Shareholder Letter Q1 2023 52 AIRPORTS BDL

Clear Secure, Inc. | Q1 2023 | Page 2 Shareholder Letter Q1 2023 First Quarter 2023 Financial Highlights (all figures are for First Quarter 2023 and percentage change is expressed as year-over-year, unless otherwise specified)* Revenue of $132.4 million was up 46.2% while Total Bookings of $149.7 million were up 38.9% Net cash provided by operating activities of $60.8 million; Free Cash Flow of $51.3 million Total Cumulative Enrollments of 16.2 million were up 37.1% Annual CLEAR Plus Net Member Retention of 91.3% was down 400 basis points year-over-year and 60 basis points sequentially Total Cumulative Platform Uses of 141.1 million were up 48.1% Net loss of $8.3 million, which includes $0.6 million of non-cash equity-based compensation costs related to vesting of previously issued warrants, $0.9 million of pre-IPO employee performance awards, $1.5 million of non-cash lease impairment and a $2.1 million non-cash asset impairment Net loss per common share basic and diluted of ($0.06), which includes $0.01 impact of non-cash equity-based compensation costs related to vesting of previously issued warrants, $0.01 of pre-IPO employee performance awards, $0.01 of non-cash lease impairment and $0.01 of a non-cash asset impairment Adjusted net income of $8.8 million; Adjusted EBITDA of $10.6 million Adjusted net income per common share, basic and diluted $0.06 Launched a record 12 new airports and expanded four locations since first quarter 2022— 52 CLEAR Plus airports with the launch of Bradley International Airport in April 2023 RESERVE powered by CLEAR live in 17 airports LinkedIn and CLEAR partnered to enhance digital safety and trust at scale Partnered with Health Gorilla to empower consumers to securely access and control their health information Repurchased 281,838 Class A Common Stock at an average $22.94 per share; Declared a $0.20 special dividend to holders of Class A and Class B Common Stock as of May 18, 2023, payable on May 25, 2023 * A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided at the end of this letter. “ Now more than ever, trust online matters. Authenticated identity —the ability to prove who you really are—is key to digital trust and safety,” said Caryn Seidman-Becker, CLEAR’s CEO

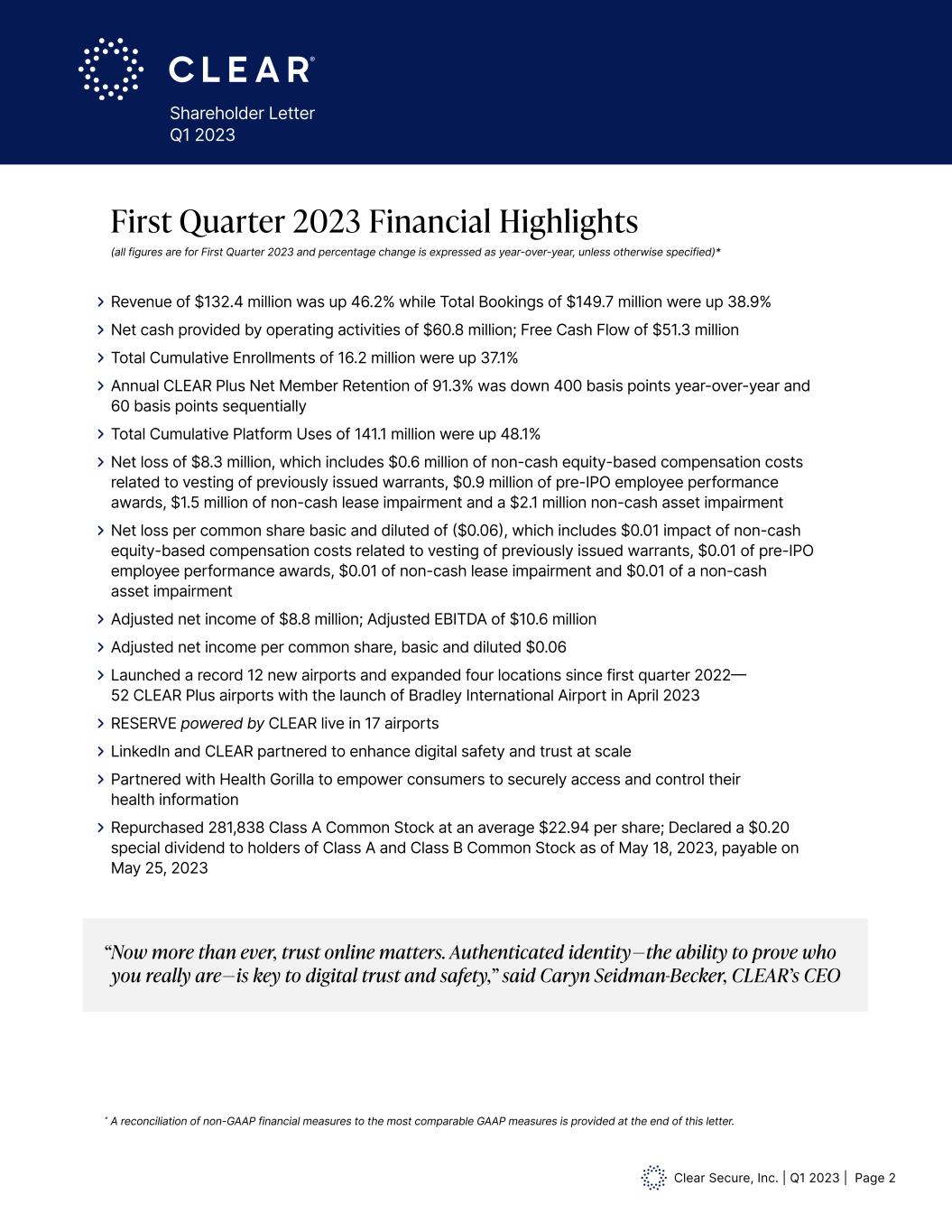

Clear Secure, Inc. | Q1 2023 | Page 3 Shareholder Letter Q1 2023 in millions in thousands Total Bookings & GAAP Revenue Total Cumulative Enrollments

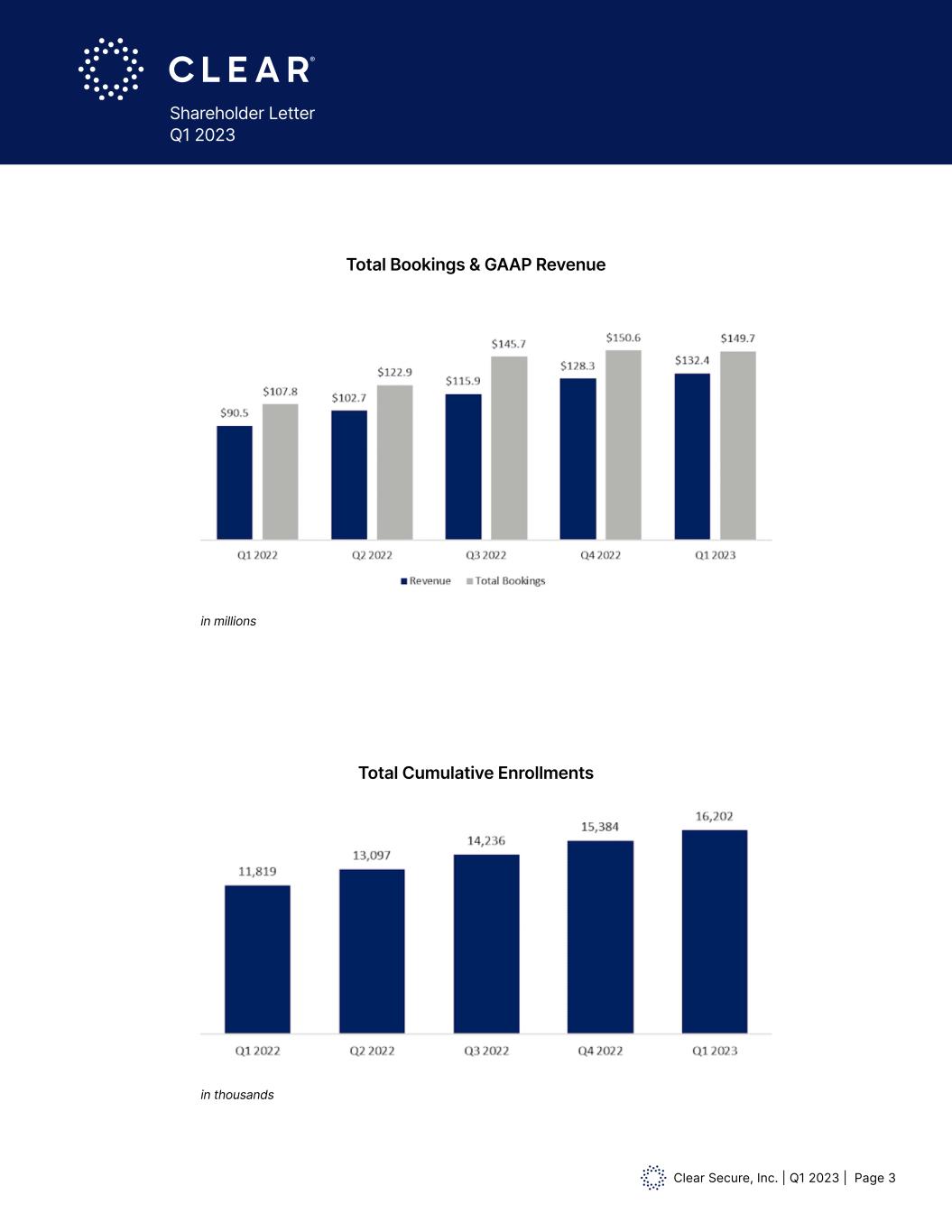

Clear Secure, Inc. | Q1 2023 | Page 4 Shareholder Letter Q1 2023 Total Cumulative Platform Uses Annual CLEAR Plus Net Member Retention in thousands

Clear Secure, Inc. | Q1 2023 | Page 5 Shareholder Letter Q1 2023 Dear Shareholder, Identity is foundational to transforming customer experiences in both digital and physical spaces. CLEAR is building a world where your identity is universal, making experiences safer and easier. The ability to authenticate your identity once and use it everywhere is the power of CLEAR’s secure identity platform—for our members and for our partners. With CLEAR, you are you every time, everywhere. Now more than ever, trust online matters. Authenticated identity—the ability to prove who you really are—is key to digital trust and safety. CLEAR’s recently announced partnership with LinkedIn is a critical step toward enhancing digital trust and safety at scale. Through CLEAR’s identity as a service platform—Powered by CLEAR—we are empowering LinkedIn’s 200 million U.S. users to verify their identity and receive a badge on their profile—for free. This partnership strengthens and democratizes trust across LinkedIn through stronger networks, better conversations, and improved outcomes. Verified profiles provide a holistic understanding of those members’ professional identities—including their education, work experience, credentials, and professional networks. It's not just about who you are, it's about all the things that make you, YOU. In the rapidly digitizing healthcare sector, Powered by CLEAR is eliminating the clipboard. We continued our momentum this quarter with new partners, including Health Gorilla. We are ensuring patients and healthcare professionals can access the streamlined experience they expect in the rest of their lives. In travel, CLEAR Plus growth exceeded expectations this quarter. We continue to see significant opportunities to introduce new products and increase members in both our established and our new markets. As a network-effect business, our proven strategy is to launch new markets that complement existing markets—driving both growth and margins over time. Return on investment in new markets is strong, as cash break-even is typically achieved in under a year. Over the last year, we launched 12 new airports and expanded four existing locations—a groundbreaking record for CLEAR. Expanding our network drives long-term value, despite initial margin dilution. This quarter, the new airports and expansions averaged 38% cost of direct salaries and benefits as a percentage of bookings, while our top five penetrated markets averaged 16%.1 New locations and expansions have higher initial operating costs; however, operating margins scale as penetration increases.

Clear Secure, Inc. | Q1 2023 | Page 6 Shareholder Letter Q1 2023 The power of the network effect on member growth is real, as evidenced by the “long tail” of increasing penetration we have experienced. Our top five markets average 5% penetration2 and saw 29% compound membership growth since 2019 (42% year-over-year in Q1 2023). The remaining airports average 2% penetration and are well positioned for long-term growth into the future. These are still early days for CLEAR, with over a third of our markets under three years old. CLEAR’s connected identity ecosystem is making digital and physical experiences safer and easier. We remain focused on growing members, Bookings, AND Free Cash Flow, while continuing to build a brand that members AND partners trust and love. Best, Caryn and Ken 1 Measured as a percentage of local attributed bookings on a weighted average basis. 2 As defined by CLEAR Plus active members according to home zip codes as a percentage of the Metropolitan Statistical Area (MSA)/Combined Statistical Area (CSA) population surrounding each airport. MSA/CSA Source: Census Bureau.

Clear Secure, Inc. | Q1 2023 | Page 7 Shareholder Letter Q1 2023 First quarter 2023 revenue of $132.4 million grew 46.2% as compared to the first quarter of 2022 while Total Bookings of $149.7 million grew 38.9%. We saw a continuation of the strong travel trends driving both membership growth and net retention, leading to better-than-expected Total Bookings growth. Our in-airport and partner channels continued to perform well. First quarter 2023 Total Cumulative Enrollments reached 16.2 million, driven primarily by the launch of new airports and an increase in CLEAR Plus enrollments. First quarter 2023 Total Cumulative Platform Uses reached 141.1 million, driven by the continued strength in air travel leading to increases in CLEAR Plus verifications. First quarter 2023 Annual CLEAR Plus Net Member Retention was 91.3%, down 400 basis points year-over-year and down 60 basis points sequentially. This performance was driven by strength in gross renewals offset by a year-over-year decrease in winbacks of previously canceled members. As previously discussed, we expect long-term Annual CLEAR Plus Net Member Retention to settle in the upper 80s percentage range, above pre-pandemic levels. Cost of revenue share fee was $19.6 million in the first quarter of 2023. Cost of revenue share fee was 14.8% of revenue, up 138 basis points year-over-year and up 148 basis points sequentially. First quarter 2022 and first quarter 2023 periods both include a pandemic-related benefit of 46 basis points. Cost of revenue share percentage may vary by quarter, but on an annual basis we expect it to remain relatively stable over time. Cost of direct salaries and benefits were $33.1 million in the first quarter of 2023, up 44.2% year-over-year, and up 12.1% sequentially. As a percentage of revenue, cost of direct salaries and benefits were down 34 basis points year-over-year and up 198 basis points sequentially. Year-over-year growth was driven by 12 new airport launches and four expansions since the first quarter of 2022 ($4.2 million of year-over-year growth, $1.7 million of sequential increase), enrollment growth, and volume growth versus depressed pandemic levels. Excluding new airport launches and expansions, year-over-year growth was 26.0% and sequential growth was 6.3%. We expect the sequential “same-store” growth rate to moderate throughout 2023. Research and development expense of $21.9 million in the first quarter of 2023 includes $0.2 million of non-cash equity-based compensation relating to pre-IPO employee performance awards and a $1.1 million non-cash asset impairment. Excluding the pre-IPO employee performance award expense and non-cash asset impairment, as well as previously disclosed prior-period non- cash items, research and development expense was up 32.7% year-over-year and up 15.1% sequentially, and, as a percentage of revenue, it was down 158 basis points year-over-year and up 161 basis points sequentially. Sales and marketing expense of $9.5 million in the first quarter of 2023 includes ($0.1) million non-cash equity-based compensation relating to pre-IPO employee performance awards. Excluding the pre-IPO employee performance award, as well as previously disclosed prior-period First Quarter 2023 Financial Discussion

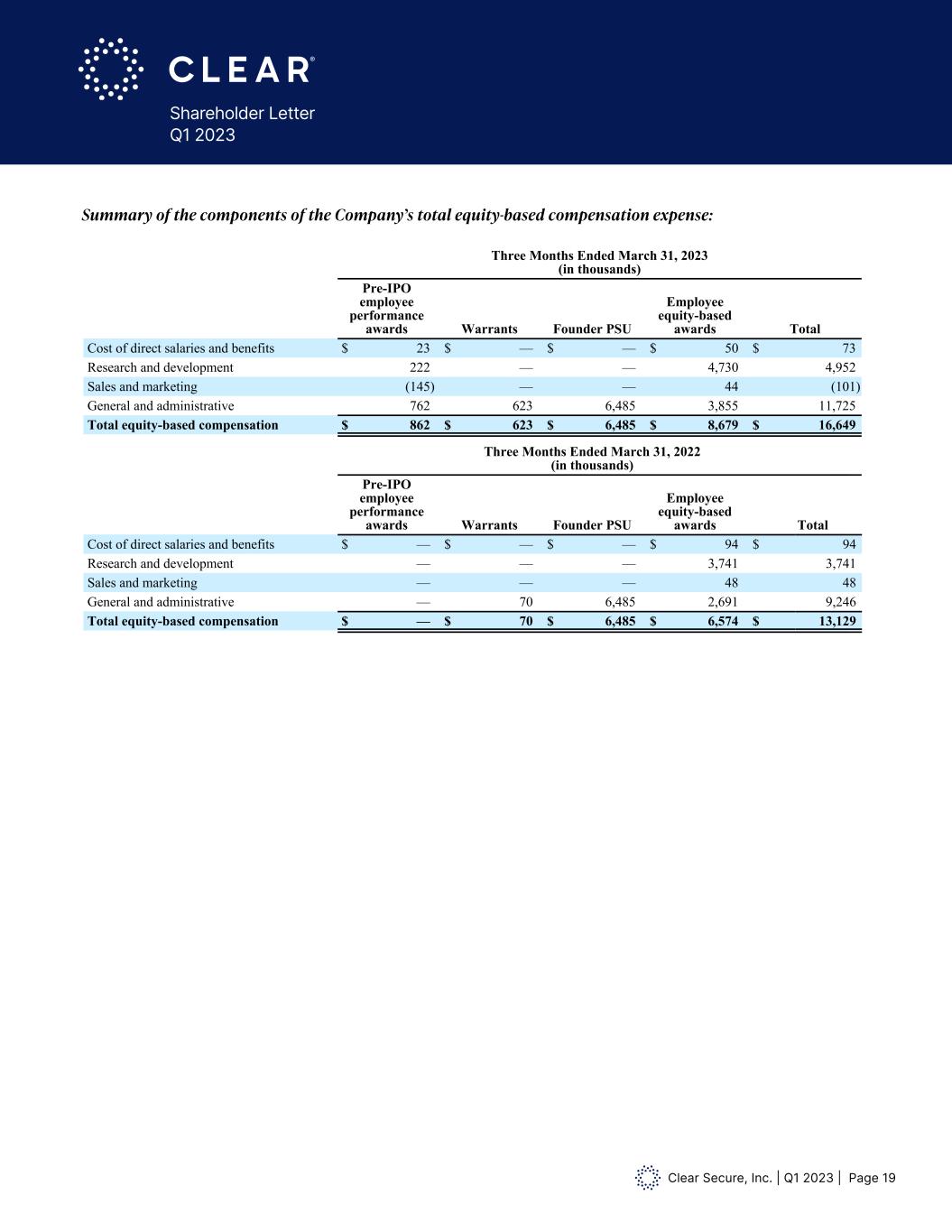

Clear Secure, Inc. | Q1 2023 | Page 8 Shareholder Letter Q1 2023 non-cash items, sales and marketing expense grew 23.3% year-over-year and declined 18.0% sequentially, and, as a percentage of revenue, it was down 135 basis points year-over-year and down 189 basis points sequentially. General and administrative expense of $58.1 million in the first quarter of 2023 includes $0.6 million of net non-cash equity-based compensation costs relating to the vesting of warrants issued pre-IPO and $0.8 million relating to pre-IPO employee performance award units. In addition, the current period includes a $1.5 million non-cash lease impairment and $1.0 million in non-cash asset impairment. Excluding the pre-IPO warrant expense, pre-IPO employee performance award unit expense, the non-cash lease impairment and non-cash asset impairment, as well as previously disclosed prior-period non-cash items, general and administrative expense of $54.2 million grew 18.2% percent year-over-year and 1.7% sequentially and as a percentage of revenue it was down 969 basis points year-over-year and 59 basis points sequentially. Stock compensation expense of $16.6 million in the first quarter of 2023 includes the following: (1) $0.6 million of net cost relating to the vesting of warrants issued pre-IPO, and (2) $0.9 million of non-cash compensation expense relating to pre-IPO employee performance award units. Excluding the pre-IPO warrant expense and the pre-IPO employee performance award unit expense, stock compensation expense of $15.2 million was up 16.1% year-over-year and down 4.0% sequentially. Net loss in the first quarter 2023 was $8.3 million, net loss per common share basic and diluted was ($0.06). Excluding the non-cash equity-based compensation cost of $0.6 million related to pre-IPO warrants and $0.9 million related to the pre-IPO employee performance award units, the $1.5 million non-cash lease impairment and $2.1 million non-cash asset impairment, net loss was $3.2 million and net loss per common share basic and diluted was ($0.02). First quarter 2023 adjusted net income was $8.8 million, adjusted net income per common share, basic and diluted was $0.06. First quarter 2023 net cash provided by operating activities was $60.8 million, Free Cash Flow was $51.3 million, and Adjusted EBITDA was $10.6 million. Because of CLEAR Plus revenue recognition policies, when Total Bookings are growing, net cash provided by operating activities and Free Cash Flow may exceed Adjusted EBITDA and net income. As of March 31, 2023, our cash and cash equivalents, marketable securities, and restricted cash totaled $778.9 million. As of May 4, 2023, the following shares of common stock were outstanding: Class A Common Stock 90,263,612, Class B Common Stock 907,234, Class C Common Stock 36,242,191, and Class D Common Stock 25,796,690, totaling 153,209,727 shares of common stock. First Quarter 2023 Financial Discussion (Cont.)

Clear Secure, Inc. | Q1 2023 | Page 9 Shareholder Letter Q1 2023 During the three-months ended March 31, 2023, we used $6.5 million to repurchase and retire 281,838 shares of its Class A Common Stock at an average price of $22.94, $2.4 million to net-settle RSUs and $6 million to make a minority equity investment. In total, common stock outstanding grew 2% year over year, but was flat when excluding the exercise of a total of 3.2 million warrants into Class A Common Stock by United Airlines in September 2022, October 2022, and January 2023. First Quarter 2023 Financial Discussion (Cont.) Second Quarter and Full Year 2023 Guidance We expect second quarter 2023 revenue of $139-$141 million and Total Bookings of $158-$160 million. In December 2022, we received Authority to Operate from TSA for TSA PreCheck® Enrollment Provided by CLEAR. We expect a soft launch in mid-2023 and bookings and revenue from this program will build throughout the back half of 2023. TSA PreCheck® bookings will be recognized as revenue in the quarter they are received. Second quarter guidance does not include any contribution from TSA PreCheck®. For fiscal year 2023, we expect to demonstrate operating leverage and growth in Free Cash Flow as compared to fiscal year 2022.

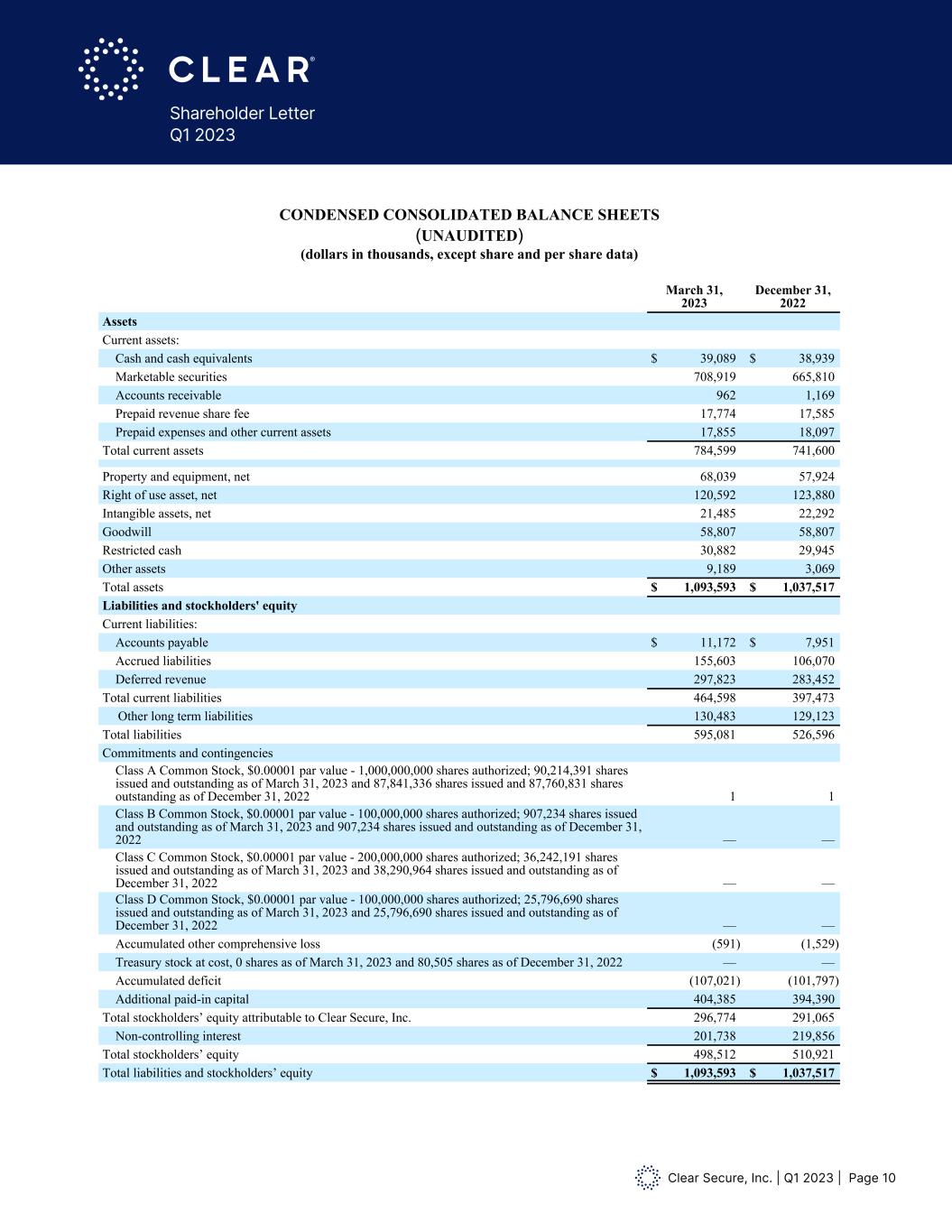

Clear Secure, Inc. | Q1 2023 | Page 10 Shareholder Letter Q1 2023 CLEAR SECURE, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (dollars in thousands, except share and per share data) March 31, 2023 December 31, 2022 Assets Current assets: Cash and cash equivalents $ 39,089 $ 38,939 Marketable securities 708,919 665,810 Accounts receivable 962 1,169 Prepaid revenue share fee 17,774 17,585 Prepaid expenses and other current assets 17,855 18,097 Total current assets 784,599 741,600 Property and equipment, net 68,039 57,924 Right of use asset, net 120,592 123,880 Intangible assets, net 21,485 22,292 Goodwill 58,807 58,807 Restricted cash 30,882 29,945 Other assets 9,189 3,069 Total assets $ 1,093,593 $ 1,037,517 Liabilities and stockholders' equity Current liabilities: Accounts payable $ 11,172 $ 7,951 Accrued liabilities 155,603 106,070 Deferred revenue 297,823 283,452 Total current liabilities 464,598 397,473 Other long term liabilities 130,483 129,123 Total liabilities 595,081 526,596 Commitments and contingencies Class A Common Stock, $0.00001 par value - 1,000,000,000 shares authorized; 90,214,391 shares issued and outstanding as of March 31, 2023 and 87,841,336 shares issued and 87,760,831 shares outstanding as of December 31, 2022 1 1 Class B Common Stock, $0.00001 par value - 100,000,000 shares authorized; 907,234 shares issued and outstanding as of March 31, 2023 and 907,234 shares issued and outstanding as of December 31, 2022 — — Class C Common Stock, $0.00001 par value - 200,000,000 shares authorized; 36,242,191 shares issued and outstanding as of March 31, 2023 and 38,290,964 shares issued and outstanding as of December 31, 2022 — — Class D Common Stock, $0.00001 par value - 100,000,000 shares authorized; 25,796,690 shares issued and outstanding as of March 31, 2023 and 25,796,690 shares issued and outstanding as of December 31, 2022 — — Accumulated other comprehensive loss (591) (1,529) Treasury stock at cost, 0 shares as of March 31, 2023 and 80,505 shares as of December 31, 2022 — — Accumulated deficit (107,021) (101,797) Additional paid-in capital 404,385 394,390 Total stockholders’ equity attributable to Clear Secure, Inc. 296,774 291,065 Non-controlling interest 201,738 219,856 Total stockholders’ equity 498,512 510,921 Total liabilities and stockholders’ equity $ 1,093,593 $ 1,037,517

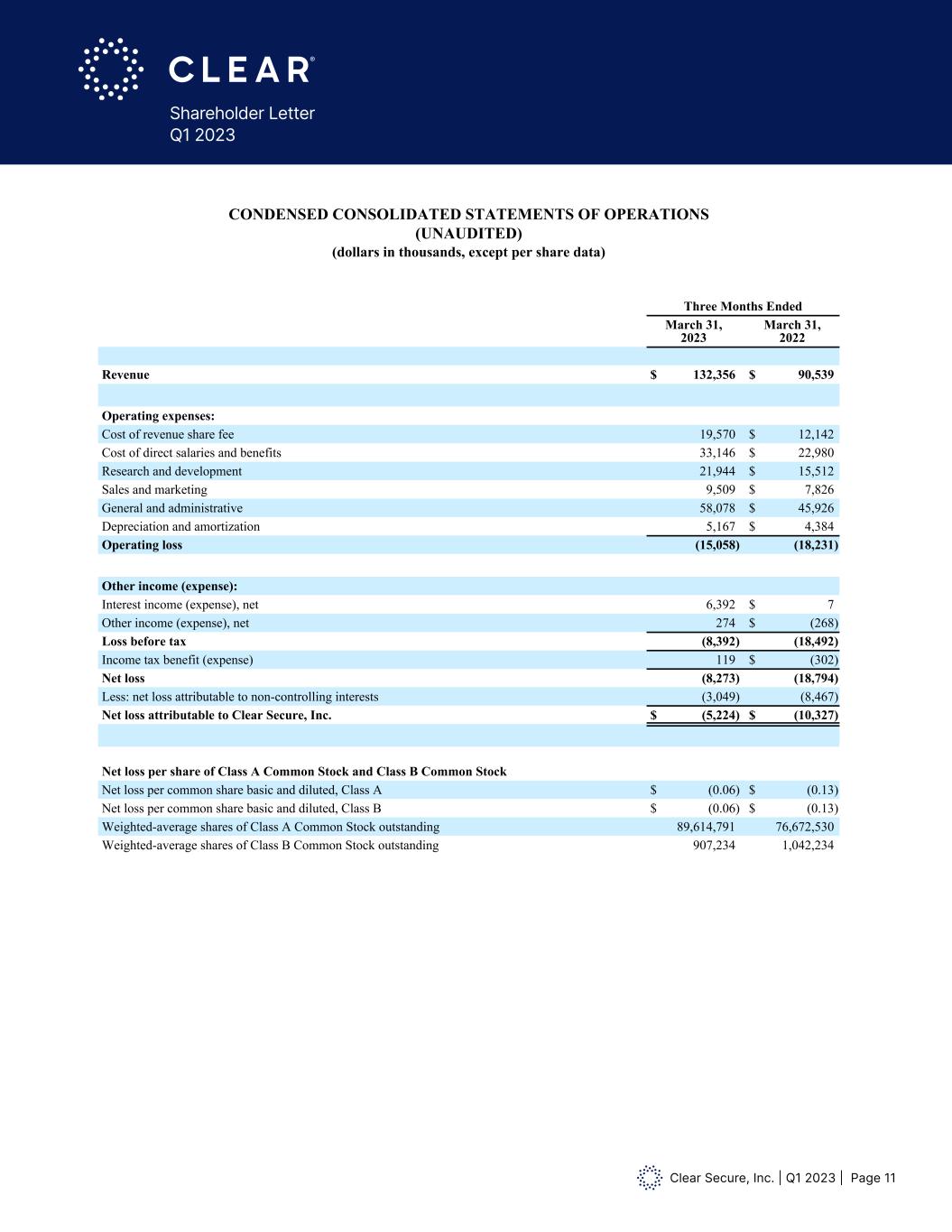

Clear Secure, Inc. | Q1 2023 | Page 11 Shareholder Letter Q1 2023 CLEAR SECURE, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (dollars in thousands, except per share data) Three Months Ended March 31, 2023 March 31, 2022 Revenue $ 132,356 $ 90,539 Operating expenses: Cost of revenue share fee 19,570 $ 12,142 Cost of direct salaries and benefits 33,146 $ 22,980 Research and development 21,944 $ 15,512 Sales and marketing 9,509 $ 7,826 General and administrative 58,078 $ 45,926 Depreciation and amortization 5,167 $ 4,384 Operating loss (15,058) (18,231) Other income (expense): Interest income (expense), net 6,392 $ 7 Other income (expense), net 274 $ (268) Loss before tax (8,392) (18,492) Income tax benefit (expense) 119 $ (302) Net loss (8,273) (18,794) Less: net loss attributable to non-controlling interests (3,049) (8,467) Net loss attributable to Clear Secure, Inc. $ (5,224) $ (10,327) Net loss per share of Class A Common Stock and Class B Common Stock Net loss per common share basic and diluted, Class A $ (0.06) $ (0.13) Net loss per common share basic and diluted, Class B $ (0.06) $ (0.13) Weighted-average shares of Class A Common Stock outstanding 89,614,791 76,672,530 Weighted-average shares of Class B Common Stock outstanding 907,234 1,042,234

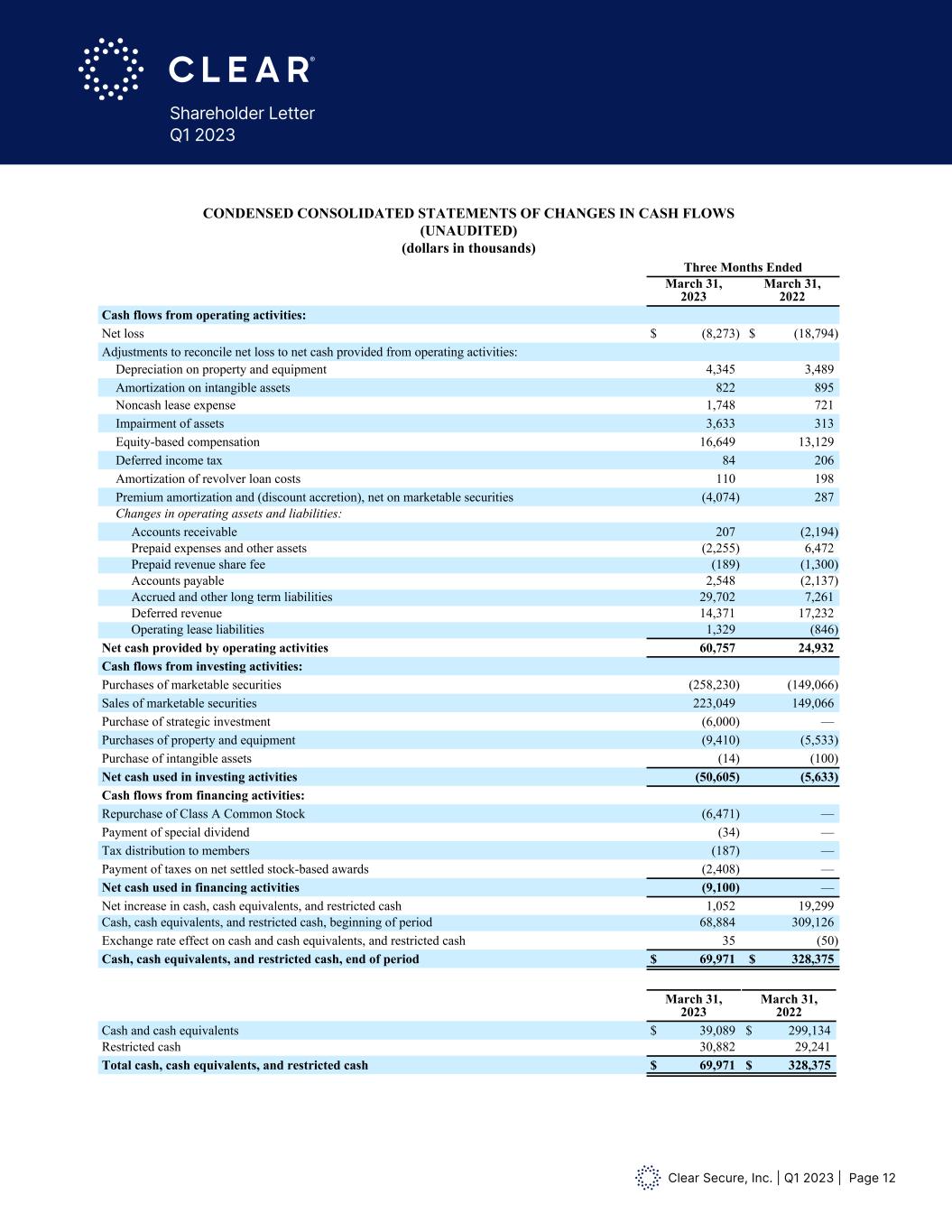

Clear Secure, Inc. | Q1 2023 | Page 12 Shareholder Letter Q1 2023 CLEAR SECURE, INC. CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN CASH FLOWS (UNAUDITED) (dollars in thousands) Three Months Ended March 31, 2023 March 31, 2022 Cash flows from operating activities: Net loss $ (8,273) $ (18,794) Adjustments to reconcile net loss to net cash provided from operating activities: Depreciation on property and equipment 4,345 3,489 Amortization on intangible assets 822 895 Noncash lease expense 1,748 721 Impairment of assets 3,633 313 Equity-based compensation 16,649 13,129 Deferred income tax 84 206 Amortization of revolver loan costs 110 198 Premium amortization and (discount accretion), net on marketable securities (4,074) 287 Changes in operating assets and liabilities: Accounts receivable 207 (2,194) Prepaid expenses and other assets (2,255) 6,472 Prepaid revenue share fee (189) (1,300) Accounts payable 2,548 (2,137) Accrued and other long term liabilities 29,702 7,261 Deferred revenue 14,371 17,232 Operating lease liabilities 1,329 (846) Net cash provided by operating activities 60,757 24,932 Cash flows from investing activities: Purchases of marketable securities (258,230) (149,066) Sales of marketable securities 223,049 149,066 Purchase of strategic investment (6,000) — Purchases of property and equipment (9,410) (5,533) Purchase of intangible assets (14) (100) Net cash used in investing activities (50,605) (5,633) Cash flows from financing activities: Repurchase of Class A Common Stock (6,471) — Payment of special dividend (34) — Tax distribution to members (187) — Payment of taxes on net settled stock-based awards (2,408) — Net cash used in financing activities (9,100) — Net increase in cash, cash equivalents, and restricted cash 1,052 19,299 Cash, cash equivalents, and restricted cash, beginning of period 68,884 309,126 Exchange rate effect on cash and cash equivalents, and restricted cash 35 (50) Cash, cash equivalents, and restricted cash, end of period $ 69,971 $ 328,375 March 31, 2023 March 31, 2022 Cash and cash equivalents $ 39,089 $ 299,134 Restricted cash 30,882 29,241 Total cash, cash equivalents, and restricted cash $ 69,971 $ 328,375

Clear Secure, Inc. | Q1 2023 | Page 13 Shareholder Letter Q1 2023 To evaluate performance of the business, we utilize a variety of other non-GAAP financial reporting and performance measures. These key measures include Total Bookings, Total Cumulative Enrollments, Total Cumulative Platform Uses, and Annual CLEAR Plus Net Member Retention. Total Bookings Total Bookings represent our total revenue plus the change in deferred revenue during the period. Total Bookings in any particular period reflect sales to new and renewing CLEAR Plus subscribers plus any accrued billings to partners. Management believes that Total Bookings is an important measure of the current health and growth of the business and views it as a leading indicator. Total Cumulative Enrollments We define Total Cumulative Enrollments as the number of enrollments since inception as of the end of the period. An Enrollment is defined as any member who has registered for the CLEAR platform since inception and has a profile (including limited time free trials regardless of conversion to paid membership) net of duplicate and/or purged accounts. This includes CLEAR Plus members who have completed enrollment with CLEAR and have ever activated a payment method, plus associated family accounts. Management views this metric as an important tool to analyze the efficacy of our growth and marketing initiatives as new members are potentially a current and leading indicator of revenues. Total Cumulative Platform Uses We define Total Cumulative Platform Uses as the number of individual engagements across CLEAR use cases, including Clear Plus, flagship app and Powered by CLEAR, since inception as of the end of the period. Management views this metric as an important tool to analyze the level of engagement of our member base which can be a leading indicator of future growth, retention, and revenue. Annual CLEAR Plus Net Member Retention We define Annual CLEAR Plus Net Member Retention as one minus the CLEAR Plus net member churn on a rolling 12-month basis. We define “CLEAR Plus net member churn” as total cancellations net of winbacks in the trailing 12-month period divided by the average active CLEAR Plus members as of the beginning of each month within the same 12-month period. Winbacks are defined as reactivated members who have been canceled for at least 60 days. Active CLEAR Plus members are defined as members who have completed enrollment with CLEAR and have activated a payment method for our in-airport CLEAR Plus service, including their registered family plan members. Active CLEAR Plus members also include those in a grace period of up to 45 days after a billing failure during which time we attempt to collect updated payment information. Management views this metric as an important tool to analyze the level of engagement of our member base, which can be a leading indicator of future growth and revenue, as well as an indicator of customer satisfaction and long term business economics. Definitions of Key Performance Indicators

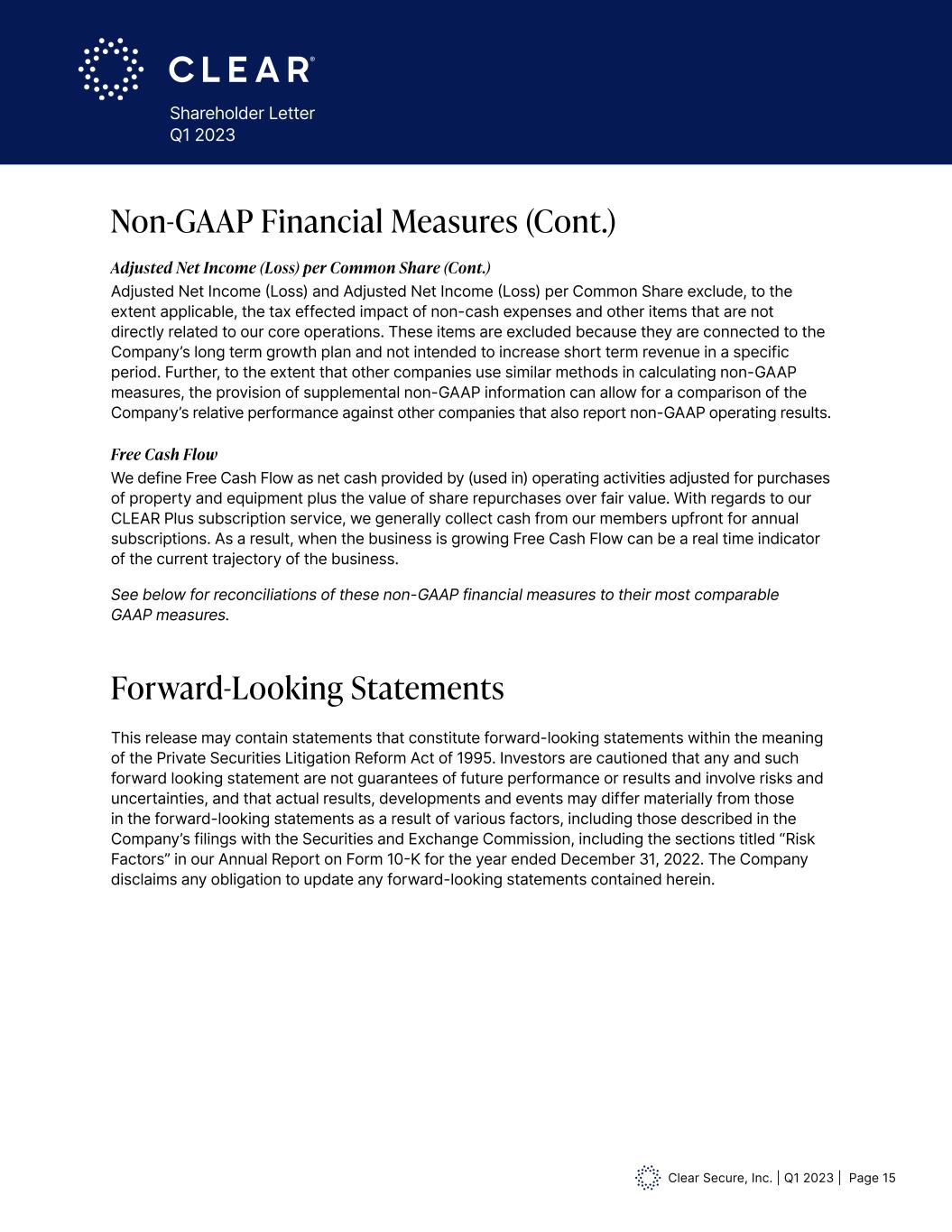

Clear Secure, Inc. | Q1 2023 | Page 14 Shareholder Letter Q1 2023 In addition to our results as determined in accordance with GAAP, we disclose Adjusted EBITDA, Free Cash Flow, Adjusted Net Income (Loss) and Adjusted Net Income (Loss) per Common Share, Basic and Diluted as non-GAAP financial measures that management believes provide useful information to investors. These measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for net income (loss), net cash provided by (used in) operating activities or any other operating performance measure calculated in accordance with GAAP, and may not be comparable to a similarly titled measure reported by other companies. Our non-GAAP financial measures are expressed in thousands. Adjusted EBITDA (Loss) We define Adjusted EBITDA (Loss) as net income (loss) adjusted for income taxes, interest (income) expense net, depreciation and amortization, impairment and losses on asset disposals, equity-based compensation expense, mark to market of warrant liabilities, net other income (expense) excluding sublease rental income, acquisition-related costs and changes in fair value of contingent consideration. Adjusted EBITDA is an important financial measure used by management and our board of directors (“Board”) to evaluate business performance. During the third quarter of fiscal year 2022, we revised our definition of Adjusted EBITDA (Loss) to exclude sublease rental income from our other income (expense) adjustment. During the fourth quarter of fiscal year 2022, we revised our definition of Adjusted EBITDA (Loss) to include impairment on assets as a separate component. We did not revise prior years' Adjusted EBITDA (Loss) because there was no impact of a similar nature in the prior period that affects comparability. Adjusted Net Income (Loss) We define Adjusted Net Income (Loss) as Net income (loss) attributable to Clear Secure, Inc. adjusted for the net income (loss) attributable to non-controlling interests, equity-based compensation expense, amortization of acquired intangible assets, acquisition-related costs, changes in fair value of contingent consideration and the income tax effect of these adjustments. Adjusted Net Income (Loss) is used in the calculation of Adjusted Net Income (Loss) per Common Share as defined below. Adjusted Net Income (Loss) per Common Share We compute Adjusted Net Income (Loss) per Common Share, Basic as Adjusted Net Income (Loss) divided by Adjusted Weighted-Average Shares Outstanding for our Class A Common Stock, Class B Common Stock, Class C Common Stock and Class D Common Stock assuming the exchange of all vested and outstanding common units in Alclear at the end of each period presented. We do not present Adjusted Net Income (Loss) per Common Share for shares of our Class B Common Stock although they are participating securities based on the assumed conversion of those shares to our Class A Common Stock. We do not present Adjusted Net Income (Loss) per Common Share on a dilutive basis for periods where we have Adjusted Net Loss since we do not assume the conversion of any potentially dilutive equity instruments as the result would be anti-dilutive. In periods where we have Adjusted Net Income, the Company also calculates Adjusted Net Income per Common Share, Diluted based on the effect of potentially dilutive equity instruments for the periods presented using the treasury stock/if-converted method, as applicable. Non-GAAP Financial Measures

Clear Secure, Inc. | Q1 2023 | Page 15 Shareholder Letter Q1 2023 Adjusted Net Income (Loss) per Common Share (Cont.) Adjusted Net Income (Loss) and Adjusted Net Income (Loss) per Common Share exclude, to the extent applicable, the tax effected impact of non-cash expenses and other items that are not directly related to our core operations. These items are excluded because they are connected to the Company’s long term growth plan and not intended to increase short term revenue in a specific period. Further, to the extent that other companies use similar methods in calculating non-GAAP measures, the provision of supplemental non-GAAP information can allow for a comparison of the Company’s relative performance against other companies that also report non-GAAP operating results. Free Cash Flow We define Free Cash Flow as net cash provided by (used in) operating activities adjusted for purchases of property and equipment plus the value of share repurchases over fair value. With regards to our CLEAR Plus subscription service, we generally collect cash from our members upfront for annual subscriptions. As a result, when the business is growing Free Cash Flow can be a real time indicator of the current trajectory of the business. See below for reconciliations of these non-GAAP financial measures to their most comparable GAAP measures. This release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any and such forward looking statement are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments and events may differ materially from those in the forward-looking statements as a result of various factors, including those described in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022. The Company disclaims any obligation to update any forward-looking statements contained herein. Non-GAAP Financial Measures (Cont.) Forward-Looking Statements

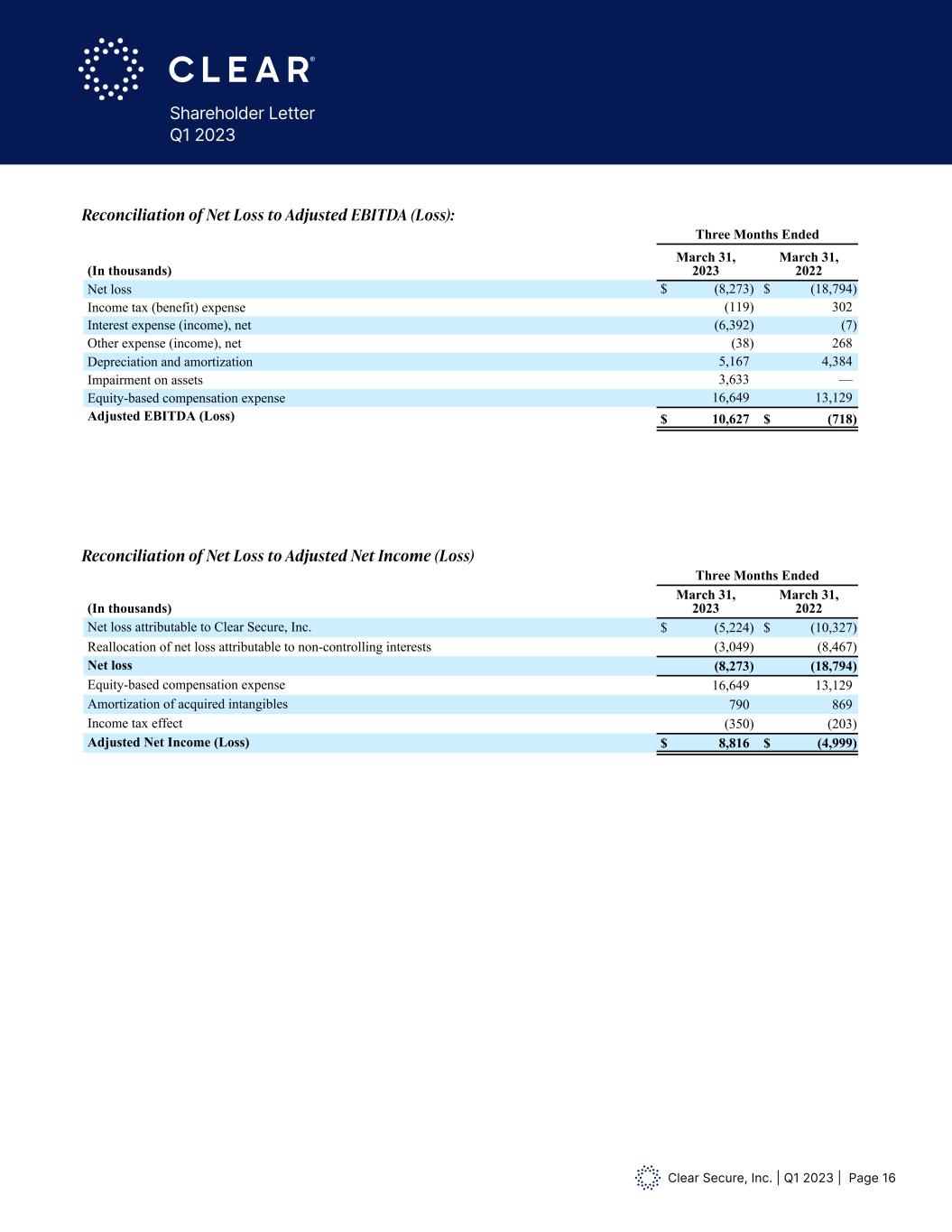

Clear Secure, Inc. | Q1 2023 | Page 16 Shareholder Letter Q1 2023 Reconciliation of Net Loss to Adjusted EBITDA (Loss): Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net loss $ (8,273) $ (18,794) Income tax (benefit) expense (119) 302 Interest expense (income), net (6,392) (7) Other expense (income), net (38) 268 Depreciation and amortization 5,167 4,384 Impairment on assets 3,633 — Equity-based compensation expense 16,649 13,129 Adjusted EBITDA (Loss) $ 10,627 $ (718) Reconciliation of Net Loss to Adjusted Net Income (Loss) Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net loss attributable to Clear Secure, Inc. $ (5,224) $ (10,327) Reallocation of net loss attributable to non-controlling interests (3,049) (8,467) Net loss (8,273) (18,794) Equity-based compensation expense 16,649 13,129 Amortization of acquired intangibles 790 869 Income tax effect (350) (203) Adjusted Net Income (Loss) $ 8,816 $ (4,999) Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three Months Ended March 31, 2023 March 31, 2022 Weighted-average number of shares outstanding, basic for Class A Common Stock 89,614,791 76,672,530 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 1,042,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 36,867,471 44,000,927 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 26,705,415 Assumed weighted-average conversion of vested and outstanding warrants — 162,957 Adjusted Weighted-Average Number of Shares Outstanding, Basic 153,186,186 148,584,063 Weighted-average impact of unvested RSAs 110,641 — Weighted-average impact of unvested RSUs 896,720 — Total incremental shares 1,007,361 — Adjusted Weighted-Average Number of Shares Outstanding, Diluted 154,193,547 148,584,063 As stated above, due to the Company incurring an adjusted net loss for certain periods presented, the Company has not calculated Adjusted Weighted-Average Number of Shares Outstanding, Diluted for those periods as the result would be antidilutive. Therefore for those periods, Adjusted Net Income (Loss) per Common Share, Basic and Dilutive will be the same. Calculation of Adjusted Basic Net Income (Loss) Per Common Share, Basic Three Months Ended March 31, 2023 March 31, 2022 Adjusted Net Income (Loss) in thousands $ 8,816 $ (4,999) Adjusted Weighted-Average Number of Shares Outstanding, Basic 153,186,186 148,584,063 Adjusted Net Income (Loss) per Common Share, Basic $ 0.06 $ (0.03) Re nciliation of Net Loss to Adjusted EBITDA (Loss): Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net loss $ (8,273) $ (18,794) Income tax (benefit) expense (119) 302 Interest expense (income), net (6,392) (7) Other expense (income), net (38) 268 Depreciation a d amor ization 5,167 4,384 Impairment on assets 3,633 — Equity-based compensation expense 16,649 13,129 Adjusted EBITDA (Loss) $ 10,627 $ (718) Reconciliation of Net Loss to Adjusted Net Income (Loss) Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net loss ttributable to Clear Secure, Inc. $ (5,224 $ (10,327 Reallocation of et loss attributable to non-controlling interests (3 049) 8 467 Net loss (8,273) (18,794) Equity-based compensation expense 16,649 13,129 Amortization of acquired intangibles 790 869 Income tax effect (350) (203) Adjusted Net Income (Loss) $ 8,816 $ (4,999) Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three Months Ended March 31, 2023 March 31, 2022 Weighte -average number of share utstanding, basic for Class A Common Stock 89,614,791 76,67 530 justments Assume weighted-average co rsion of i sued and outstanding Class B Common Stock 907 234 1,042,234 Assume weighted-average co rsion of i sued and outstanding Class C Common Stock 36, 67 471 44,000,927 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25 796 690 26,705,415 ss m weighted-average conversion of vested and ou standing warrants — 162 957 Adjusted Weighted-Average Number of Shares Outstanding, Basic 153,186,186 148,584,063 Weighted-average impact of unvested RSAs 110,641 — Weighted-average impact of unvested RSUs 896,720 — Total incremental shares 1,007,361 — Adjusted Weighted-Average Number of Shares Outstanding, Diluted 154,193,547 148,584,063 As stated above, due to the Company incurring an adjusted net loss for certain periods presented, th Company has not calculated Adjusted Weighted-Average Number of Shares Outstanding, Diluted for those periods as the result would be antidilutive. Therefore for those periods, Adjusted Net Income (Loss) per Common Share, Basic and Dilutive will be the same. Calculation of Adjusted Basic Net Income (Loss) Per Common Share, Basic Three Months Ended March 31, 2023 March 31, 2022 Adjusted Net Income (Loss) in thousands $ 8,816 $ (4,999) Adjusted Weighted-Average Number of Shares Outstanding, Basic 153,186,186 148,584,063 Adjusted Net Income (Loss) per Common Share, Basic $ 0.06 $ (0.03) Reconciliation of Net Loss to Adjusted EBITDA (Loss): Reconciliation of Net Loss to Adjusted Net Income (Loss)

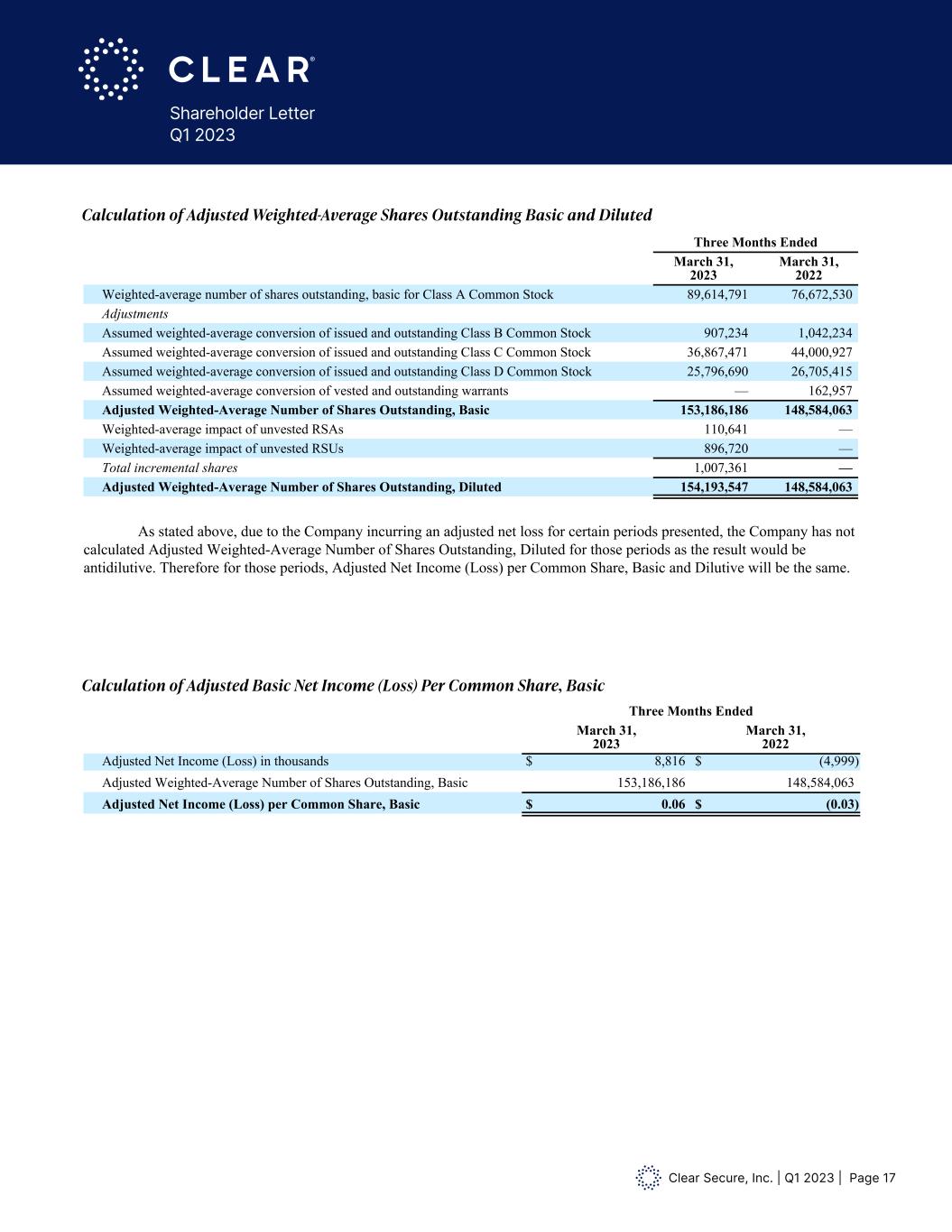

Clear Secure, Inc. | Q1 2023 | Page 17 Shareholder Letter Q1 2023 Reconciliation of Net Loss to Adjusted EBITDA (Loss): Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net loss $ (8,273) $ (18,794) Income tax (benefit) expense (119) 302 Interest expense (income), net (6,392) (7) Other expense (income), net (38) 268 Depreciation and amortization 5,167 4,384 Impairment on assets 3,633 — Equity-based compensation expense 16,649 13,129 Adjusted EBITDA (Loss) $ 10,627 $ (718) Reconciliation of Net Loss to Adjusted Net Income (Loss) Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net loss attributable to Clear Secure, Inc. $ (5,224) $ (10,327) Reallocation of net loss attributable to non-controlling interests (3,049) (8,467) Net loss (8,273) (18,794) Equity-based compensation expense 16,649 13,129 Amortization of acquired intangibles 790 869 Income tax effect (350) (203) Adjusted Net Income (Loss) $ 8,816 $ (4,999) Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three Months Ended March 31, 2023 March 31, 2022 Weighted-average number of shares outstanding, basic for Class A Common Stock 89,614,791 76,672,530 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 1,042,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 36,867,471 44,000,927 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 26,705,415 Assumed weighted-average conversion of vested and outstanding warrants — 162,957 Adjusted Weighted-Average Number of Shares Outstanding, Basic 153,186,186 148,584,063 Weighted-average impact of unvested RSAs 110,641 — Weighted-average impact of unvested RSUs 896,720 — Total incremental shares 1,007,361 — Adjusted Weighted-Average Number of Shares Outstanding, Diluted 154,193,547 148,584,063 As stated above, due to the Company incurring an adjusted net loss for certain periods presented, the Company has not calculated Adjusted Weighted-Average Number of Shares Outstanding, Diluted for those periods as the result would be antidilutive. Therefore for those periods, Adjusted Net Income (Loss) per Common Share, Basic and Dilutive will be the same. Calculation of Adjusted Basic Net Income (Loss) Per Common Share, Basic Three Months Ended March 31, 2023 March 31, 2022 Adjusted Net Income (Loss) in thousands $ 8,816 $ (4,999) Adjusted Weighted-Average Number of Shares Outstanding, Basic 153,186,186 148,584,063 Adjusted Net Income (Loss) per Common Share, Basic $ 0.06 $ (0.03) Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Reconciliation of Net Loss to Adjusted EBITDA (Loss): Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net loss $ (8,273) $ (18,794) Income tax (benefit) expense (119) 302 Interest expense (income), net (6,392) (7) Other expense (income), net (38) 268 Depreciation and amortization 5,167 4,384 Impairment on assets 3,633 — Equity-based compensation expense 16,649 13,129 Adjusted EBITDA (Loss) $ 10,627 $ (718) Reconciliation of Net Loss to Adjusted Net Income (Loss) Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net loss attributable to Clear Secure, Inc. $ (5,224) $ (10,327) Reallocation of net loss attributable to non-controlling interests (3,049) (8,467) Net loss (8,273) (18,794) Equity-based compensation expense 16,649 13,129 Amortizat n of acquired intangibles 790 869 Income tax effect (350) (203) Adjusted Net Income (Loss) $ 8,816 $ (4,999) Calculation of Adjusted Weighted-Average Shares Outstanding Basic and Diluted Three Months Ended March 31, 2023 March 31, 2022 Weighted-average number of shares outstanding, basic for Class A Common Stock 89,614,791 76,672,530 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 907,234 1,042,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 36,867,471 44,000,927 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 25,796,690 26,705,415 Assumed weighted-average conversion of vested and outstanding warrants — 162,957 Adjusted eighted-Average Nu ber of Shares Outstanding, Basic 153,186,186 148,584,063 Weighted-average impact of unvested RSAs 110,641 — Weighted-average impact of unvested RSUs 896,720 — Tot l incremental shares 1,007,361 — Adj sted Weighted-Average Number of Shares Outs a ding, Diluted 154,193,547 148,584,063 As stated above, due to the Company incurring an adjusted net loss for certain periods presented, the Company has not calculated Adjusted Weighted-Average Number of Shares Outstanding, Diluted for those periods as t e result would be antidilutive. Therefore for those periods, Adjusted Net Income (Loss) per Common Share, Basic and Dilutive will be the same. Calculation of Adjusted Basic Net Income (Loss) Per Common Share, Basic Three Months Ended March 31, 2023 March 31, 2022 Adjusted Net Income (Loss) in thousands $ 8,816 $ (4,999) Adjusted Weighted-Average Number of Shares Outstanding, Basic 153,186,186 148,584,063 Adjusted Net Income (Loss) per Common Share, Basic $ 0.06 $ (0.03) lc lation of Adjusted Basic Net Income (Loss) Per C mmon Sh re, Basic

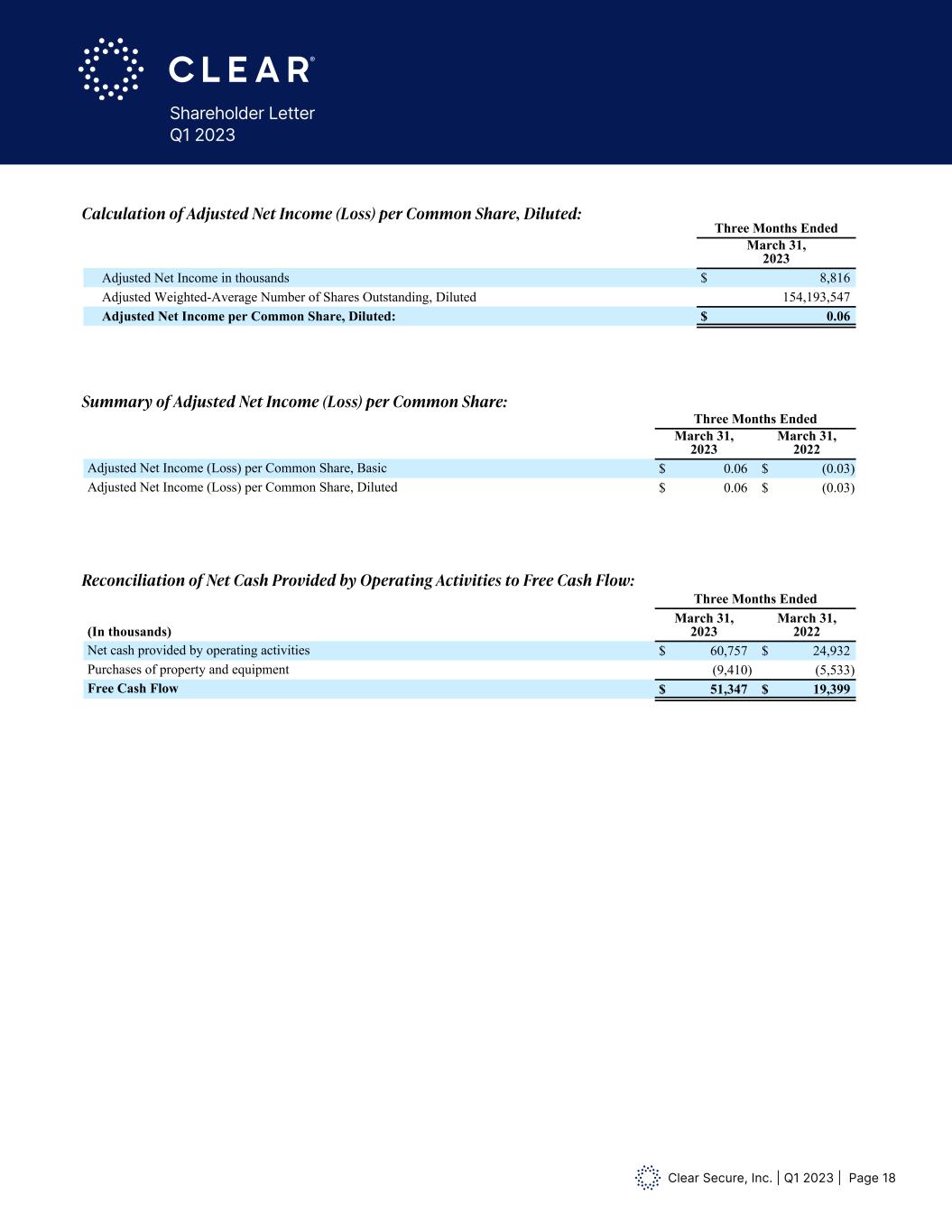

Clear Secure, Inc. | Q1 2023 | Page 18 Shareholder Letter Q1 2023 Calculation of Adjusted Net Income (Loss) per Common Share, Diluted Three Months Ended March 31, 2023 Adjusted Net Income in thousands $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 154,193,547 Adjusted Net Income per Common Share, Diluted: $ 0.06 Summary of Adjusted Net Income (Loss) per Common Share: Three Months Ended March 31, 2023 March 31, 2022 Adjusted Net Income (Loss) per Common Share, Basic $ 0.06 $ (0.03) Adjusted Net Income (Loss) per Common Share, Diluted $ 0.06 $ (0.03) Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net cash provided by operating activities $ 60,757 $ 24,932 Purchases of property and equipment (9,410) (5,533) Free Cash Flow $ 51,347 $ 19,399 Summary of the components of the Company’s total equity-based compensation expense: Three Months Ended March 31, 2023 (in thousands) Pre-IPO employee performance awards Warrants Founder PSU Employee equity-based awards Total Cost of direct salaries and benefits $ 23 $ — $ — $ 50 $ 73 Research and development 222 — — 4,730 4,952 Sales and marketing (145) — — 44 (101) General and administrative 762 623 6,485 3,855 11,725 Total equity-based compensation $ 862 $ 623 $ 6,485 $ 8,679 $ 16,649 Three Months Ended March 31, 2022 (in thousands) Pre-IPO employee performance awards Warrants Founder PSU Employee equity-based awards Total Cost of direct salaries and benefits $ — $ — $ — $ 94 $ 94 Research and development — — — 3,741 3,741 Sales and marketing — — — 48 48 General and administrative — 70 6,485 2,691 9,246 Total equity-based compensation $ — $ 70 $ 6,485 $ 6,574 $ 13,129 Calculation of Adjusted Net Income (Loss) per Common Share, Diluted Three Months Ended March 31, 2023 Adjusted Net Income in thousands $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 154,193,547 Adjusted Net Income per Common Share, Diluted: $ 0.06 Summary of Adjusted Net Income (Loss) per Common Share: Three Months Ended March 31, 2023 March 31, 2022 Adjusted Net Income (Loss) per Common Share, Basic $ 0.06 $ (0.03) Adjusted Net Income (Loss) per Common Share, Diluted $ 0.06 $ (0.03) Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net cash provided by operating activities $ 60,757 $ 24,932 Purchases of property and equipment (9,410) (5,533) Free Cash Flow $ 51,347 $ 19,399 Summary of the components of the Company’s total equity-based compensation expense: Three Months Ended March 31, 2023 (in thousands) Pre-IPO employee performance awards Warrants Founder PSU Employe equity-based awards Total Cost of direct salaries and benefits $ 23 $ — $ — $ 50 $ 73 Research and development 222 — — 4,730 4,952 Sales and marketing (145) — — 44 (101) General and administrative 762 623 6,485 3,855 11,725 Total equity-based compensation $ 862 $ 623 $ 6,485 $ 8,679 $ 16,649 Three Months Ended March 31, 2022 (in thousands) Pre-IPO employee performance awards Warrants Founder PSU Employe equity-based awards Total Cost of direct salaries and benefits $ — $ — $ — $ 94 $ 94 Research and development — — — 3,741 3,741 Sales and marketing — — — 48 48 General and administrative — 70 6,485 2,691 9,246 Total equity-based compensation $ — $ 70 $ 6,485 $ 6,574 $ 13,129 Calculation of Adjusted Net Income (Loss) per Common Share, Diluted Three Months Ended March 31, 2023 Adjusted Net Income in thousands $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 154,193,547 Adjusted Net Income per Com on Share, Diluted: $ 0.06 Summary of Adjusted Net Income (Loss) per Common Share: Three Months Ended March 31, 2023 March 31, 2022 Adjusted Net Income (Loss) per Common Share, Basic $ 0.06 $ (0.03) Adjusted Net I come (Loss) per Common Share, Diluted $ 0.06 $ (0.03) Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net cash provided by operating activities $ 60,757 $ 24,932 Purchases of property and equipment (9,410) (5,533) Free Cash Flow $ 51,347 $ 19,399 Summary of the components of the Company’s total equity-based compensation expense: Three Months Ended March 31, 2023 (in thousands) Pre-IPO employee performance awards Warrants Founder PSU Employee equity-based awards Total Cost of direct salaries and benefits $ 23 $ — $ — $ 50 $ 73 Research and development 222 — — 4,730 4,952 Sales and marketing (145) — — 44 (101) General and administrative 762 623 6,485 3,855 11,725 Total equity-based compensation $ 862 $ 623 $ 6,485 $ 8,679 $ 16,649 Three Months Ended March 31, 2022 (in thousands) Pre-IPO employee performance awards Warrants Founder PSU Employee equity-based awards Total Cost of direct salaries and benefits $ — $ — $ — $ 94 $ 94 Research and development — — — 3,741 3,741 Sales and marketing — — — 48 48 General and administrative — 70 6,485 2,691 9,246 Total equity-based compensation $ — $ 70 $ 6,485 $ 6,574 $ 13,129 Calculation of Adjusted Net Income (Loss) per Common Share, Diluted: ary of Adjusted Net Income (Loss) per C mmon Share: Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow:

Clear Secure, Inc. | Q1 2023 | Page 19 Shareholder Letter Q1 2023 Summary of the components of the Company’s total equity-based compensation expense: Calculation of Adjusted Net Income (Loss) per Common Share, Diluted Three Months Ended March 31, 2023 Adjusted Net Income in thousands $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 154,193,547 Adjusted Net Income per Common Share, Diluted: $ 0.06 Summary of Adjusted Net Income (Loss) per Common Share: Three Months Ended March 31, 2023 March 31, 2022 Adjusted Net Income (Loss) per Common Share, Basic $ 0.06 $ (0.03) Adjusted Net Income (Loss) per Common Share, Diluted $ 0.06 $ (0.03) Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow: Three Months Ended (In thousands) March 31, 2023 March 31, 2022 Net cash provided by operating activities $ 60,757 $ 24,932 Purchases of property and equipment (9,410) (5,533) Free Cash Flow $ 51,347 $ 19,399 Summary of the components of the Company’s total equity-based compensation expense: Three Months Ended March 31, 2023 (in thousands) Pre-IPO employee performance awards Warrants Founder PSU Employee equity-based awards Total Cost of direct salaries and benefits $ 23 $ — $ — $ 50 $ 73 Research and development 222 — — 4,730 4,952 Sales and marketing (145) — — 44 (101) General and administrative 762 623 6,485 3,855 11,725 Total equity-based compensation $ 862 $ 623 $ 6,485 $ 8,679 $ 16,649 Three Months Ended March 31, 2022 (in thousands) Pre-IPO employee performance awards Warrants Founder PSU Employee equity-based awards Total Cost of direct salaries and benefits $ — $ — $ — $ 94 $ 94 Research and development — — — 3,741 3,741 Sales and marketing — — — 48 48 General and administrative — 70 6,485 2,691 9,246 Total equity-based compensation $ — $ 70 $ 6,485 $ 6,574 $ 13,129 Calculation of Adjusted Net Income (Loss) per Co mon Share, Diluted Three Months En ed March 31, 023 Adjusted Net Income in thousands $ 8,816 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 154,193,547 Adjusted Net Incom per Co mon Share, Diluted: $ 0.06 Su mary of Adjusted Net Income (Loss) per Co mon Share: Three Months En ed March 31, 023 March 31, 022 Adjusted Net Income (Loss) per Common Share, Basic $ 0.06 $ (0.03) Adjusted Net Income (Loss) per Common Share, Diluted $ 0.06 $ (0.03) Reconcil ation of Net Cash Provi ed by Operating Activities to Free Cash Flow: Three Months En ed (In thousands) March 31, 023 March 31, 022 Net cash provi ed by operating activities $ 60, 57 $ 24,932 Purchases of property and equipment (9,410) (5,533) Free Cash Flow $ 51,347 $ 1 ,399 Su mary of the compo ents of the Company’s total equity-based compensation expense: Three Months En ed March 31, 023 (in thousands) Pre-IPO employee performance wards Warrants Founder PSU Employee equity-based wards Total Cost of direct salaries and benefits $ 23 $ — $ — $ 50 $ 73 Research and development 22 — — 4,730 4,952 Sales and marketing (145) — — 44 ( 01) Gener l an adminis rative 762 623 6,485 3,855 11,725 Total equity-based compensation $ 862 $ 623 $ 6,485 $ 8,679 $ 16,649 Three Months En ed March 31, 022 (in thousands) Pre-IPO employee performance wards Warrants Founder PSU Employee equity-based wards Total Cost of direct salaries and benefits $ — $ — $ — $ 94 $ 94 Research and development — — — 3,741 3,741 Sales and marketing — — — 48 48 Gener l an adminis rative — 70 6,485 2,691 9,246 Total equity-based compensation $ — $ 70 $ 6,485 $ 6,574 $ 3,129 e 9 1