Plus product. Annual CLEAR Plus Member Usage We define Annual CLEAR Plus Member Usage as the total number of unique CLEAR Plus airport verifications in the 365 days prior to the end of the period divided by Active CLEAR Plus Members as of the end of the period who have been enrolled for at least 365 days. The numerator includes only verifications of the population in the denominator. Management views this as an important tool to analyze the level of engagement of our active CLEAR Plus Member base. Definitions of Key Performance Indicators (Cont.)

Clear Secure, Inc. | Q1 2024 | Page 17 Shareholder Letter Q1 2024 We periodically reassess the components of our Non-GAAP adjustments for changes in how we evaluate our performance and changes in how we make financial and operational decisions to ensure the adjustments remain relevant and meaningful. Adjusted EBITDA and Adjusted EBITDA Margin We define Adjusted EBITDA as net income (loss) adjusted for income taxes, interest (income) expense net, depreciation and amortization, impairment and losses on asset disposals, equity-based compensation expense, mark to market of warrant liabilities, net other income (expense) excluding sublease rental income, acquisition-related costs and changes in fair value of contingent consideration. Adjusted EBITDA is an important financial measure used by management and our board of directors (“Board”) to evaluate business performance. During the third quarter of fiscal year 2022, we revised our definition of Adjusted EBITDA (Loss) to exclude sublease rental income from our other income (expense) adjustment. During the fourth quarter of fiscal year 2022, we revised our definition of Adjusted EBITDA to include impairment on assets as a separate component. We did not revise prior years' Adjusted EBITDA because there was no impact of a similar nature in the prior period that affects comparability. Adjusted EBITDA margin is adjusted EBITDA, divided by total revenues. Adjusted Net Income We define Adjusted Net Income as net income (loss) attributable to Clear Secure, Inc. adjusted for the net income (loss) attributable to non-controlling interests, equity-based compensation expense, amortization of acquired intangible assets, acquisition- related costs, changes in fair value of contingent consideration and the income tax effect of these adjustments. Adjusted Net Income is used in the calculation of Adjusted Net Income per Common Share as defined below. Adjusted Net Income per Common Share We compute Adjusted Net Income per Common Share, Basic as Adjusted Net Income divided by Adjusted Weighted- Average Shares Outstanding for our Class A Common Stock, Class B Common Stock, Class C Common Stock and Class D Common Stock assuming the exchange of all vested and outstanding common units in Alclear at the end of each period presented. We do not present Adjusted Net Income per Common Share for shares of our Class B Common Stock although they are participating securities based on the assumed conversion of those shares to our Class A Common Stock. We do not present Adjusted Net Income per Common Share on a dilutive basis for periods where we have Adjusted Net Income since we do not assume the conversion of any potentially dilutive equity instruments as the result would be anti-dilutive. In periods where we have Adjusted Net Income, the Company also calculates Adjusted Net Income per Common Share, Diluted based on the effect of potentially dilutive equity instruments for the periods presented using the treasury stock/if-converted method, as applicable. Adjusted Net Income and Adjusted Net Income per Common Share exclude, to the extent applicable, the tax effected impact of non-cash expenses and other items that are not directly related to our core operations. These items are excluded because they are connected to the Company’s long term Non-GAAP Financial Measures (Cont.)

Clear Secure, Inc. | Q1 2024 | Page 18 Shareholder Letter Q1 2024 growth plan and not intended to increase short term revenue in a specific period. Further, to the extent that other companies use similar methods in calculating non-GAAP measures, the provision of supplemental non-GAAP information can allow for a comparison of the Company’s relative performance against other companies that also report non-GAAP operating results. Free Cash Flow We define Free Cash Flow as net cash provided by operating activities adjusted for purchases of property and equipment plus the value of share repurchases over fair value. With regards to our CLEAR Plus subscription service, we generally collect cash from our members upfront for annual subscriptions. As a result, when the business is growing Free Cash Flow can be a real time indicator of the current trajectory of the business. See below for reconciliations of these non-GAAP financial measures to their most comparable GAAP measures. Forward-Looking Statements This release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any and such forward looking statement are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments and events may differ materially from those in the forward-looking statements as a result of various factors, including those described in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. The Company disclaims any obligation to update any forward looking statements contained herein.

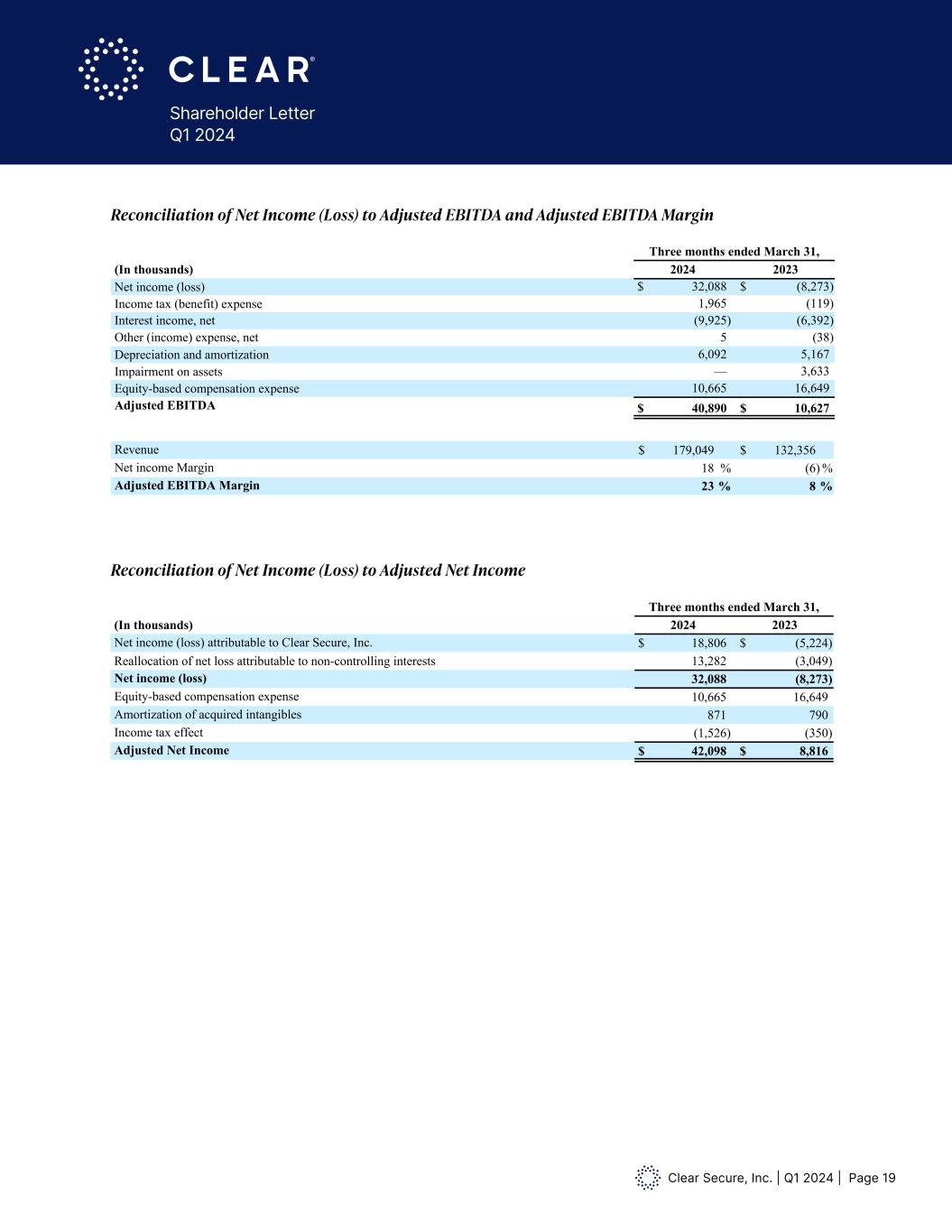

Clear Secure, Inc. | Q1 2024 | Page 19 Shareholder Letter Q1 2024 Reconciliation of Net Income (Loss) to Adjusted EBITDA: Three months ended March 31, (In thousands) 2024 2023 Net income (loss) $ 32,088 $ (8,273) Income tax (benefit) expense 1,965 (119) Interest income, net (9,925) (6,392) Other (income) expense, net 5 (38) Depreciation and amortization 6,092 5,167 Impairment on assets — 3,633 Equity-based compensation expense 10,665 16,649 Adjusted EBITDA $ 40,890 $ 10,627 Revenue $ 179,049 $ 132,356 Net income Margin 18 % (6) % Adjusted EBITDA Margin 23 % 8 % Reconciliation of Net Income (Loss) to Adjusted Net Income Three months ended March 31, (In thousands) 2024 2023 Net income (loss) attributable to Clear Secure, Inc. $ 18,806 $ (5,224) Reallocation of net loss attributable to non-controlling interests 13,282 (3,049) Net income (loss) 32,088 (8,273) Equity-based compensation expense 10,665 16,649 Amortization of acquired intangibles 871 790 Income tax effect (1,526) (350) Adjusted Net Income $ 42,098 $ 8,816 Reconciliation of Net Income (Loss) to Adjusted EBITDA: Three months ended March 31, (In thousands) 2024 2023 Net income (loss) $ 32,088 $ (8,273) Income tax (benefit) expense 1,965 (119) Interest income, net (9,925) (6,392) Other (income) expense, net 5 (38) Depreciation and amortization 6,092 5,167 Impairment on assets — 3,633 Equity-based compensation expense 10,665 16,649 Adjusted EBITDA $ 40,890 $ 10,627 Revenue $ 179,049 $ 132,356 Net income Margin 18 % (6) % Adjusted EBITDA Margin 23 % 8 % Reconciliation of Net Income (Loss) to Adjusted Net Income Three months ended March 31, (In thousands) 2024 2023 Net income (loss) attributable to Clear Secure, Inc. $ 18,806 $ (5,224) Reallocation of net loss attributable to non-controlling interests 13,282 (3,049) Net income (loss) 32,088 (8,273) Equity-based compensation expense 10,665 16,649 Amortization of acquired intangibles 871 790 Income tax effect (1,526) (350) Adjusted Net Income $ 42,098 $ 8,816 Reconciliation of Net Income (Loss) to Adjusted EBITDA and Adjusted EBITDA Margin Reconciliation of Net Income (Loss) to Adjusted Net Income

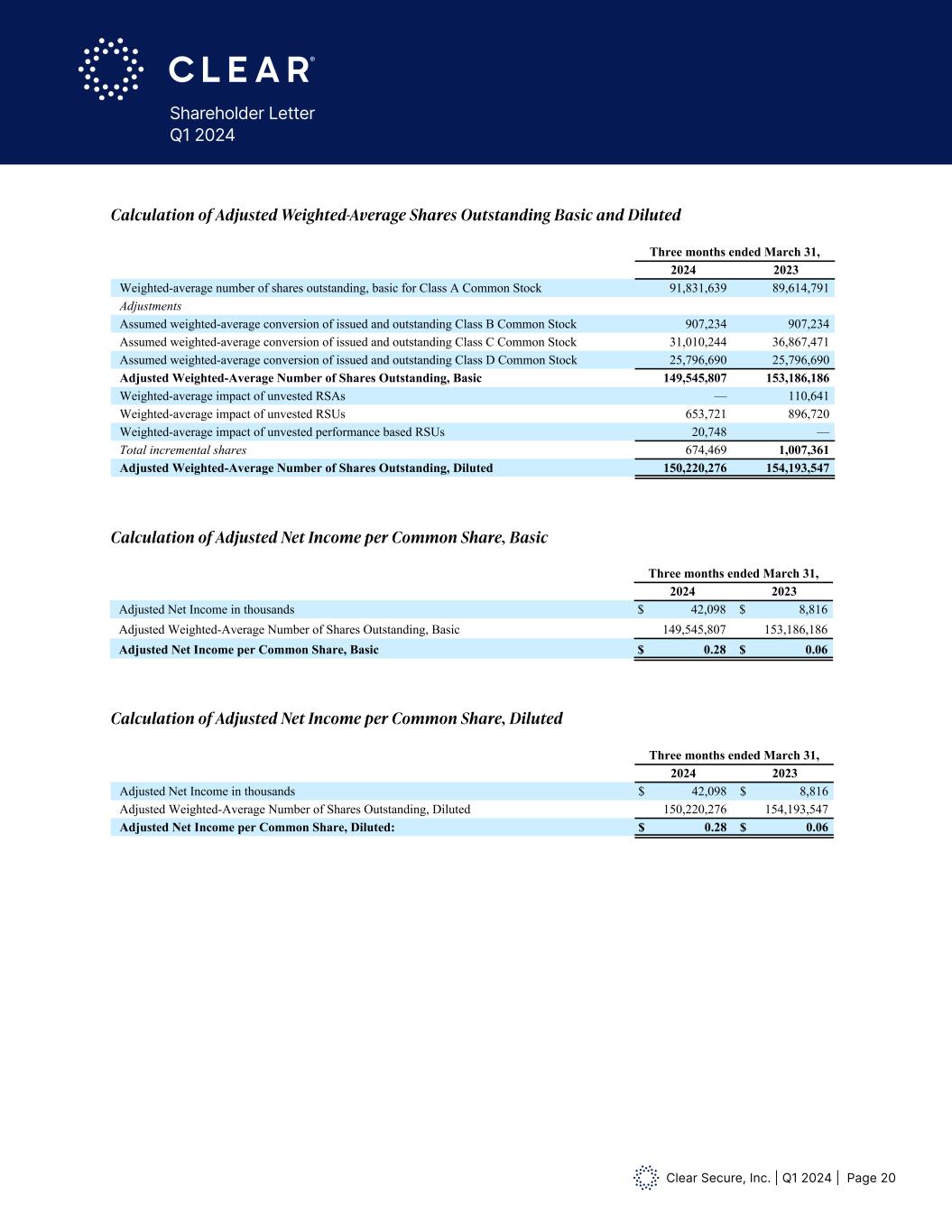

Clear Secure, Inc. | Q1 2024 | Page 20 Shareholder Letter Q1 2024 Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Calculation of Adjusted Net Income per Common Share, Basic Calculation of Adjusted Net Income per Common Share, Diluted Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three months ended March 31, 2024 2023 Weighted-average number of shares outstanding, basic for Class A Common Stock 91,831,639 89,614,791 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 31,010,244 36,867,471 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 25,796,690 Adjusted Weighted-Average Number of Shares Outstanding, Basic 149,545,807 153,186,186 Weighted-average impact of unvested RSAs — 110,641 Weighted-average impact of unvested RSUs 653,721 896,720 Weighted-average impact of unvested performance based RSUs 20,748 — Total incremental shares 674,469 1,007,361 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 150,220,276 154,193,547 Calculation of Adjusted Net Income per Common Share, Basic Three months ended March 31, 2024 2023 Adjusted Net Income in thousands $ 42,098 $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Basic 149,545,807 153,186,186 Adjusted Net Income per Common Share, Basic $ 0.28 $ 0.06 Calculation of Adjusted Net Income per Common Share, Diluted Three months ended March 31, 2024 2023 Adjusted Net Income in thousands $ 42,098 $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 150,220,276 154,193,547 Adjusted Net Income per Common Share, Diluted: $ 0.28 $ 0.06 Summary of Adjusted Net Income per Common Share: Three months ended March 31, 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.28 $ 0.06 Adjusted Net Income per Common Share, Diluted $ 0.28 $ 0.06 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three months ended March 31, (In thousands) 2024 2023 Net cash provided by operating activities $ 80,349 $ 60,757 Purchases of property and equipment (2,776) (9,410) Free Cash Flow $ 77,573 $ 51,347 Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three months ended March 31, 2024 2023 Weighted-average number of shares outstanding, basic for Class A Common Stock 91,831,639 89,614,791 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 31,010,244 36,867,471 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 25,796,690 Adjusted Weighted-Average Number of Shares Outstanding, Basic 149,545,807 153,186,186 Weighted-average impact of unvested RSAs — 110,641 Weighted-average impact of unvested RSUs 653,721 896,720 Weighted-average impact of unvested performance based RSUs 20,748 — Total incremental shares 674,469 1,007,361 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 150,220,276 154,193,547 Calculation of Adjusted Net Income per Common Share, Basic Three months ended March 31, 2024 2023 Adjusted Net Income in thousands $ 42,098 $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Basic 149,545,807 153,186,186 Adjusted Net Income per Common Share, Basic $ 0.28 $ 0.06 Calculation of Adjusted Net Income per Common Share, Diluted Three months ended March 31, 2024 2023 Adjusted Net Income in thousands $ 42,098 $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 150,220,276 154,193,547 Adjusted Net Income per Common Share, Diluted: $ 0.28 $ 0.06 Summary of Adjusted Net Income per Common Share: Three months ended March 31, 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.28 $ 0.06 Adjusted Net Income per Common Share, Diluted $ 0.28 $ 0.06 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three months ended March 31, (In thousands) 2024 2023 Net cash provided by operating activities $ 80,349 $ 60,757 Purchases of property and equipment (2,776) (9,410) Free Cash Flow $ 77,573 $ 51,347 Calc lation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three months ended March 31, 2024 2023 Weighted-average number of shares outstanding, basic for Class A Common Stock 91,831,639 89,614,791 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 31,010,244 36,867,471 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 25,796,690 Adjusted eighted-Average Nu ber of Shares Outstanding, Basic 149,545,807 153,186,186 Weighted-average impact of unvested RSAs — 110,641 Weighted-average impact of unvested RSUs 653,721 896,720 Weighted-average impact of unvested performance based RSUs 20,748 — Total incremental shares 674,469 1,007,361 j sted Weighted-Average Number of Shares Outstanding, Diluted 150,220,276 154,193,547 Calculation of Adjusted Net Income per Common Share, Basic Three months ended March 31, 2024 2023 Adjusted Net Income in thousands $ 42,098 $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Basic 149,545,807 153,186,186 j sted Net Income per Common Share, Basic 0.2 0.0 Calculation of Adjusted Net Inc me per Common Share, Diluted Three months ended March 31, 2024 2023 Adjusted Net Income in thousands $ 42,098 $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 15 , 20,276 154,193,547 Adjusted Net Income per Common Share, Diluted: . . Summary of Adjusted Net Income per Common Share: Three months ended March 31, 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.28 $ 0.06 Adjusted Net Income per Common Share, Diluted 0.28 0.06 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three months ended March 31, (In thousands) 2024 2023 Net cash provided by operating activities $ 80,349 $ 60,757 Purchases of property and equipment (2,776) (9,410) Free Cash Flow $ 77,573 $ 51,347

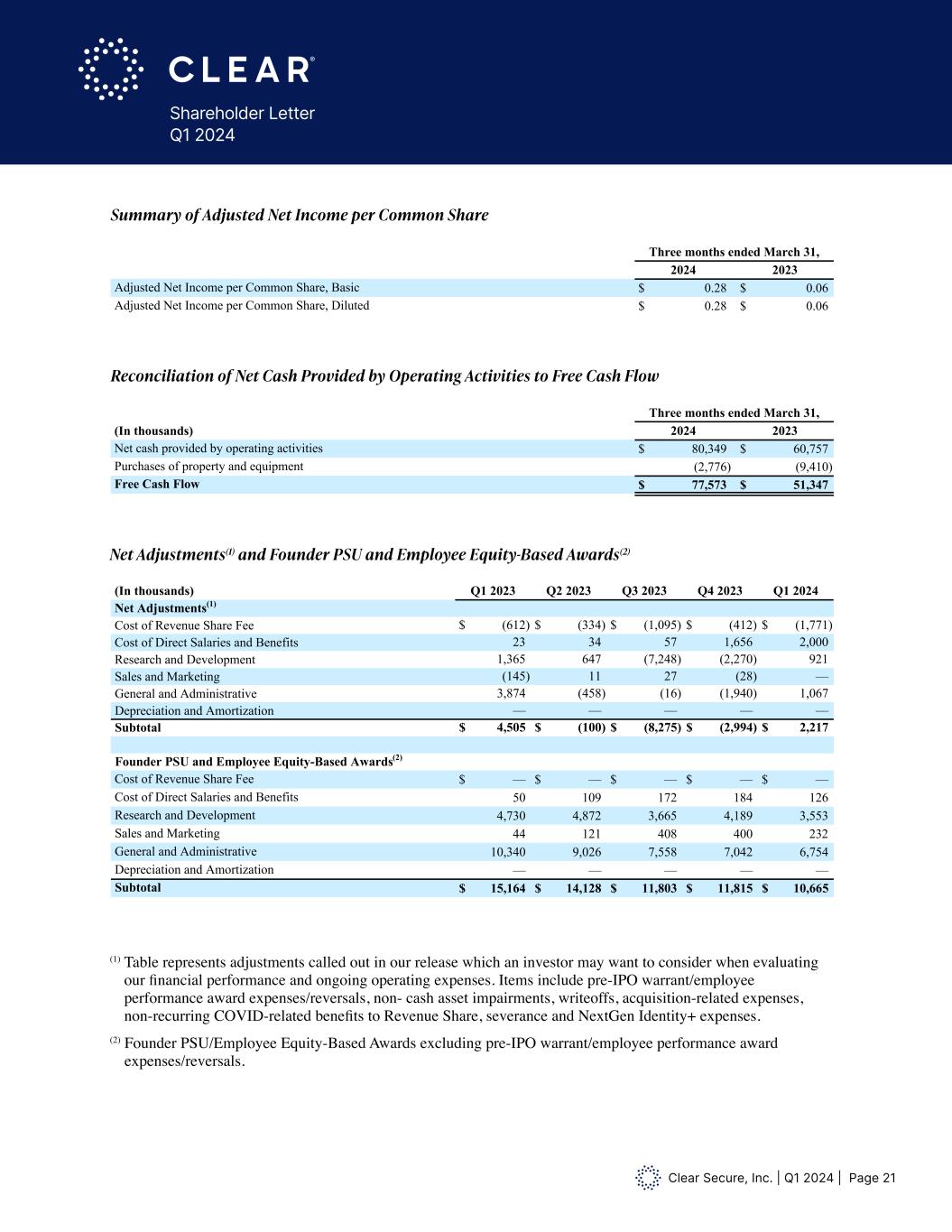

Clear Secure, Inc. | Q1 2024 | Page 21 Shareholder Letter Q1 2024 Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three months ended March 31, 2024 2023 Weighted-average number of shares outstanding, basic for Class A Common Stock 91,831,639 89,614,791 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 31,010,244 36,867,471 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 25,796,690 Adjusted Weighted-Average Number of Shares Outstanding, Basic 149,545,807 153,186,186 Weighted-average impact of unvested RSAs — 110,641 Weighted-average impact of unvested RSUs 653,721 896,720 Weighted-average impact of unvested performance based RSUs 20,748 — Total incremental shares 674,469 1,007,361 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 150,220,276 154,193,547 Calculation of Adjusted Net Income per Common Share, Basic Three months ended March 31, 2024 2023 Adjusted Net Income in thousands $ 42,098 $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Basic 149,545,807 153,186,186 Adjusted Net Income per Common Share, Basic $ 0.28 $ 0.06 Calculation of Adjusted Net Income per Common Share, Diluted Three months ended March 31, 2024 2023 Adjusted Net Income in thousands $ 42,098 $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 150,220,276 154,193,547 Adjusted Net Income per Common Share, Diluted: $ 0.28 $ 0.06 Summary of Adjusted Net Income per Common Share: Three months ended March 31, 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.28 $ 0.06 Adjusted Net Income per Common Share, Diluted $ 0.28 $ 0.06 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three months ended March 31, (In thousands) 2024 2023 Net cash provided by operating activities $ 80,349 $ 60,757 Purchases of property and equipment (2,776) (9,410) Free Cash Flow $ 77,573 $ 51,347 Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three months ended March 31, 2024 2023 Weighted-average number of shares outstanding, basic for Class A Common Stock 91,831,639 89,614,791 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 31,010,244 36,867,471 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 25,796,690 Adjusted Weighted-Average Number of Shares Outstanding, Basic 149,545,807 153,186,186 Weighted-average impact of unvested RSAs — 110,641 Weighted-average impact of unvested RSUs 653,721 896,720 Weighted-average impact of unvested performance based RSUs 20,748 — Total incremental shares 674,469 1,007,361 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 150,220,276 154,193,547 Calculation of Adjusted Net Income per Common Share, Basic Three months ended March 31, 2024 2023 Adjusted Net Income in thousands $ 42,098 $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Basic 149,545,807 153,186,186 Adjusted Net Income per Common Share, Basic $ 0.28 $ 0.06 Calculation of Adjusted Net Income per Common Share, Diluted Three months ended March 31, 2024 2023 Adjusted Net Income in thousands $ 42,098 $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 150,220,276 154,193,547 Adjusted Net Income per Common Share, Diluted: $ 0.28 $ 0.06 Summary of Adjusted Net Income per Common Share: Three months ended March 31, 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.28 $ 0.06 Adjusted Net Income per Common Share, Diluted $ 0.28 $ 0.06 Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three months ended March 31, (In thousands) 2024 2023 Net cash provided by operating activities $ 80,349 $ 60,757 Purchases of property and equipment (2,776) (9,410) Free Cash Flow $ 77,573 $ 51,347 Summary of Adjusted Net Income per Common Share Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow Net Adjustments(1) and Founder PSU and Employee Equity-Based Awards(2) (1) Table represents adjustments called out in our release which an investor may want to consider when evaluating our financial performance and ongoing operating expenses. Items include pre-IPO warrant/employee performance award expenses/reversals, non- cash asset impairments, writeoffs, acquisition-related expenses, non-recurring COVID-related benefits to Revenue Share, severance and NextGen Identity+ expenses. (2) Founder PSU/Employee Equity-Based Awards excluding pre-IPO warrant/employee performance award expenses/reversals. Net Adjustments(1) and Founder PSU and Employee Equity-Based Awards(2) (In thousands) Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Net Adjustments(1) Cost of Revenue Share Fee $ (612) $ (334) $ (1,095) $ (412) $ (1,771) Cost of Direct Salaries and Benefits 23 34 57 1,656 2,000 Research and Development 1,365 647 (7,248) (2,270) 921 Sales and Marketing (145) 11 27 (28) — General and Administrative 3,874 (458) (16) (1,940) 1,067 Depreciation and Amortization — — — — — Subtotal $ 4,505 $ (100) $ (8,275) $ (2,994) $ 2,217 Founder PSU and Employee Equity-Based Awards(2) Cost of Revenue Share Fee $ — $ — $ — $ — $ — Cost of Direct Salaries and Benefits 50 109 172 184 126 Research and Development 4,730 4,872 3,665 4,189 3,553 Sales and Marketing 44 121 408 400 233 General and Administrative 10,340 9,026 7,558 7,042 6,754 Depreciation and Amortization — — — — — Subtotal $ 15,164 $ 14,128 $ 11,803 $ 11,815 $ 10,666 (1) Table represents adjustments called out in our release which an investor may want to consider when evaluating our financial performance and ongoing operating expenses. Items include pre-IPO warrant/employee performance award expenses/reversals, non- cash asset impairments, writeoffs, acquisition-related expenses, non-recurring COVID-rel ted benefits to Rev u Share, severance and NextGen Identity+ expenses. (2) F under PSU/Employee Equity-Based Awards xcluding pre-IPO warrant/employee p rformance award xp nses/reversals. Net Adjustments(1) and Founder PSU and Employe Equity-Based Awards(2) (In thousands) 1 2 3 4 3 Q1 2024 Net Adjustments(1) Cost of Revenue Share Fee 612 (334 (1,095 (412 $ (1,771) Cost of Direct Salaries and Benefits 23 34 7 1 656 2,000 Research a d Development 1,365 6 7 7 48 (2,270) 921 Sales and Marketing (145) 11 7 (28) — General and Administrative 3,874 (458 (16 ( 940) 1,067 Depreciation a d Amortization — Subtotal 4,5 5 (100 8 275 ( 994) $ 2,217 Founder PSU and Employ e Equity-Based Awards(2) Cost of Revenue Share Fee $ — Cost of Direct Salaries and Benefits 50 09 72 84 126 Research a d Development 730 4 872 3 665 4 189 3,553 Sales and Marketing 44 121 8 400 233 General and Administrative 10 340 9 026 558 7 042 6,754 Depreciation a d Amortization — Subtotal 5 64 4 128 03 1 815 $ 10,666 (1) Table represents djustments called out in our release which n investor may want to consider when evaluating our financial perf rmance and ongoing operating expenses. Items include pre-IPO warrant/employe performance award expenses/reversals, non- c sh asset impairments, write ffs, acquisition-r lated expenses, non-recur ing COVID-related benefits to Rev nue Share, severance and NextGen Id ntity+ expenses. (2) Founder PSU/Employee Equity-Based Awards xcluding pre-IPO warrant/employe performance award expenses/reversals. Net Adjustm nts(1) and Founder PSU and Employee quity-Based Awards(2) (In thousands) Q1 023 Q2 023 Q3 023 Q4 023 Q1 024 Net Adjustments(1) Cost of R venue Shar Fee $ (612) $ (334) $ (1,095) $ (412) $ (1,771) Cost of Direct Salaries and B nefits 23 34 57 1, 56 2, 00 Research and D velopment 1,365 647 (7,248) (2,270) 921 Sales and Mark ting (145) 11 27 (28) — G ner l and Adminis rative 3,874 ( 58) (16) (1,940) 1, 67 Deprec ation and Amortiz tion — — — — — Subtotal $ 4, 05 $ (100) $ (8,275) $ (2,994) $ 2,217 Founder PSU a Employee Equity-Based Awards(2) Cost of R venue Shar Fee $ — $ — $ — $ — $ — Cost of Direct Salaries and B nefits 50 109 172 184 126 Research and D velopment 4,730 4,872 3,665 4,189 3,553 Sales and Mark ting 44 21 408 400 233 G ner l and Adminis rative 10,340 9, 26 7,558 7,042 6,754 Deprec ation and Amortiz tion — — — — — Subtotal $ 15,164 $ 14,128 $ 11, 03 $ 11,815 $ 10, 66 (1) Tabl repr sents adjustments called out in our release which a investor may want to consider whe evaluating our fi a cial performance and ongoing operating ex n es. Items includ pre-IPO war ant/employee performance award expen es/r versals, on- cash ass t impairm nts, writeoffs, acquisition-related exp n es, on-recurri g COVID-related b efi s to R venue Share, s veranc and NextGe Id nti y+ exp es. (2) Founde PSU/Employee quity-Based Awards xcluding pre-IPO war ant/employee performance award expen es/r versals.