Shareholder Letter Q1 2022

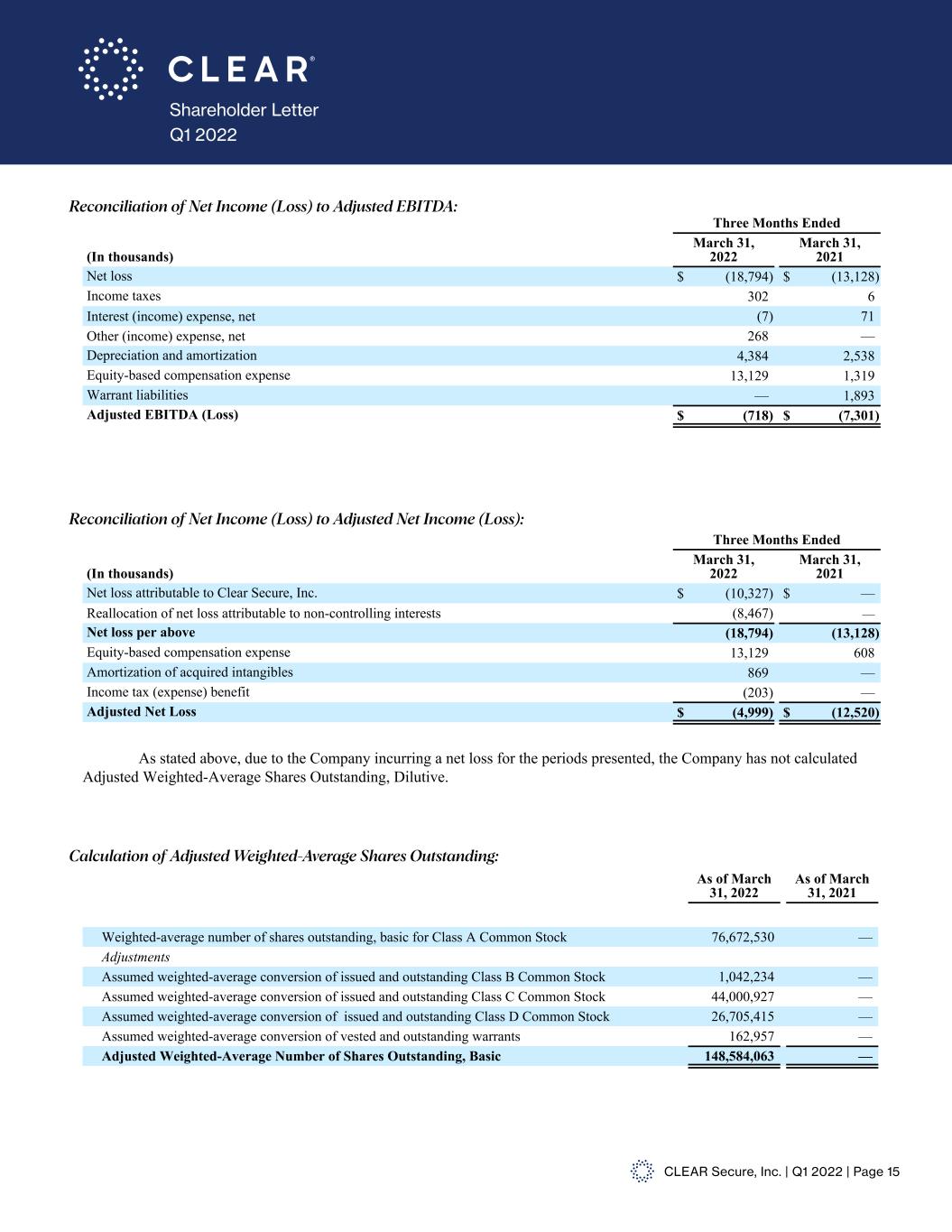

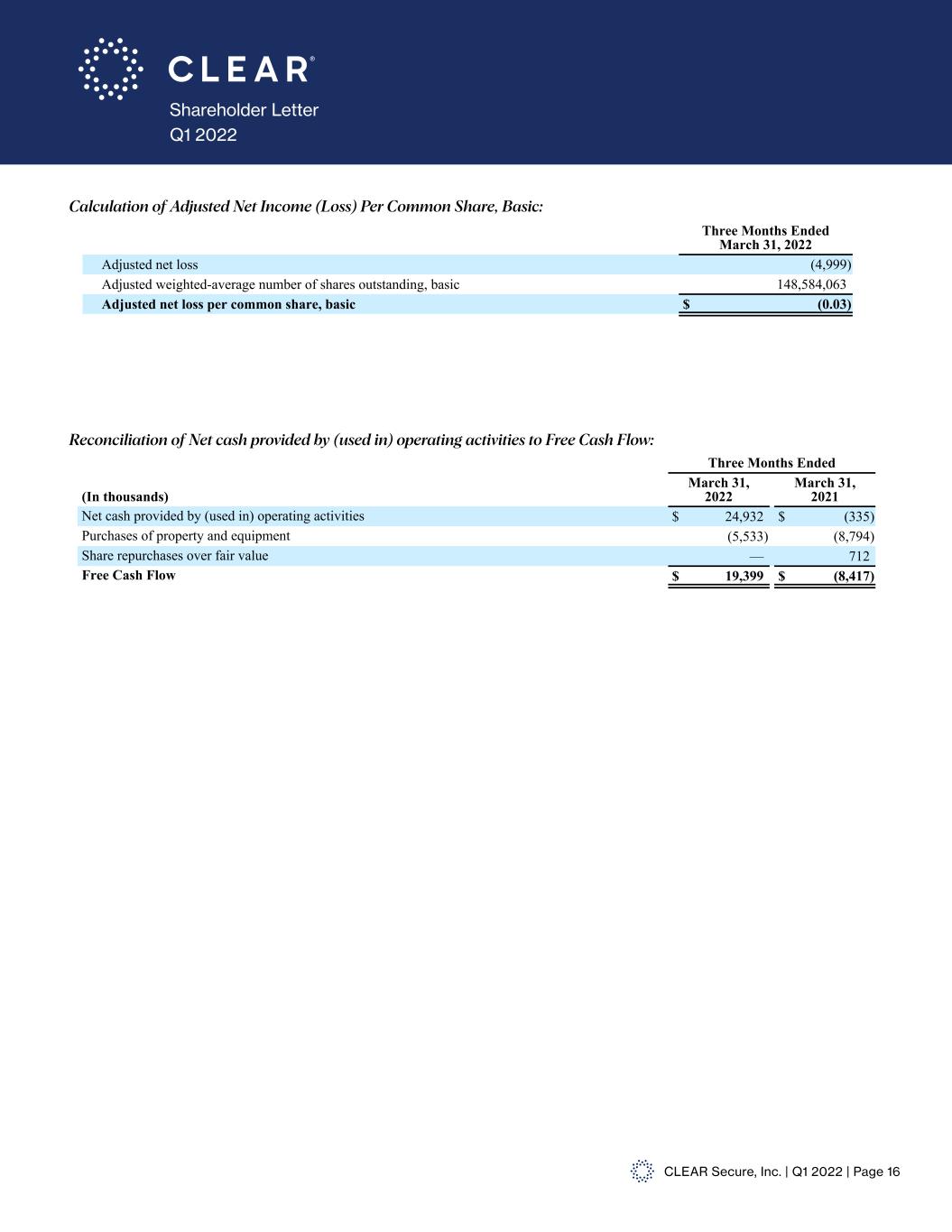

CLEAR Secure, Inc. | Q1 2022 | Page 1 Shareholder Letter Q1 2022 First Quarter 2022 Financial Highlights (all figures are for First Quarter 2022 and percentage change is expressed as year-over-year, unless otherwise specified)* Revenue of $90.5 million was up 79.1% while Total Bookings of $107.8 million were up 73.5% Net cash provided by operating activities of $24.9 million; Free Cash Flow of $19.4 million Total Cumulative Enrollments of 11.8 million were up 112% year-over-year Annual CLEAR Plus Net Member Retention of 95.3% was up 1,810 basis points year-over-year and up 300 basis points sequentially Total Cumulative Platform Uses of 95.3 million were up 57% year-over-year Net Loss ($18.8) million; Adjusted Net Loss ($5.0) million; Adjusted EBITDA ($0.7) million Basic and Diluted Net Loss Per Share ($0.13); Adjusted Net Loss Per Share ($0.03) $100 million share repurchase authorized by CLEAR’s Board of Directors Launched Palm Springs International, Ontario International and San Diego International airports bringing total to 43 Launched virtual queueing in Phoenix International; now live in 6 airports *A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided at the end of this letter. “ Our first quarter performance continued the broad-based strength experienced in our fourth quarter. The business saw operating leverage and generated strong free cash flow. We remain bullish on travel as people are allocating more discretionary spend to experiences, including travel.” —Caryn Seidman-Becker, CLEAR’s CEO

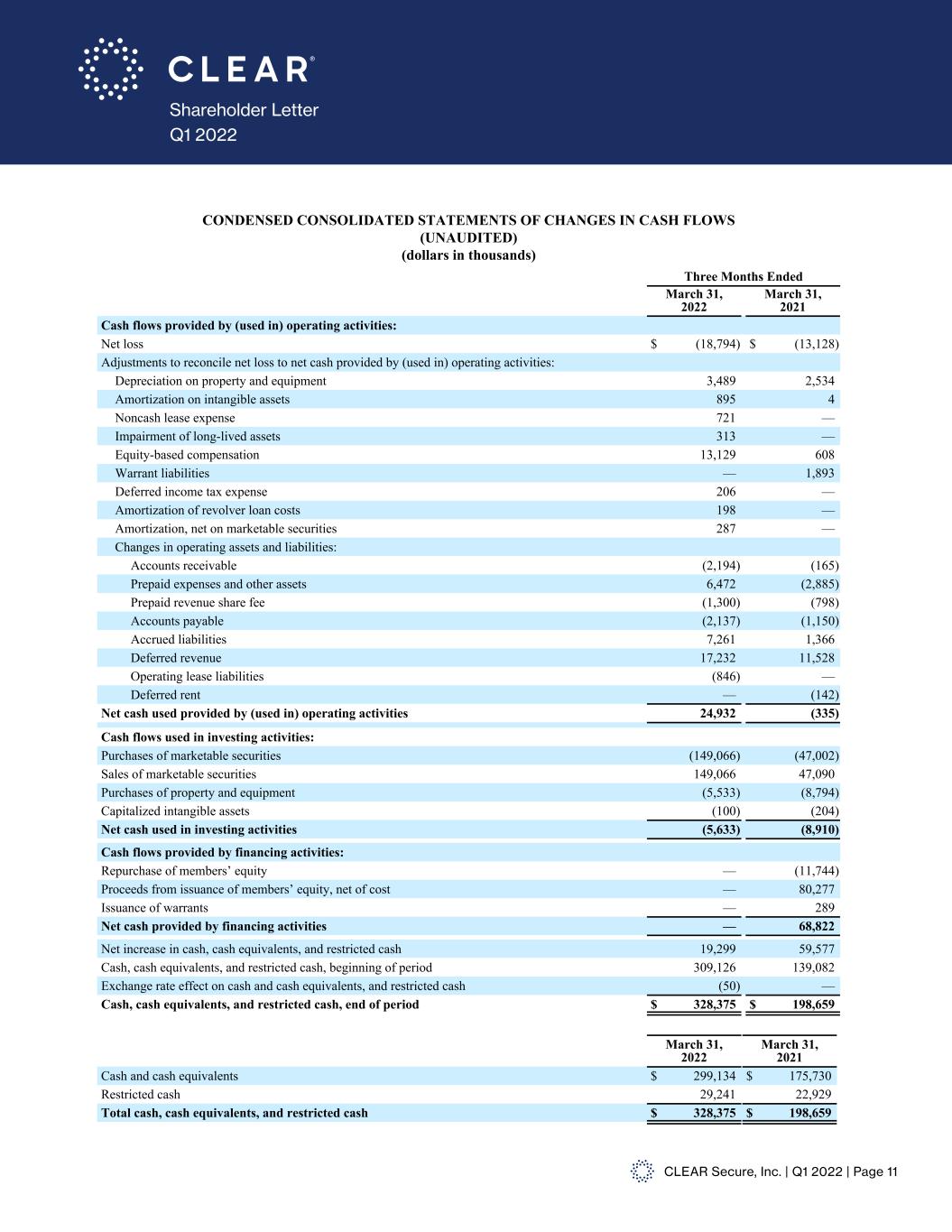

CLEAR Secure, Inc. | Q1 2022 | Page 2 Shareholder Letter Q1 2022 in millions in thousands Total Bookings & GAAP Revenue Total Cumulative Enrollments

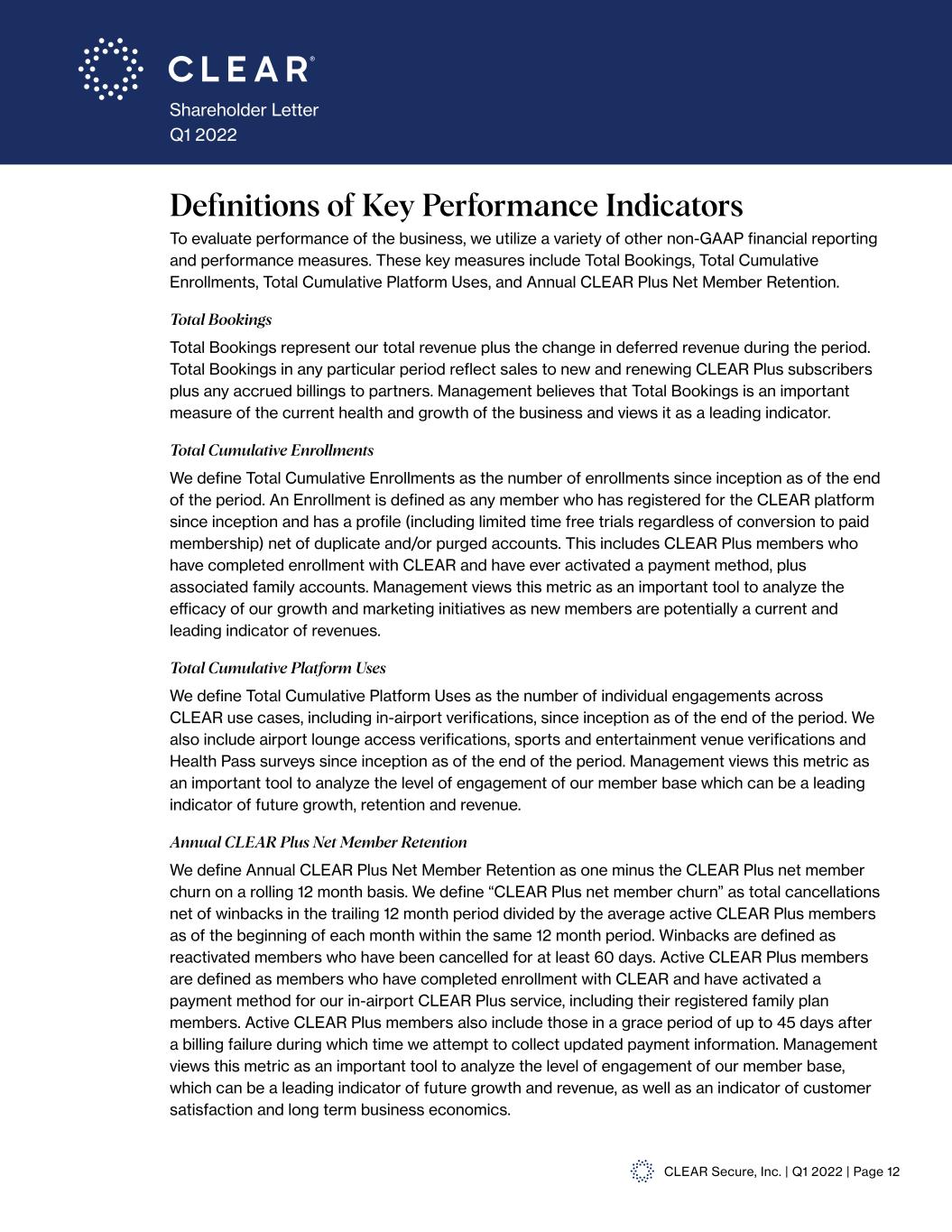

CLEAR Secure, Inc. | Q1 2022 | Page 3 Shareholder Letter Q1 2022 Total Cumulative Platform Uses Annual CLEAR Plus Net Member Retention in thousands

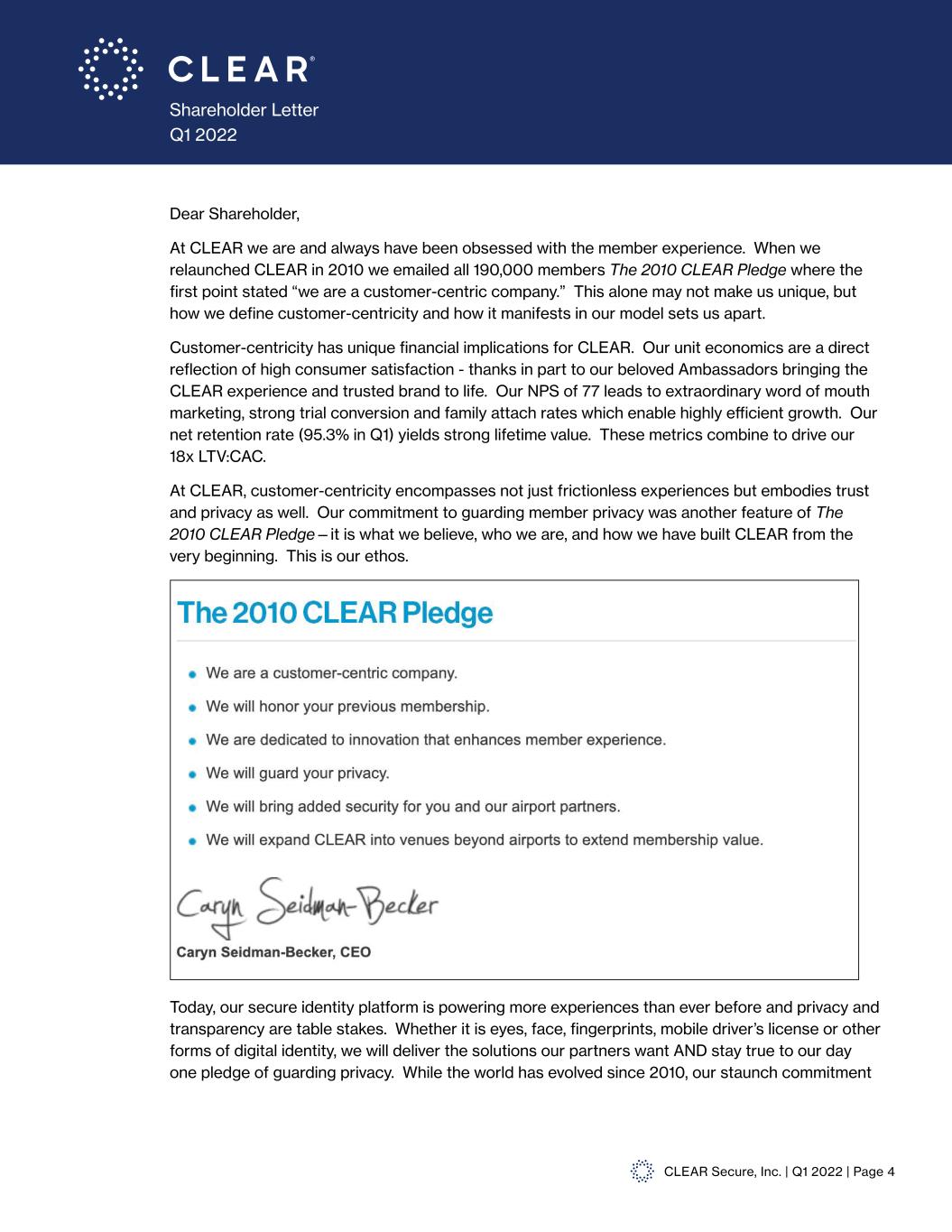

CLEAR Secure, Inc. | Q1 2022 | Page 4 Shareholder Letter Q1 2022 Dear Shareholder, At CLEAR we are and always have been obsessed with the member experience. When we relaunched CLEAR in 2010 we emailed all 190,000 members The 2010 CLEAR Pledge where the first point stated “we are a customer-centric company.” This alone may not make us unique, but how we define customer-centricity and how it manifests in our model sets us apart. Customer-centricity has unique financial implications for CLEAR. Our unit economics are a direct reflection of high consumer satisfaction - thanks in part to our beloved Ambassadors bringing the CLEAR experience and trusted brand to life. Our NPS of 77 leads to extraordinary word of mouth marketing, strong trial conversion and family attach rates which enable highly efficient growth. Our net retention rate (95.3% in Q1) yields strong lifetime value. These metrics combine to drive our 18x LTV:CAC. At CLEAR, customer-centricity encompasses not just frictionless experiences but embodies trust and privacy as well. Our commitment to guarding member privacy was another feature of The 2010 CLEAR Pledge—it is what we believe, who we are, and how we have built CLEAR from the very beginning. This is our ethos. • • Today, our secure identity platform is powering more experiences than ever before and privacy and transparency are table stakes. Whether it is eyes, face, fingerprints, mobile driver’s license or other forms of digital identity, we will deliver the solutions our partners want AND stay true to our day one pledge of guarding privacy. While the world has evolved since 2010, our staunch commitment

CLEAR Secure, Inc. | Q1 2022 | Page 5 Shareholder Letter Q1 2022 to privacy has never wavered. We recently released our Privacy Principles—which serve as a guide for us. They can be found on our website (clearme.com/privacycommitment) and a summary of these principles are below: • CLEAR will never sell your data • CLEAR will always be opt-in • You control your biometric information • You have a right to transparency • You can always delete your data • Privacy done right also means keeping your data secure The magical experience we deliver in airports and the trust we have built with our members has earned us the right to expand in travel, to enter new verticals and to bring the CLEAR experience to new industries. We give members back their most precious asset—TIME. Our first quarter 2022 results and second quarter 2022 guidance reflect broad-based strength across business lines. We remain bullish on the travel recovery as there is significant pent-up demand for experiences such as travel. March was our best CLEAR Plus enrollment month on record and that strength has continued into Q2. We remain focused on growing members, bookings AND free cash flow while continuing to build a brand that members trust and love. Best, Caryn and Ken

CLEAR Secure, Inc. | Q1 2022 | Page 6 Shareholder Letter Q1 2022 First Quarter 2022 Financial Discussion First quarter 2022 revenue grew 79.1% as compared to the first quarter of 2021 while Total Bookings increased 73.5% period over period. We saw a continuation of the strong travel trends experienced in the fourth quarter driving both membership growth and net retention, leading to better than expected Total Bookings growth. Our in-airport and partner channels continued to perform well. Our B2B platform bookings were driven by new enterprise partners. The growth in our first quarter 2022 Total Bookings is not fully reflected in our first quarter 2022 revenues because our revenues lag behind our Total Bookings (we bill members upfront and recognize that revenue over the life of a membership, usually 12 months). First quarter 2022 Total Cumulative Enrollments reached 11.8 million, driven by strength in both CLEAR Plus enrollments and Platform enrollments. First quarter 2022 Total Cumulative Platform Uses reached 95.3 million, representing 56.7% growth year-over-year, driven by the rapid growth of Health Pass usage as business and events are reopening and the continued rebound in CLEAR Plus verifications in connection with a rebound in air travel. First quarter 2022 Annual CLEAR Plus Net Member Retention increased to 95.3%, up 1,810 basis points sequentially. This performance was driven by strength in gross renewals and winbacks of previously canceled members. Cost of Revenue Share was $12.1 million in the first quarter of 2022, representing 13.4% of revenue, versus 15.4% in the first quarter of 2021. Cost of Revenue Share percentage may vary by quarter, but on an annual basis we expect it to remain relatively stable over time. Cost of Direct Salaries and Benefits were $23.0 million in the first quarter, up 89.2% year- over-year versus a depressed comparison and 6.3% sequentially. Throughout 2021 we returned airport staffing levels to more normalized levels ahead of the travel rebound after managing costs and expenses in 2020 resulting from the COVID-19 pandemic-driven collapse in travel demand. Sequential growth was driven by airport volumes, success-based variable compensation and new hiring in preparation for recently announced airport launches. Cost of Direct Salaries and Benefits declined 142 basis points sequentially as a percentage of revenue. Research and Development expense was $15.5 million in the first quarter, up 72.3% year-over- year and 9.3% sequentially. Excluding non-cash equity-based compensation, year-over-year growth was 31.6% while sequential change was 9.4%. Approximately one-third of the sequential growth was driven by a full quarter of Whyline and Atlas operating expenses. As a percentage of revenue, Research and Development declined 47 basis points sequentially. Sales and Marketing expense of $7.8 million in the first quarter was up 57.9% year-over-year but down 16.7% sequentially. We will continue to be opportunistic and returns-driven when evaluating sales and marketing investments.

CLEAR Secure, Inc. | Q1 2022 | Page 7 Shareholder Letter Q1 2022 Financial Discussion (cont) General and Administrative expense of $45.9 million in the first quarter includes $9.1 million of non-cash stock-based compensation expense. Excluding these non-cash expenses, General and Administrative expense of $36.9 million was up 53.5% year-over year and down (8.5%) sequentially. As previously discussed, the sequential decline was driven by certain elevated expenses incurred in the fourth quarter of 2021 that either declined or did not recur in the 2022 first quarter. On a sequential basis, General and Administrative expenses were down 1,450 basis points and 925 basis points, respectively, as a percent of revenue, including and excluding non- cash stock-based compensation expenses. Stock compensation expense of $13.1 million in the first quarter was down ($2.7) million sequentially driven by the runoff of legacy warrant amortization, offset in part by new hiring. Of the $13.1 million, $0.1 million relates to legacy warrant expense, $6.6 relates to non-founder stock compensation expense and $6.5 relates to the Founders’ Post-IPO Performance Awards (“Founder PSUs”) as detailed in our Final Prospectus, dated June 29, 2021. The Founder PSUs are eligible to vest over a five-year period based on the achievement of pre-determined stock price goals ranging from $46.50 to $93 during measurement periods beginning June 2023 and ending June 2026. The Founder PSUs will be expensed through June 29, 2025 regardless of vesting probability. First quarter 2022 net loss was ($18.8) million, basic and diluted loss per share was ($0.13). First quarter 2022 Adjusted Net Loss was ($5.0) million, Adjusted Net Loss per Share was ($0.03). First quarter 2022 net cash provided by operating activities was $24.9 million, Free Cash Flow was $19.4 million and Adjusted EBITDA was ($0.7) million. Because of CLEAR Plus revenue recognition policies described above, when Total Bookings are growing, net cash provided by operations and Free Cash Flow may exceed Adjusted EBITDA and Net Income. As of March 31, 2022, our cash and cash equivalents, including marketable securities and restricted cash were $663 million. As of May 12, 2022, the following shares of common stock were outstanding: Class A Common Stock 78,579,207, Class B Common Stock 1,042,234, Class C Common Stock 43,527,355, and Class D Common Stock 26,705,315 totaling 149,854,111 shares of common stock.

CLEAR Secure, Inc. | Q1 2022 | Page 8 Shareholder Letter Q1 2022 Share Repurchase Authorization Today we announced that CLEAR’s Board of Directors has authorized a share repurchase program pursuant to which the Company may purchase up to $100 million of its Class A Common Stock. Under the repurchase program, CLEAR may purchase shares of its Class A Common Stock on a discretionary basis from time to time through open market repurchases, privately negotiated transactions, or other means, including through Rule 10b5-1 trading plans. The timing and actual number of shares repurchased will be determined by management depending on a variety of factors, including stock price, trading volume, market conditions and other general business considerations. The repurchase program has no expiration date and may be modified, suspended, or terminated at any time. Repurchases under this program will be funded from CLEAR’s existing cash and cash equivalents or future cash flow. As of March 31, 2022, CLEAR had $663 million in cash and cash equivalents, restricted cash, and marketable securities. Second Quarter 2022 Guidance We expect second quarter 2022 revenue of $99-101 million and Total Bookings of $110-114 million. Our second quarter 2022 revenue and Total Bookings guidance exclude any contribution from the launch of our TSA PreCheck enrollment service, which we continue to expect to launch in the next several months. We are working collaboratively with our TSA partners through the launch process. TSA PreCheck Bookings will be recognized as revenue in the quarter in which they are received. We continue to incur operating expenses in the second quarter associated with the future launch of this program.

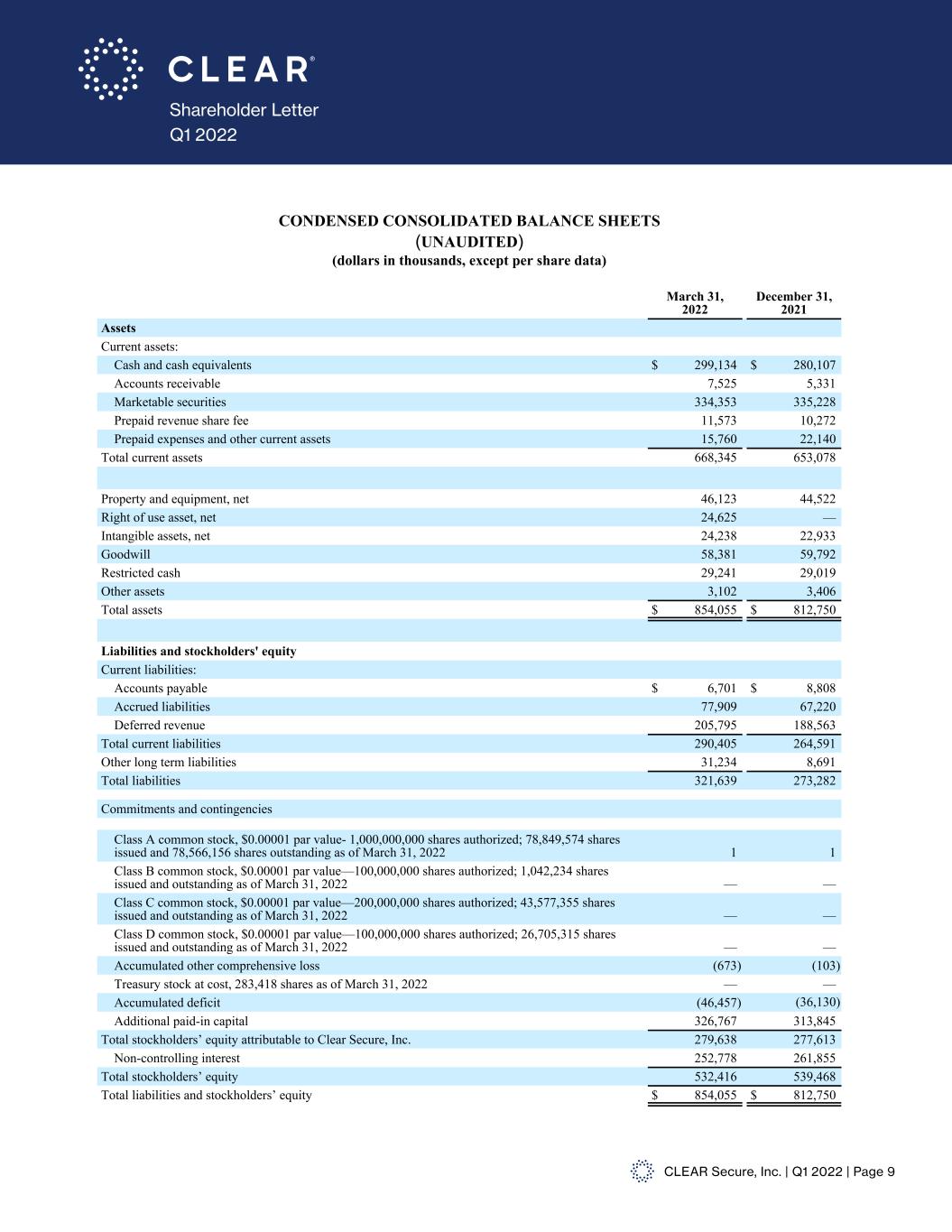

CLEAR Secure, Inc. | Q1 2022 | Page 9 Shareholder Letter Q1 2022 CLEAR SECURE, INC. CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED) (dollars in thousands, except per share data) March 31, 2022 December 31, 2021 Assets Current assets: Cash and cash equivalents $ 299,134 $ 280,107 Accounts receivable 7,525 5,331 Marketable securities 334,353 335,228 Prepaid revenue share fee 11,573 10,272 Prepaid expenses and other current assets 15,760 22,140 Total current assets 668,345 653,078 Property and equipment, net 46,123 44,522 Right of use asset, net 24,625 — Intangible assets, net 24,238 22,933 Goodwill 58,381 59,792 Restricted cash 29,241 29,019 Other assets 3,102 3,406 Total assets $ 854,055 $ 812,750 Liabilities and stockholders' equity Current liabilities: Accounts payable $ 6,701 $ 8,808 Accrued liabilities 77,909 67,220 Deferred revenue 205,795 188,563 Total current liabilities 290,405 264,591 Other long term liabilities 31,234 8,691 Total liabilities 321,639 273,282 Commitments and contingencies Class A common stock, $0.00001 par value- 1,000,000,000 shares authorized; 78,849,574 shares issued and 78,566,156 shares outstanding as of March 31, 2022 1 1 Class B common stock, $0.00001 par value—100,000,000 shares authorized; 1,042,234 shares issued and outstanding as of March 31, 2022 — — Class C common stock, $0.00001 par value—200,000,000 shares authorized; 43,577,355 shares issued and outstanding as of March 31, 2022 — — Class D common stock, $0.00001 par value—100,000,000 shares authorized; 26,705,315 shares issued and outstanding as of March 31, 2022 — — Accumulated other comprehensive loss (673) (103) Treasury stock at cost, 283,418 shares as of March 31, 2022 — — Accumulated deficit (46,457) (36,130) Additional paid-in capital 326,767 313,845 Total stockholders’ equity attributable to Clear Secure, Inc. 279,638 277,613 Non-controlling interest 252,778 261,855 Total stockholders’ equity 532,416 539,468 Total liabilities and stockholders’ equity $ 854,055 $ 812,750

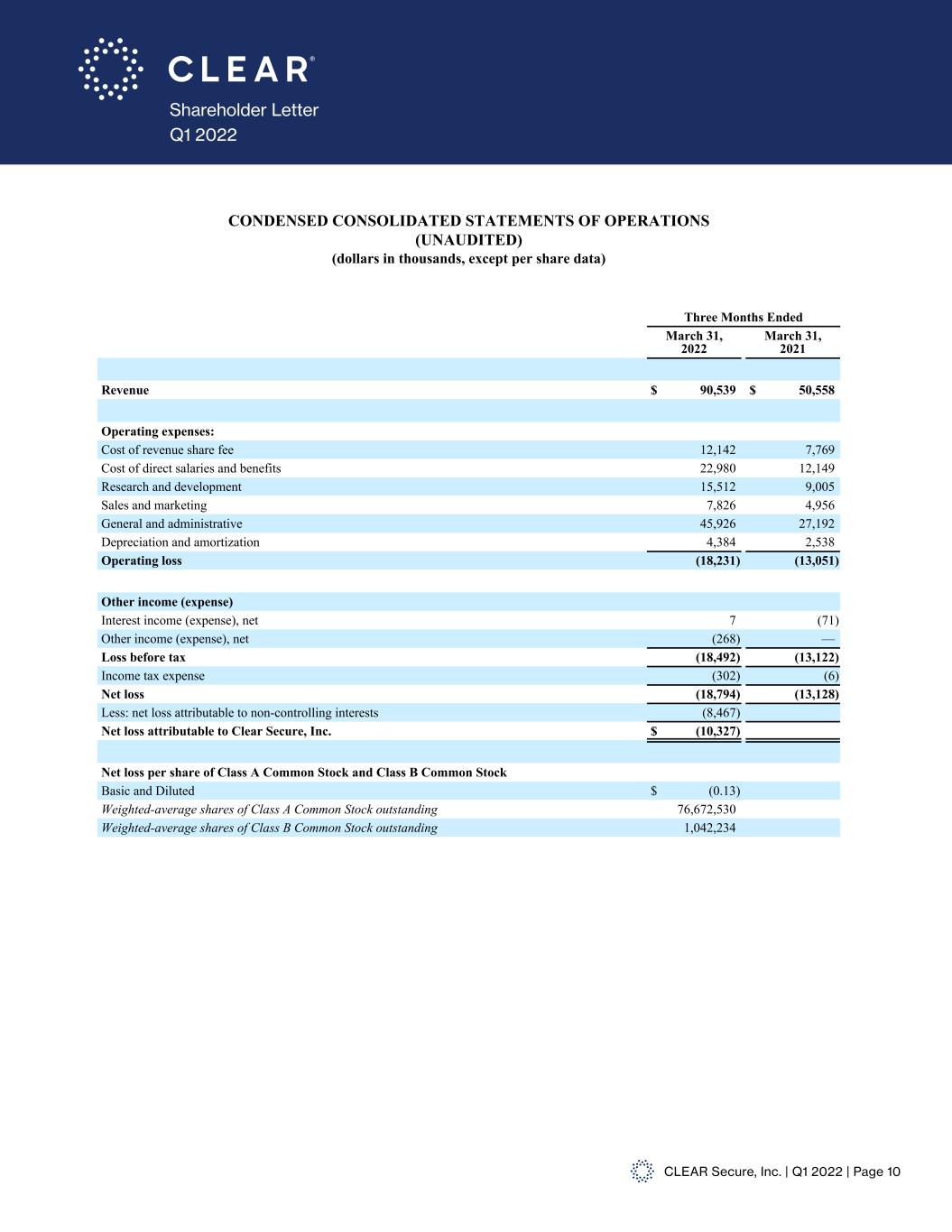

CLEAR Secure, Inc. | Q1 2022 | Page 10 Shareholder Letter Q1 2022 CLEAR SECURE, INC. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (dollars in thousands, except per share data) Three Months Ended March 31, 2022 March 31, 2021 Revenue $ 90,539 $ 50,558 Operating expenses: Cost of revenue share fee 12,142 7,769 Cost of direct salaries and benefits 22,980 12,149 Research and development 15,512 9,005 Sales and marketing 7,826 4,956 General and administrative 45,926 27,192 Depreciation and amortization 4,384 2,538 Operating loss (18,231) (13,051) Other income (expense) Interest income (expense), net 7 (71) Other income (expense), net (268) — Loss before tax (18,492) (13,122) Income tax expense (302) (6) Net loss (18,794) (13,128) Less: net loss attributable to non-controlling interests (8,467) Net loss attributable to Clear Secure, Inc. $ (10,327) Net loss per share of Class A Common Stock and Class B Common Stock Basic and Diluted $ (0.13) Weighted-average shares of Class A Common Stock outstanding 76,672,530 Weighted-average shares of Class B Common Stock outstanding 1,042,234

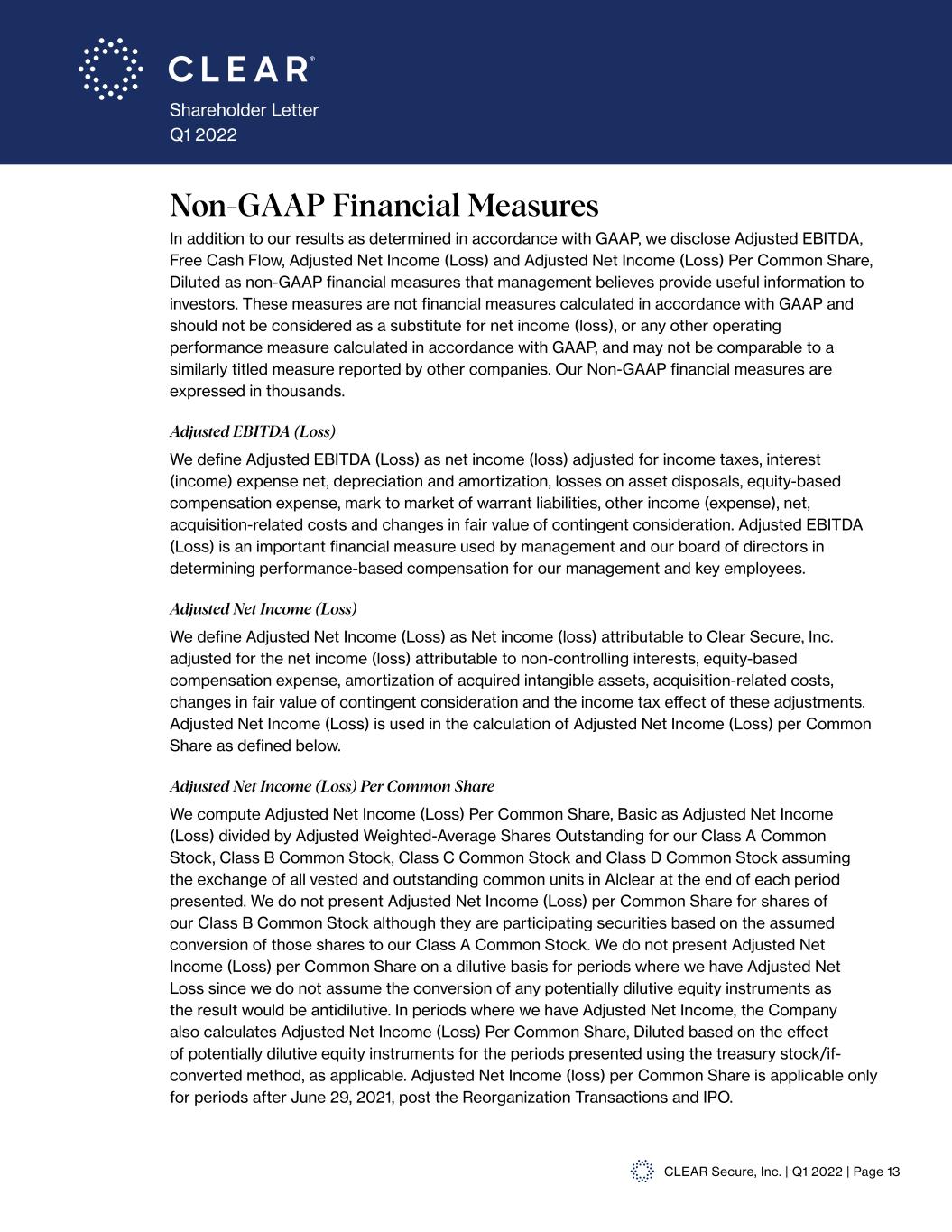

CLEAR Secure, Inc. | Q1 2022 | Page 11 Shareholder Letter Q1 2022 CLEAR SECURE, INC. CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN CASH FLOWS (UNAUDITED) (dollars in thousands) Three Months Ended March 31, 2022 March 31, 2021 Cash flows provided by (used in) operating activities: Net loss $ (18,794) $ (13,128) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Depreciation on property and equipment 3,489 2,534 Amortization on intangible assets 895 4 Noncash lease expense 721 — Impairment of long-lived assets 313 — Equity-based compensation 13,129 608 Warrant liabilities — 1,893 Deferred income tax expense 206 — Amortization of revolver loan costs 198 — Amortization, net on marketable securities 287 — Changes in operating assets and liabilities: Accounts receivable (2,194) (165) Prepaid expenses and other assets 6,472 (2,885) Prepaid revenue share fee (1,300) (798) Accounts payable (2,137) (1,150) Accrued liabilities 7,261 1,366 Deferred revenue 17,232 11,528 Operating lease liabilities (846) — Deferred rent — (142) Net cash used provided by (used in) operating activities 24,932 (335) Cash flows used in investing activities: Purchases of marketable securities (149,066) (47,002) Sales of marketable securities 149,066 47,090 Purchases of property and equipment (5,533) (8,794) Capitalized intangible assets (100) (204) Net cash used in investing activities (5,633) (8,910) Cash flows provided by financing activities: Repurchase of members’ equity — (11,744) Proceeds from issuance of members’ equity, net of cost — 80,277 Issuance of warrants — 289 Net cash provided by financing activities — 68,822 Net increase in cash, cash equivalents, and restricted cash 19,299 59,577 Cash, cash equivalents, and restricted cash, beginning of period 309,126 139,082 Exchange rate effect on cash and cash equivalents, and restricted cash (50) — Cash, cash equivalents, and restricted cash, end of period $ 328,375 $ 198,659 March 31, 2022 March 31, 2021 Cash and cash equivalents $ 299,134 $ 175,730 Restricted cash 29,241 22,929 Total cash, cash equivalents, and restricted cash $ 328,375 $ 198,659

CLEAR Secure, Inc. | Q1 2022 | Page 12 Shareholder Letter Q1 2022 Definitions of Key Performance Indicators To evaluate performance of the business, we utilize a variety of other non-GAAP financial reporting and performance measures. These key measures include Total Bookings, Total Cumulative Enrollments, Total Cumulative Platform Uses, and Annual CLEAR Plus Net Member Retention. Total Bookings Total Bookings represent our total revenue plus the change in deferred revenue during the period. Total Bookings in any particular period reflect sales to new and renewing CLEAR Plus subscribers plus any accrued billings to partners. Management believes that Total Bookings is an important measure of the current health and growth of the business and views it as a leading indicator. Total Cumulative Enrollments We define Total Cumulative Enrollments as the number of enrollments since inception as of the end of the period. An Enrollment is defined as any member who has registered for the CLEAR platform since inception and has a profile (including limited time free trials regardless of conversion to paid membership) net of duplicate and/or purged accounts. This includes CLEAR Plus members who have completed enrollment with CLEAR and have ever activated a payment method, plus associated family accounts. Management views this metric as an important tool to analyze the efficacy of our growth and marketing initiatives as new members are potentially a current and leading indicator of revenues. Total Cumulative Platform Uses We define Total Cumulative Platform Uses as the number of individual engagements across CLEAR use cases, including in-airport verifications, since inception as of the end of the period. We also include airport lounge access verifications, sports and entertainment venue verifications and Health Pass surveys since inception as of the end of the period. Management views this metric as an important tool to analyze the level of engagement of our member base which can be a leading indicator of future growth, retention and revenue. Annual CLEAR Plus Net Member Retention We define Annual CLEAR Plus Net Member Retention as one minus the CLEAR Plus net member churn on a rolling 12 month basis. We define “CLEAR Plus net member churn” as total cancellations net of winbacks in the trailing 12 month period divided by the average active CLEAR Plus members as of the beginning of each month within the same 12 month period. Winbacks are defined as reactivated members who have been cancelled for at least 60 days. Active CLEAR Plus members are defined as members who have completed enrollment with CLEAR and have activated a payment method for our in-airport CLEAR Plus service, including their registered family plan members. Active CLEAR Plus members also include those in a grace period of up to 45 days after a billing failure during which time we attempt to collect updated payment information. Management views this metric as an important tool to analyze the level of engagement of our member base, which can be a leading indicator of future growth and revenue, as well as an indicator of customer satisfaction and long term business economics.

CLEAR Secure, Inc. | Q1 2022 | Page 13 Shareholder Letter Q1 2022 Non-GAAP Financial Measures In addition to our results as determined in accordance with GAAP, we disclose Adjusted EBITDA, Free Cash Flow, Adjusted Net Income (Loss) and Adjusted Net Income (Loss) Per Common Share, Diluted as non-GAAP financial measures that management believes provide useful information to investors. These measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for net income (loss), or any other operating performance measure calculated in accordance with GAAP, and may not be comparable to a similarly titled measure reported by other companies. Our Non-GAAP financial measures are expressed in thousands. Adjusted EBITDA (Loss) We define Adjusted EBITDA (Loss) as net income (loss) adjusted for income taxes, interest (income) expense net, depreciation and amortization, losses on asset disposals, equity-based compensation expense, mark to market of warrant liabilities, other income (expense), net, acquisition-related costs and changes in fair value of contingent consideration. Adjusted EBITDA (Loss) is an important financial measure used by management and our board of directors in determining performance-based compensation for our management and key employees. Adjusted Net Income (Loss) We define Adjusted Net Income (Loss) as Net income (loss) attributable to Clear Secure, Inc. adjusted for the net income (loss) attributable to non-controlling interests, equity-based compensation expense, amortization of acquired intangible assets, acquisition-related costs, changes in fair value of contingent consideration and the income tax effect of these adjustments. Adjusted Net Income (Loss) is used in the calculation of Adjusted Net Income (Loss) per Common Share as defined below. Adjusted Net Income (Loss) Per Common Share We compute Adjusted Net Income (Loss) Per Common Share, Basic as Adjusted Net Income (Loss) divided by Adjusted Weighted-Average Shares Outstanding for our Class A Common Stock, Class B Common Stock, Class C Common Stock and Class D Common Stock assuming the exchange of all vested and outstanding common units in Alclear at the end of each period presented. We do not present Adjusted Net Income (Loss) per Common Share for shares of our Class B Common Stock although they are participating securities based on the assumed conversion of those shares to our Class A Common Stock. We do not present Adjusted Net Income (Loss) per Common Share on a dilutive basis for periods where we have Adjusted Net Loss since we do not assume the conversion of any potentially dilutive equity instruments as the result would be antidilutive. In periods where we have Adjusted Net Income, the Company also calculates Adjusted Net Income (Loss) Per Common Share, Diluted based on the effect of potentially dilutive equity instruments for the periods presented using the treasury stock/if- converted method, as applicable. Adjusted Net Income (loss) per Common Share is applicable only for periods after June 29, 2021, post the Reorganization Transactions and IPO.

CLEAR Secure, Inc. | Q1 2022 | Page 14 Shareholder Letter Q1 2022 Adjusted Net Income (Loss) Per Common Share (cont) Adjusted Net Income (Loss) and Adjusted Earnings (Loss) Per Common Share, exclude, to the extent applicable, the tax effected impact of non-cash expenses, other items that are not directly related to our core operations. These items are excluded because they are connected to the Company’s long term growth plan and not intended to increase short term revenue in a specific period. Further, to the extent that other companies use similar methods in calculating non-GAAP measures, the provision of supplemental non-GAAP information can allow for a comparison of the company’s relative performance against other companies that also report non-GAAP operating results. Free Cash Flow We define Free Cash Flow as net cash provided by (used in) operating activities adjusted for purchases of property and equipment plus the value of share repurchases over fair value. With regards to our CLEAR Plus subscription service, we generally collect cash from our members upfront for annual subscriptions. As a result, when the business is growing Free Cash Flow can be a real time indicator of the current trajectory of the business. See below for reconciliations of these non-GAAP financial measures to their most comparable GAAP measures. Forward-Looking Statements This release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any and such forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments and events may differ materially from those in the forward-looking statements as a result of various factors, including those described in the Company’s filings within the Securities and Exchange Commission, including the sections titled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021. The Company disclaims any obligation to update any forward-looking statements contained herein.

CLEAR Secure, Inc. | Q1 2022 | Page 15 Shareholder Letter Q1 2022 Three Months Ended (In thousands) March 31, 2022 March 31, 2021 Net loss $ (18,794) $ (13,128) Income taxes 302 6 Interest (income) expense, net (7) 71 Other (income) expense, net 268 — Depreciation and amortization 4,384 2,538 Equity-based compensation expense 13,129 1,319 Warrant liabilities — 1,893 Adjusted EBITDA (Loss) $ (718) $ (7,301) Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss) Three Months Ended (In thousands) March 31, 2022 March 31, 2021 Net loss attributable to Clear Secure, Inc. $ (10,327) $ — Reallocation of net loss attributable to non-controlling interests (8,467) — Net loss per above (18,794) (13,128) Equity-based compensation expense 13,129 608 Amortization of acquired intangibles 869 — Income tax (expense) benefit (203) — Adjusted Net Loss $ (4,999) $ (12,520) As stated above, due to the Company incurring a net loss for the periods presented, the Company has not calculated Adjusted Weighted-Average Shares Outstanding, Dilutive. Calculation of Adjusted Weighted-Average Shares Outstanding As of March 31, 2022 As of March 31, 2021 Weighted-average number of shares outstanding, basic for Class A Common Stock 76,672,530 — Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 1,042,234 — Assumed weighted-average conversion of issued and outstanding Class C Common Stock 44,000,927 — Assumed weighted-average conversion of issued and outstanding Class D Common Stock 26,705,415 — Assumed weighted-average conversion of vested and outstanding warrants 162,957 — Adjusted Weighted-Average Number of Shares Outstanding, Basic 148,584,063 — Calculation of Adjusted Net Income (Loss) Per Common Share, Basic Three Months Ended March 31, 2022 Adjusted net loss (4,999) Adjusted weighted-average number of shares outstanding, basic 148,584,063 Adjusted net loss per common share, basic $ (0.03) Reconciliation of Net cash provided by (used in) operating activities to Free Cash Flow: Three Months Ended (In thousands) March 31, 2022 March 31, 2021 Net loss $ (18,794) $ (13,128) Income taxes 302 6 Interest (income) expense, net (7) 71 Other (income) expense, net 268 — Depreciation and amortization 4,384 2,538 Equity-based compensation expense 13,129 1,319 Warrant liabilities — 1,893 Adjusted EBITDA (Loss) $ (718) $ (7,301) Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss) Three Months Ended (In thousands) March 31, 2022 March 31, 2021 Net loss attributable to Clear Secure, Inc. $ (10,327) $ — Reallocation of net loss attributable to non-controlling interests (8,467) — Net loss per above (18,794) (13,128) Equity-based compensation expense 13,129 608 Amortization of acquired intangibles 869 Income tax (expense) benefit (203) — Adjusted Net Loss $ (4,999) $ (12,520) As stated above, due to the Company incurring a net loss for the periods presented, the Company has not calculated Adjusted Weighted-Average Shares Outstanding, Dilutive. Calculation of Adjusted Weighted-Average Shares Outstanding As of March 31, 2022 As of March 31, 2021 Weighted-average number of shares outstanding, basic for Class A Common Stock 76,672,530 — Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 1,042,234 — Assumed weighted-average conversion of issued and outstanding Class C Common Stock 44,000,927 ssumed weighted-average conversion of issued and outstanding Class D Common Stock 26,705,415 — ssu ed eighted-average conversion of vested and outstanding warrants 162,957 djusted Weighted-Average Number of Shares Outstanding, Basic 148,584,063 Calculation of Adjusted Net Income (Loss) Per Common Share, Basic Three Months Ended March 31, 2022 Adjusted net loss (4,999) Adjusted weighted-average number of shares outstanding, basic 148,584,063 Adjusted net loss per common share, basic $ (0.03) Reconciliation of Net cash provided by (used in) operating activities to Free Cash Flow: Reconciliation of Net Income (Loss) to Adjusted EBITDA: Reconciliation of Net Income (Loss) t j ste et I c e (Loss): Calculation of Adjusted Weighted-Aver ge Shares Outst nding: Three Months Ended (In thousands March 31, 2022 March 31, 2021 N t loss $ (18,79 ) $ (13,12 ) Income t x s 302 6 Interest (income) expense, net (7) 71 Other (income) expense, net 26 — Depreciation and amortization 4,384 2,538 Equity-based compensation exp nse 13,129 1,319 Warrant liabilities — 1,893 Adjusted EBITDA (Loss) $ (718) $ (7,301) Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss) Three Months Ended (In thousan s) March 31, 2022 March 31, 2021 Net loss attributable to Clear Secur , Inc. $ (10,327) $ Reallocation of net loss attr butable to non-controlling interests (8,467 Net loss per above (18,7 4 3,1 8 Equity-based compensation expense 13,129 608 Amortization of acquired intangibles 869 Income tax (expense) benefit (203) — Adjusted Net Loss $ (4,999) $ (12,520) As stated above, due to the Company incurring a net loss for the periods presented, the Company has not calculated Adjusted Weighted-Average Shares Outstanding, Dilutive. Calculation of Adjusted Weighted-Average Shares Outstanding As of March 31, 2022 As of March 31, 2021 Weighte -average number of share utstanding, basic for Class A Common Stock 7 ,672,530 Adj stments Ass m weighted-average conversion of issued and outstanding Class B Common Stock 1,042,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 44,000,927 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 26,705,415 Assumed weighted-average conversion of vested and outstanding warrants 162,957 Adjusted Weighted-Average Number of Shares Outstanding, Basic 148,584,063 — Calculation of Adjusted N t Income (Loss) Per Common Share, Basic Three Months Ended March 31, 2022 Adjusted net loss (4,999) Adjusted weighted-average number of shares outstanding, basic 148,584,063 Adjusted net loss per common share, basic $ (0.03) Reconciliation of Net cash provided by (used in) operating activities to Free Cash Flow:

CLEAR Secure, Inc. | Q1 2022 | Page 16 Shareholder Letter Q1 2022 Three Months Ended (In thousands) March 31, 2022 March 31, 2021 Net loss $ (18,794) $ (13,128) Income taxes 302 6 Interest (income) expense, net (7) 71 Other (income) expense, net 268 — Depreciation and amortization 4,384 2,538 Equity-based compensation expense 13,129 1,319 Warrant liabilities — 1,893 Adjusted EBITDA (Loss) $ (718) $ (7,301) Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss) Three Months Ended (In thousands) March 31, 2022 March 31, 2021 Net loss attributable to Clear Secure, Inc. $ (10,327) $ — Reallocation of net loss attributable to non-controlling interests (8,467) — Net loss per above (18,794) (13,128) Equity-based compensation expense 13,129 608 Amortization of acquired intangibles 869 — Income tax (expense) benefit (203) — Adjusted Net Loss $ (4,999) $ (12,520) As stated above, due to the Company incurring a net loss for the periods presented, the Company has not calculated Adjusted Weighted-Average Shares Outstanding, Dilutive. Calculation of Adjusted Weighted-Average Shares Outstanding As of March 31, 2022 As of March 31, 2021 Weighted-average number of shares outstanding, basic for Class A Common Stock 76,672,530 — Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 1,042,234 — Assumed weighted-average conversion of issued and outstanding Class C Common Stock 44,000,927 — Assumed weighted-average conversion of issued and outstanding Class D Common Stock 26,705,415 — Assumed weighted-average conversion of vested and outstanding warrants 162,957 — Adjusted Weighted-Average Number of Shares Outstanding, Basic 148,584,063 — Calculation of Adjusted Net Income (Loss) Per Common Share, Basic Three Months Ended March 31, 2022 Adjusted net loss (4,999) Adjusted weighted-average number of shares outstanding, basic 148,584,063 Adjusted net loss per common share, basic $ (0.03) Reconciliation of Net cash provided by (used in) operating activities to Free Cash Flow: Three Months Ended (In thousands) March 31, 2022 March 31, 2021 Net cash provided by (used in) operating activities $ 24,932 $ (335) Purchases of property and equipment (5,533) (8,794) Share repurchases over fair value — 712 Free Cash Flow $ 19,399 $ (8,417) Calculation of Adjusted Net Inco on Share, Basic: Reconciliation of Net cash provided by (used in) operating activities to Free Cash Flow: